June 16, 2009

June 16, 2009 Featured Trades: (USO), (DJP), (SPX), (EEM), (TBT), (FXE), (JNK), (HYG), ($USD), (CSJ),(IDU), (WHEAT), (HEALTH CARE)

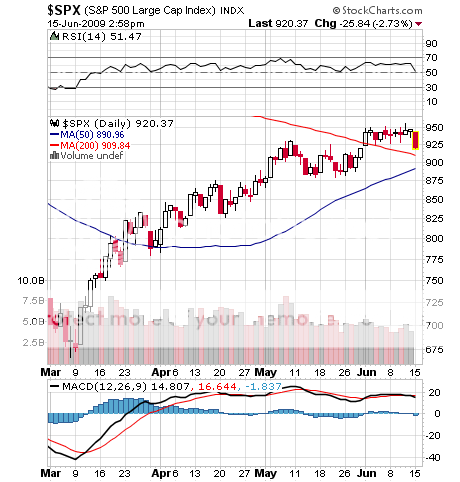

1)It looks like the worm has finally turned. Hedge funds that rushed headlong into piling on new risk positions as recently as last Friday are now unwinding them today just as fast. All last week the smart money was selling to the late comers, newbies, and wanabees. The Viagra is starting to wear off. It?s time to take short term trading profits on crude (USO), commodities (DJP), all stocks (SPX), emerging markets (EEM), short Treasury bonds (TBT), all currencies (FXE), and junk bonds (JNK, HYG). I love all these things long term, but suffer from a short term tolerance for pain. When the best case scenario is sideways, I?m outa there. Look for decent bounces in risk reducing positions like the dollar ($USD), short dated Treasury securities (CSJ), and defensive sectors like utilities (IDU). It has been obvious to me that all of the good, long term holds were rolling over on shrinking volumes right at 50 or 200 day moving averages, since last month (see ?Sell in May and Go Away?). All of a sudden burgers on the back yard BBQ, booking campsites at Big Sur, and visiting those long lost, but nearby relatives looks like a better choice. I?m having a ?staycation? this year to save money. Instead of Italy?s Amalfi Coast, you?ll find me dining at my local cheapo Italian restaurant with the nice Roman mural painted on the wall, the red checked tablecloths, and the plastic grapes draped over the doors. Please pass the parmesan cheese!

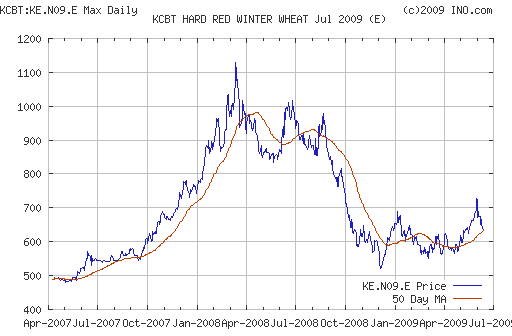

2) I just thought I?d give you an alert here to put ?wheat? on your watch list, with a view to a buy. The harvest for spring wheat is in full swing and the weather has been great, both here and in India, so prices have dropped $1.00 from the $7.25 top it put in two weeks ago. You usually see peak production in June, so this is traditionally a timely window to put on medium term long positions, as cash strapped farmers hedge known inputs. New plantings are down 25% in Argentina, and 18% in Canada. A multiyear drought continues in Australia, where my younger sister, unable to coax life out of her 7,000 acres near Esperance, has resorted to driving a huge Caterpillar truck at the ore mines up North to make ends meet. It?s just a matter of time before the food riots resume. For the raging long term bull case for wheat see my May 22, 2009 Newsletter. There is maybe $1.00 of downside here if we get perfect weather, but a possible double on the upside, and more if we get lucky. This is the kind of risk/reward ratio I am constantly hunting for. Wheat is one of the few Ag plays that is not overbought right now.

