June 21, 2023

(INTEREST RATES IN AUSTRALIA AND THE EUROZONE)

Wednesday, June 21, 2023

Hello everyone,

I hope you all had a wonderful long weekend.

Interest rates rose in the Eurozone and in Australia, but were put on pause in the U.S.

Let’s investigate.

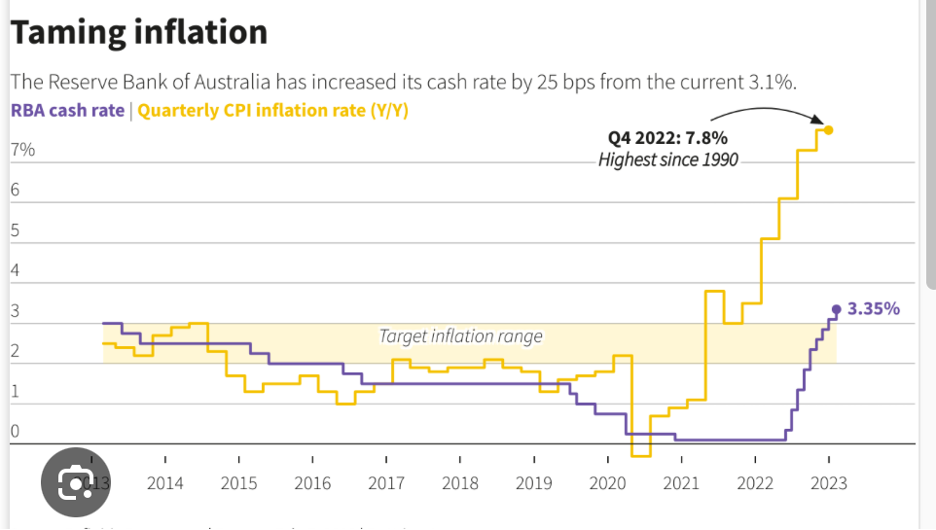

The decision to hike another 25 basis points in Australia brings the cash rate to 4.1%, its highest level in 11 years. And there are more hikes to come to make sure inflation returns to target.

The Reserve Bank of Australia (RBA) currently forecasts headline inflation – which was running at 7% last quarter- to return to the top of its target range of 2-3% by mid-2025, a slower path than many other economies as Lowe wants to preserve strong gains in the labour market.

Mortgage owners have been hit with a 400-basis point hike in the space of a year in what has been hailed as the fastest tightening cycle on record, as inflation stays stubbornly high.

April 2023 has been the only exception, when the RBA briefly paused rates, giving mortgage holders a much-needed reprieve.

Aussies with an average loan size of $577,000 will be spending over $15,000 more per year on their mortgage compared to what they were in April last year.

Lowe has already acknowledged the risks of a more pronounced downturn in the economy, saying the path to “achieving a soft landing remains a narrow one”. The RBA is walking a tight policy rope.

It is thought that the RBA will hike again in July or August to bring rates up to 4.35%. Some of the major banks in Australia are estimating that there won’t be any rate cuts until November 2024. And the banks are also suggesting that mortgage rates could hit 7+% before they start to moderate in late 2024 and into 2025.

Many homeowners bought houses in Australia in the last few years before interest rates surged as there was a firm commitment expressed by the RBA not to raise rates until 2024. Now, many of these people are being forced to sell their homes because they can’t meet the increased costs.

