June 18, 2009

June 18, 2009Featured Trades: (OIL), (USO), (WTIC), (INDIA), ($BSE), (MS), (CALIFORNIA), (LUMBER), (WY)

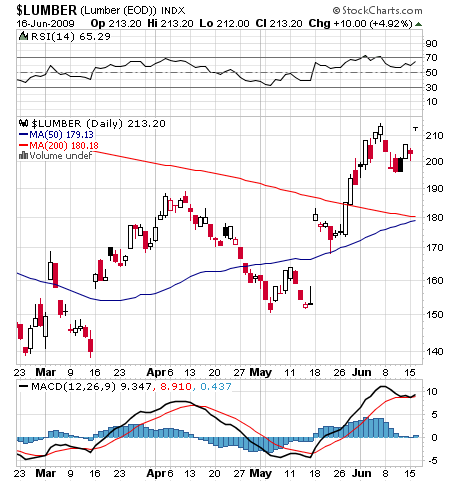

1)There?s nothing like getting up in the morning, taking off your shirt, and splitting a quarter cord of wood to get the blood flowing. One of life?s little pleasures is also calling up investors and telling them their position went limit up yesterday. That is what happened with lumber, and I seem to be the only one out there who likes the knotty, aromatic commodity. The knee jerk explanation was that the numbers for housing starts for May were up a blistering 17%, much better than expected. Starts have been bouncing along at an annual rate of 500,000, compared to the peak of 2.2 million in 2005. But the big lumber stocks like Weyerhaeuser (WY) didn?t go up, nor did the besieged homebuilders. The real reason is that we are crawling off of a five year bottom; we have miles to go before we approach a decade high of $4.60, and that lumber is still inherently cheap. What will happen when the Chinese start buying? They?ve bought everything else. One of the tip offs that you?ve got a great position is that all of the accidents and surprises tend to happen on the upside.

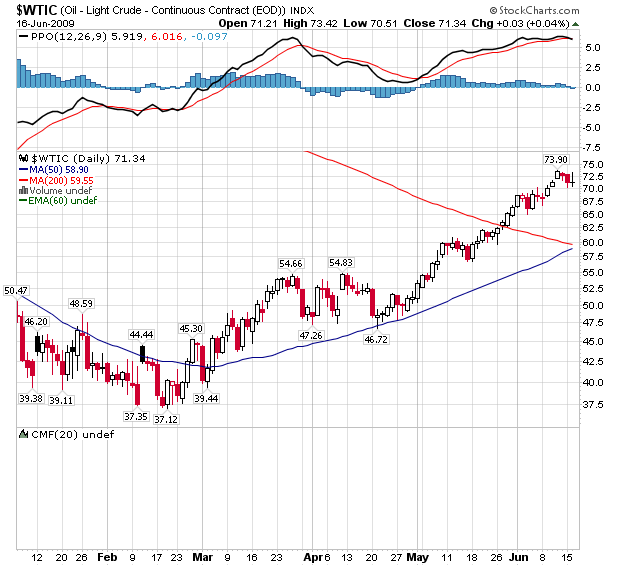

2)First of all, let?s get some facts straight. No one is buying oil here at $72 because they plan to burn it, use it to drive more miles, make asphalt or plastics, or rub it all over their bodies. They are buying Texas tea because they hate the dollar and there is no other surrogate reserve currency. Some of the biggest buyers of crude now are the oil producers, desperate for any appreciating asset they can park their revenues in size. This is why you can now walk across the Caribbean and not get your feet wet, jumping from one storage tanker to the next. The world is choking on surplus crude. Does anyone see anything wrong with this picture? Even perma bull Boone Pickens has a target of only $75. I hope he remembers to sell this time (sorry for the cheap shot Boone). The problem is that when you have so many hedge funds, financial players, and non consumers bunching up in a trade, the turns can be particularly vicious. All it would take is a little more evidence of a double dip economy, or even just an innocently strong dollar. Watch those green shoots with a magnifying glass.