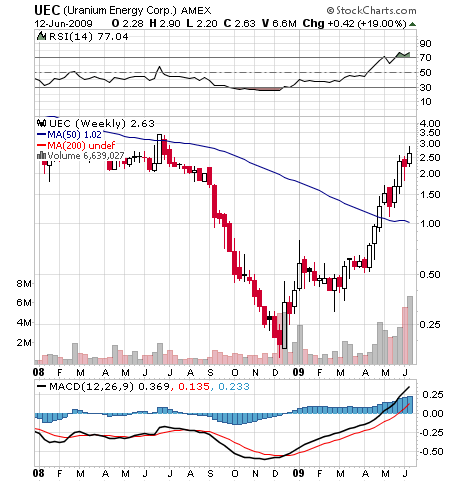

3) If we are just on the verge of entering a long term bull market for nuclear energy, as I mentioned in my piece yesterday (http://madhedgefundradio.com/June_15__2009.html), then you would have to expect the same for nuclear fuel producers. Last year, the US consumed 55 million pounds of ?yellow cake? or uranium oxide, but produced only 4 million pounds. The rest came out of stockpiles or from imports, much if it from the reprocessed Russian nuclear warheads. The new Dept. of Energy under Dr. Stephen Chu has made a big priority of making loan guarantees available to expand nuclear capacity from a lowly 20% of our total grid. The price of uranium is also rising, dragged up by crude, and has bounced 25% from a low this year of $40/pound, to $50. You can take a look at Austin, TX based Uranium Energy Corporation (UEC), which could start production at its Golead mine next year.

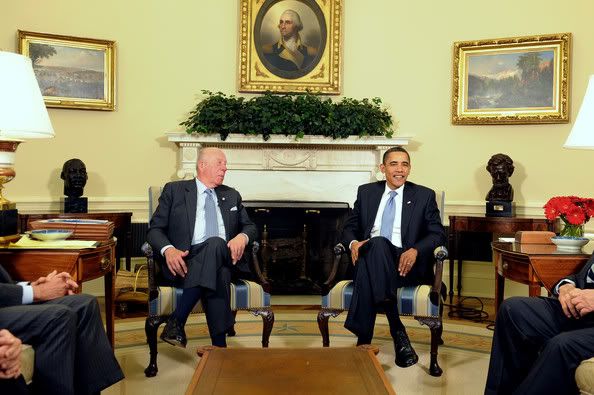

4) After my chat with Christine Romer on the health care issue last week, I thought I?d give George Schultz equal time on the other side of the aisle. Economics professor at MIT and the University of Chicago, former Treasury Secretary and Secretary of State, George has certainly covered all the bases. Now 89, he is the senior statesman and eminence gris of San Francisco, as well as a major philanthropist. When I read his bio, I feel like my own life in comparison has been spent watching Archie Bunker on TV in All in the Family. I first ran into George in the seventies as the President of Bechtel, and pursued him while in the White House Press Corp. I have since occupied the box next to his in the San Francisco Opera, and joined him in several Marine Corps charities. George said that America?s health care headache started in WWII, when wages and costs were controlled, but not benefits. So companies competed for labor by offering increasingly generous, tax free benefits programs. And when something is free, you lose a lot of it, driving total costs through the roof. The end result is large misallocations of resources that you don?t see in other businesses. Private American companies have made possible tremendous medical advances for a profit, and this system should be allowed to continue. But we need to incentivize future advances with cost containment. We need a universal, subsidized plan that heads off intergenerational conflict by not allowing healthy young people to escape obligations, nor denying older people with preexisting conditions. Allowing consumers to buy private insurance across state lines, which is now impossible,?? would be a start. Today your average 65 year old lives for 20 years, compared to 13 years in 1965, and two years in 1900. An equitable system would enable those who wish to continue working after 65, without burdening employers with health care costs, adding $1 trillion to GDP that will help us pay for this all. If George represents the conservative response to Obama?s proposals, then I can see enough common ground for something major to get done this year.

QUOTE OF THE DAY

?Freedom of the press is only true if you own a press,? said A.J. Liebling, a famed journalist for the New Yorker.