June 17, 2009

June 17, 2009

Featured Trades: (WHEAT), (SYT), (MON), (DD), (RSX), (UEC), (VIX)

1) Ho hum. Another day of financial reform debate. Another day of closing the barn door after the horses have bolted. Please stop scratching your fingernails on the chalkboard, will you? What has the market come to? The volatility index (VIX) spikes 7% in one day, and we only get a 187 point drop in the Dow. It?s getting so you can?t even get a decent crash going. Thank goodness I?m not a Master of the Universe anymore. Life in that industry is about to become incredibly boring.

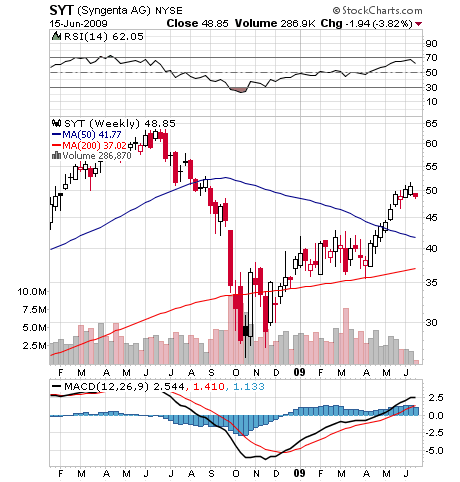

2) Here?s a follow up on my call to buy wheat yesterday. There is a new fungus out there called UG 99 which has the potential to wipe out 80% of the world?s wheat crop. It has been doing damage to crops in Africa for the last ten years, and if it escapes to Asia, where wheat is a major part of the diet, the results could be disastrous. Sygenta (SYT) is the world leader in producing the fungicide for this particularly nasty form of wheat rust, and has already seen its stock double over the past eight months. Unfortunately, ridiculous European fears about genetically modified crops and ?Frankenfoods? have discouraged further research in the field. There is no money in wheat, so companies like Monsanto and Du Pont focus their attentions on rice, soybeans, and canola, which see more processing and are therefore less subject to the EC restrictions. Needless to say, if UG 99 makes it to Asia, or Heaven forbid, here, the effect on prices would be unimaginable. See the long term bull case for grains. There will be no food bailout. The Fed can?t print calories.

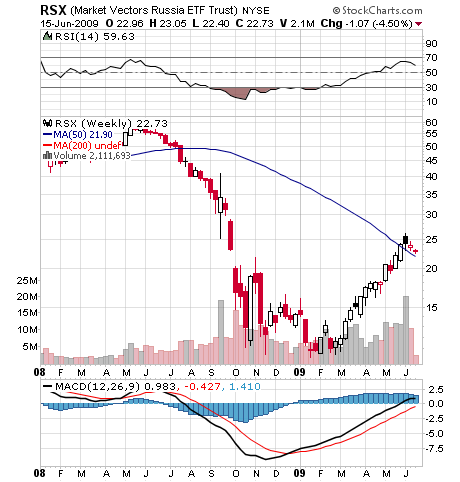

3) Last January I was extremely positive about building long equity exposure in Russia, one of the two BRICKS that is a big energy exporter. I predicted that the RSX would deliver double the upside of the S&P 500. Well I lied. It actually came in at 2.4 times the US market performance. It even would have worked as a pairs trade, long Russia, short the US. This turned out to be an oil play on steroids, and a recovery in the ruble gave you a nice hockey stick effect in the dollar traded ETF. The bounce in the Russian currency stopped the country?s reserve outflow dead in its tracks, and enabled the Russian Central Bank to start shaving interest rates from the nosebleed territory of 13%. There is plenty of room for further cuts. Russia is not out of the woods yet. Some 30% of the $780 billion in corporate debt is due for rollover this year, the unemployment rate is at 9.5% and climbing, and ruble short term rates are at a sky high 15-20%. It also doesn?t help that they lock up oligarchs on bogus tax charges, and will expropriate foreign assets, as they did with Shell, at the drop of a hat. But none of my investors told me I could only do business with nice people who gave me a warm and fuzzy feeling. I had to bribe my late wife out of Moscow?s notorious Lubyanka prison once. But a rising oil price atones for all sins. Use this dip in crude to add to your positions, but watch out for the volatility.

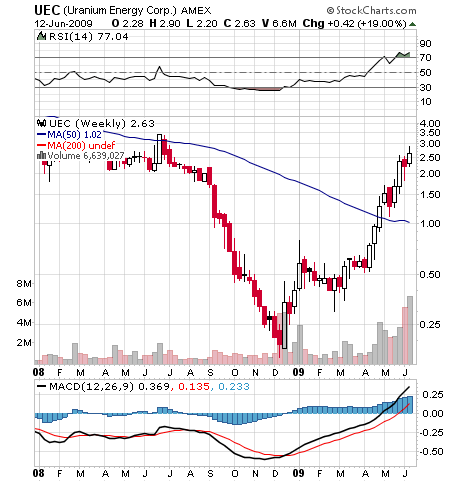

4) If we are just on the verge of entering a long term bull market for nuclear energy, as I mentioned in my earlier piece, then you would have to expect the same for nuclear fuel producers. Last year, the US consumed 55 million pounds of ?yellow cake? or uranium oxide, but produced only 4 million pounds. The rest came out of stockpiles or from imports, much if it from the reprocessed Russian nuclear warheads. The new Dept. of Energy under Dr. Stephen Chu has made a big priority of making loan guarantees available to expand nuclear capacity from a lowly 20% of our total grid. The price of uranium is also rising, dragged up by crude, and has bounced 25% from a low this year of $40/pound, to $50. You can take a look at Austin, TX based Uranium Energy Corporation (UEC), which could start production at its Golead mine next year.

QUOTE OF THE DAY

?A nation of sheep will beget a government of wolves,? said the legendary CBS correspondent Edgar R. Morrow.