June 11, 2009

June 11, 2009

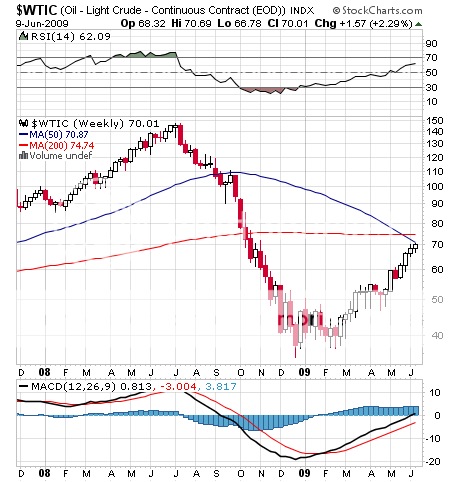

1) I chatted with Jeff Rubin last night, former chief economist with CIBC World Markets, who reaffirmed my own hyper-bull case for crude in bucketfuls.? He was in San Francisco, admiring our civic planning and mass transit system, as part of a tour to promote his new book ?Why Your World is About to Get a Whole Lot Smaller: Oil and the End of Globalization.?? We are in the bottom of the ninth inning of the hydrocarbon age. The next super spike will take us to over $100/barrel within 12 months of the beginning of an economic recovery, and much higher after that. The problem is that we are losing 4 million barrels/day through depletion just when demand is increasing. The only offset will be dirty, foul, huge carbon footprint, $100/barrel Canadian tar sands, which will double, to account for 40% of our imports. The biggest increase in consumption is in OPEC itself, where consumption has ballooned to 13 million barrel/day and oil is being wasted on a prodigious scale, compared to only 7 million b/d in China. Gas there costs only 25 cents/gal, utilities in Saudi Arabia pay only three cents/gallon for bunker fuel, and Dubai is blowing 3,000 b/d equivalent running an indoor ski resort. Oil over $100/barrel will bring globalization to a screeching halt. Economies will go local because it will cost too much to transport goods, as we have in the past. No more California avocados in Toronto. More importantly, no more Chinese steel in the US, or any other heavy exports, which will lead to a resurgence in domestic manufacturing and the jobs that come with it. Last year $90 of the $600 cost of Chinese steel went to shipping costs. $10/gal gasoline will take 50 million of our 240 million cars off the road. Even if we replace them with electric cars, we don?t have the power grid to juice them. Chinese exports will collapse, but so will their Treasury purchases, meaning no more bailouts for us. Oops. Subprime neighborhoods will get plowed back into farmland so we can eat. I think Jeff is dead on about oil prices. But as necessity is the mother of invention, some of his? predictions about their impact on international trade are a bit extreme for me.

2) Just another update on my core short in long dated US Treasury bonds, the TBT, which hit a new high for the year of $60, up 72% from my initial call . The nine to eleven year note auction went off OK, despite its enormous size. What drove the yield on the ten year to a seven month high of 3.99%, the 30 year to 4.67%, and herded buyers into the TBT was the May US budget deficit of $190 billion, an all time record, despite massive inflows of income tax revenues.? There was also word that Russia didn?t want to buy any more US government debt because they hated the dollar. After having spent four decades on the front lines of the cold war, I have to pinch myself when I hear stuff like this. The news sent equities on a 200 point intraday swoon. If higher rates and $70 crude don?t go away, they are going to kill the stock market. Everyone is holding their breath for the 30 Treasury bond auction tomorrow. The time to pay the piper is coming, and his rates are going up.

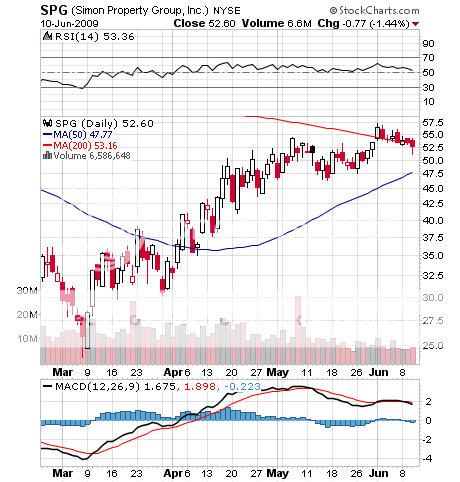

3) The Dana Point, California St. Regis Monarch Beach Hotel has defaulted on a $70 million loan, while lenders have repossessed the ?W? Hotel in San Diego. Thus, the spotlight is again refocused on the next phase of the financial crisis, where an army of shoes are falling. A torrent of tenant bankruptcies is creating ?see through? buildings in cities throughout the country, which are becoming as abundant as Priuses at an Obama rally. Some players see a further three year bleed that could take property prices down another 40% from here. Large, publically traded REITS have used the three month stock market rally to raise $11.5 billion in new equity that will enable to reduce debt and leverage, as well as buy up of weak competitors and distressed property. Look at Simon Properties Group (SPG), up 128% from the March lows. The saving grace here is that the recent bubble was nowhere as inflated as the S&L crisis in the early nineties. But cap rates may have to climb to the double digit levels we saw then before this period of punishment ends. Cash rich hedge funds are circling.

4) The Western US has found a new wrinkle in the housing collapse, where homeowners are desperately struggling to cut living costs to meet the next doubling of their adjustable rate mortgage payments on their underwater houses. Raising horses can cost more than children, so Nevadans are turning them loose to join herds of wild mustangs, to dodge the $30,000/year it costs to board and care for them. Local populations are exploding, eating local ranchers out of house and home, who depend on public grazing lands to feed commercial livestock. Mustangs are the feral descendents of horses which escaped the conquistadores, and there are now thought to be 30,000 out there, down from a 19th century peak of 2 million. The Bureau of Land Management has another 30,000 in pens, and is making 10,000/year available for adoption at $125/each. The problem is that many adopt ?pets? who then flip them to Canadian slaughterhouses, which cater to the odd French taste for horseflesh. To see how this works, watch Clark Gable?s last film, The Misfits. Madeleine Pickens, the wife of famed oil trader Boone Pickens, has offered to take the BLM?s entire herd and put them out to pasture at an undisclosed million acre location. If there is anyone who could have an undisclosed million acres, it is Boone. I have frequently run into majestic and beautiful mustang herds over the years while camping in the remote desert (no, I don?t go to Burning Man). Reminding me that there is still some ?wild? in the ?West?, I will miss them if they are gone.

QUOTE OF THE DAY

?There will be no energy bailout. The Fed can?t print BTU?s,? said Jeff Rubin, former chief economist at CIBC World Markets.