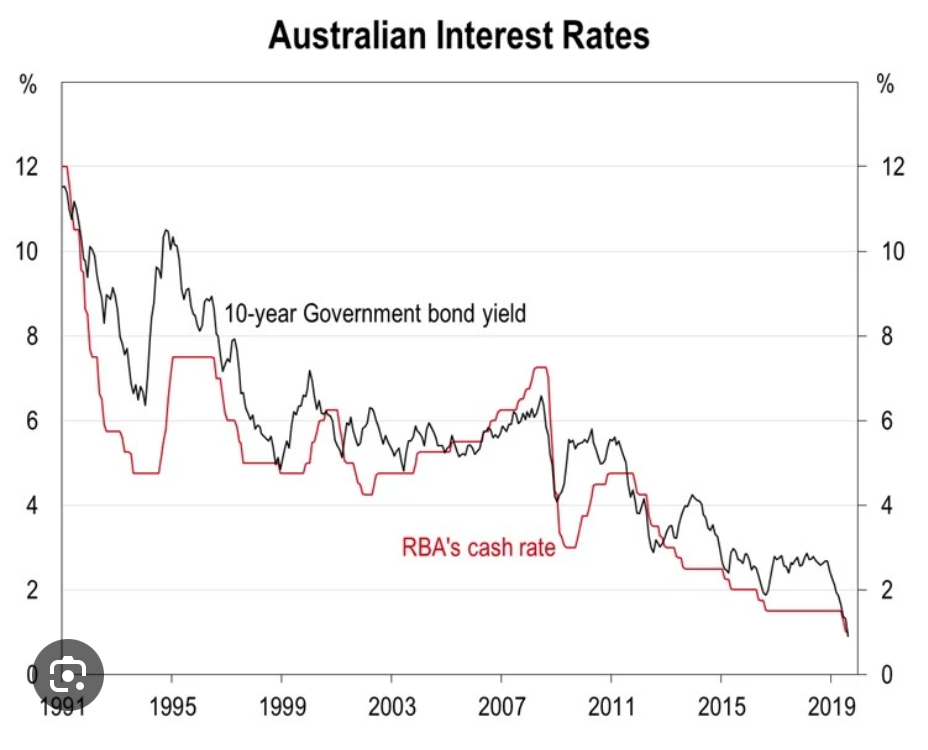

Looking historically at rates from the 1970s onwards in Australia, high interest rates have not been uncommon. Rates exceeded 10% for the first time in 1974 and pretty much remained above 10% until 1995. In just 4 years, interest rates dropped from the high of 17% (January 1990) to the low of 8.75% (June 1994). After a peak of 10.5% in 1995, interest rates reached a low point of 6.5% in December 1998.

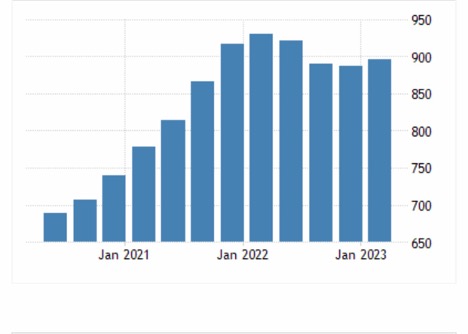

Average House prices in Australia increased to $896,000 (AUD) in the first quarter of 2023 from $887,500 in the fourth quarter of 2022.

Australian Fixed Housing Interest Rates

Average house prices in Australia from late 2020 to early 2023

So, what’s happening in Europe? Are they in a better position than Australia?

