June 2, 2011 - 'RISK OFF' Returns With a Vengeance

Featured Trades: (RISK OFF RETURNS WITH A VENGEANCE)

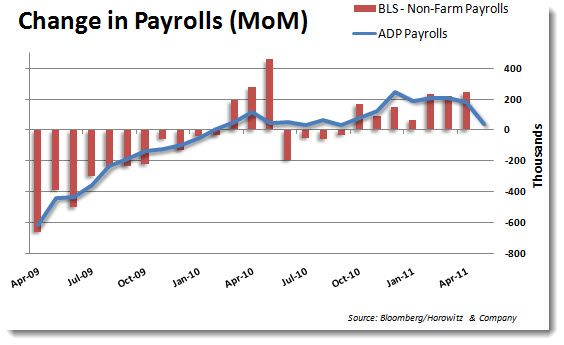

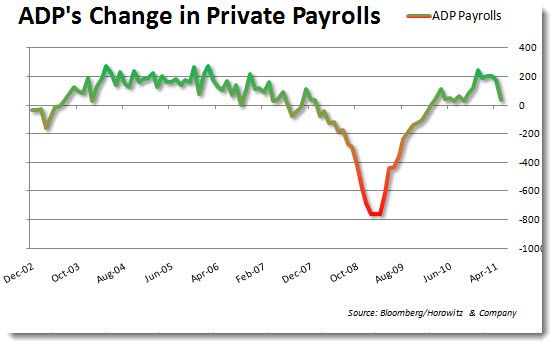

2) 'RISK OFF' Returns With a Vengeance. I have not seen a day this ugly in quite a long time. From the second that a dismal ADP report came out in the pre-market, it was a steady slide, right up until the close. The S&P 500 couldn't rally even five points on the day, and closed down a stomach churning 30.66 points.

I knew that risk markets had to be peaking yesterday when several hedge fund managers called me to review my logic behind my current short positions, right after the S&P Case Shiller U.S. National Home Price Index showed that residential real estate had returned to free fall mode.

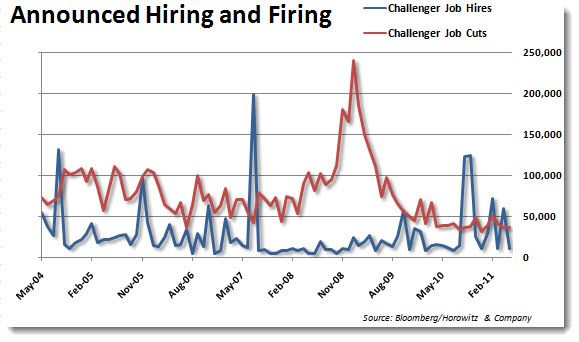

The Challenger-Grey ADP report, an indicator of employment trends, could not have been worse. Consensus expectations hovered around 190,000, but came in at only 38,000. Then the May ISM index plunged from 60.4 to 53.5, the lowest point in nearly three years. Moody's threw fat on the fire with several sovereign debt downgrades.

All of this comes on top if negative economic reports from China, Australia, and South Korea. The big picture is one of a global slowdown, with the US economy dragging the rest of the world into the ditch. Many were puzzled by a steady drip, drip of worsening economic news producing rising stock prices for most of last week. But I knew that once you reached the tipping point, the sell orders would pour in like a breached Hoover Dam. That is exactly what we got today.

Of course, it was a great day to follow a particular newsletter that has been pounding the table about the 'RISK OFF' trade for the past six weeks. Once the selling in stocks accelerated, it spilled over to commodities, foreign currencies, oil, junk bonds, and silver, pretty much anything that still had a bid. Treasury bonds and the dollar skyrocketed. It all added up to a one day, 3.5% pop in the value of the Macro Millionaire model portfolio.

All of this makes this coming Friday's May nonfarm payroll even more interesting, with economists back peddling their estimates so fast, they could well be Lance Armstrong racing in reverse. Goldman Sachs cut their number by a whopping 50,000. Confidence is melting by the second.

-

-

-

Thar She Blows!

-

Which Way Now, Lance?