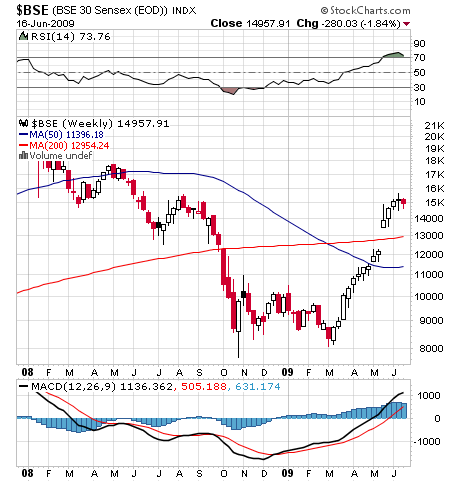

3) I couldn?t help but laugh when I saw my old colleague from Morgan Stanley, Stephen Roach, on CNBC today. The current chairman of Morgan Stanley Asia (MS) is bearish on the economy and sees no chance of a ?V? shaped recovery, just a very weak one at best. The ?green shoots? are still underground. ?The consumer is toast,? he averred, and he expects consumer spending to plummet from a record 72% of GDP to 67% in five years. Since a massive external deficit has to be funded by foreigners, the outlook for the dollar is ?down, down, down.? There won?t be a crash, just a gradual descent, as we have seen for the last 38 years. China isn?t going to bail us out. The US has only 4.5% of the global population, but accounts for $10 trillion of consumer spending. China and India together have 40% of the population, but only spend $2 trillion. This disparity is 50:1.?? Steve was an early BRIC fan, like me, and since China is so overbought short term, India is his first pick. You want to buy countries that have to build infrastructure and a middle class, and China has already done that. India?s recent election of a more pro business government is the trigger. I aggressively pushed India at the beginning of the year, and it has doubled since then. The humorous thing about all of this is that Steve has been spouting the same bearish line for the US for 15 years. The in-house joke at MS was that he was sent to China because his negative sentiments were scaring the firm?s conservative US institutional investors. Given the performance of the BRIC?s since then, it is Steve having the last laugh.

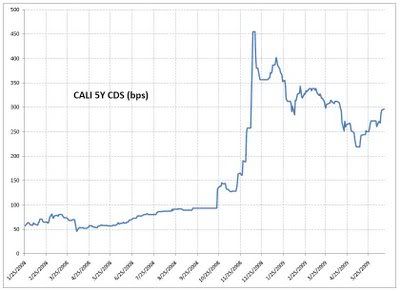

4) Sadly, once again, my once beloved but now spurned home state of California is threatening to commit suicide. The formerly Golden State officially runs out of cash in 50 days, and our body building governator, Arnold Schwarzenegger, refuses to borrow any more until the legislature delivers $24 billion in spending cuts. Standard & Poor?s has placed it on Credit Watch, and premiums for credit default swaps on the state?s debt have already spiked back up to 300 bp. I got a letter today from Robert Birgeneau, Chancellor of the University of California at Berkeley, where my son goes to school, telling me that his budget shortfall has just leapt from $67 million to $145 million, and that tuition is going up 9.3%, while staff wages will be cut by 8%, and financial aid will be chopped to the bone. Yikes! And this is the place we are counting on to deliver the scientists, engineers, and professionals who are supposed to keep us globally competitive.?? Pleas to Obama for a bailout have already been brushed aside, like a pesky fly. He rightly sees us as an alcoholic friend asking to buy him just one last drink. A default would be no joke, as California accounts for 15% of US GDP, and ranks as the world?s eighth largest economy. Few realize that the state is home to the country?s second highest per capita payers of tax revenue into Treasury coffers, after New York (Sarah Palin?s Alaska is the lowest). Hardly a day goes by without banner headlines about closing state parks, cancelling local sports programs, or freezing payments to mothers with dependent children. In fact, most state residents now prefer the Sacramento government to go bust in order to bring a speedier resolution. There is only one possible solution. A new governor holds a constitutional convention to reduce the vote to pass a budget from two thirds to 50%, or a statewide voter initiative accomplishes the same. Maybe ex Ebay CEO Meg Whitman, who will run for Arnold?s job next year, is up to the task?

QUOTE OF THE DAY

?It?s hard to believe that with more regulatory oversight and less leverage permitted, that return on equity is not going to fall??.my guess is that it is three to four points lowe

r,? said Bob Doll, co-chairman at Black Rock, the world?s largest money manager.