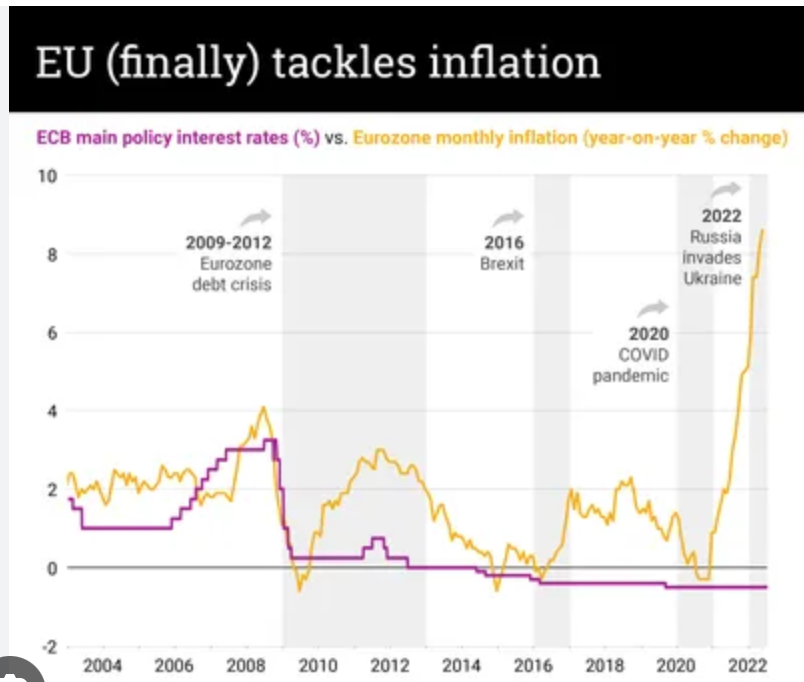

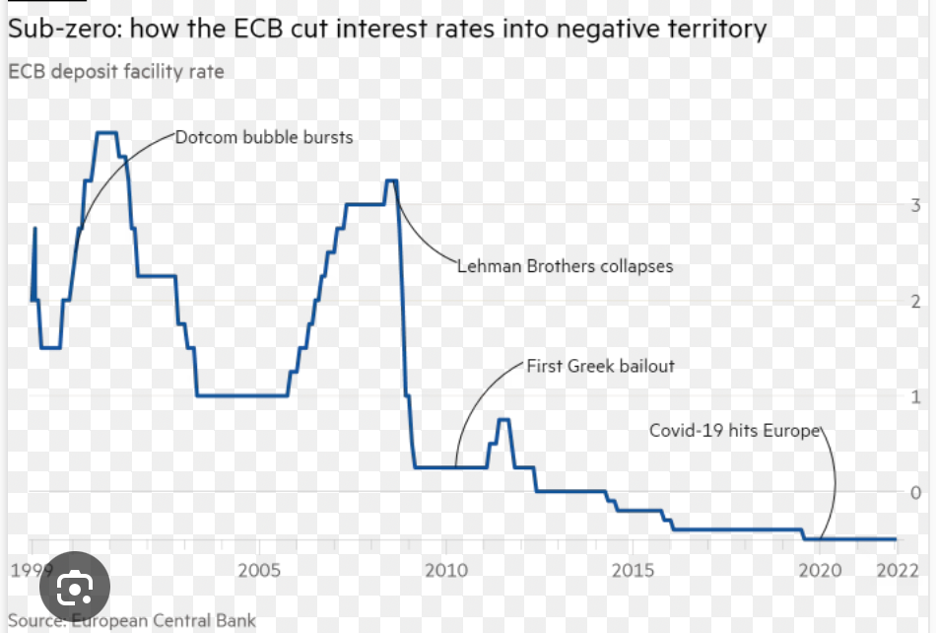

Last Thursday, the European Central Bank raised eurozone interest rates by a quarter-percentage point to the highest level since 2001 and they have indicated that another hike is likely as they strive to get inflation under control. The hike marks the eighth successive rate rise for the bank showing that they too are struggling to rein in price rises amid quavering economic growth.

The latest increase pushes the ECB’s deposit rate, which is paid on commercial bank deposits, to 3.5% - the highest since 2001. Inflation is expected to average 5.4% in 2023, before dropping to 3% in 2024, according to fresh projections from ECB staff.

The central bank’s rates cover the 19 member economies that make up the eurozone. The latest rate hike marks the sharp shift in economic forces when compared with last summer’s deposit rate of -0.5%.

Last week, revised data showed that the eurozone had slipped into recession as the rising cost of living dampened consumer spending. Economic output shrank by 0.1% in the final quarter of 2022 and the first quarter of 2023, according to official data from Eurostat. A technical recession is generally defined as two consecutive quarters of negative growth. The central bank is “very likely” to raise rates again in July as there is still ground to cover in taming inflation according to Christine Lagarde.

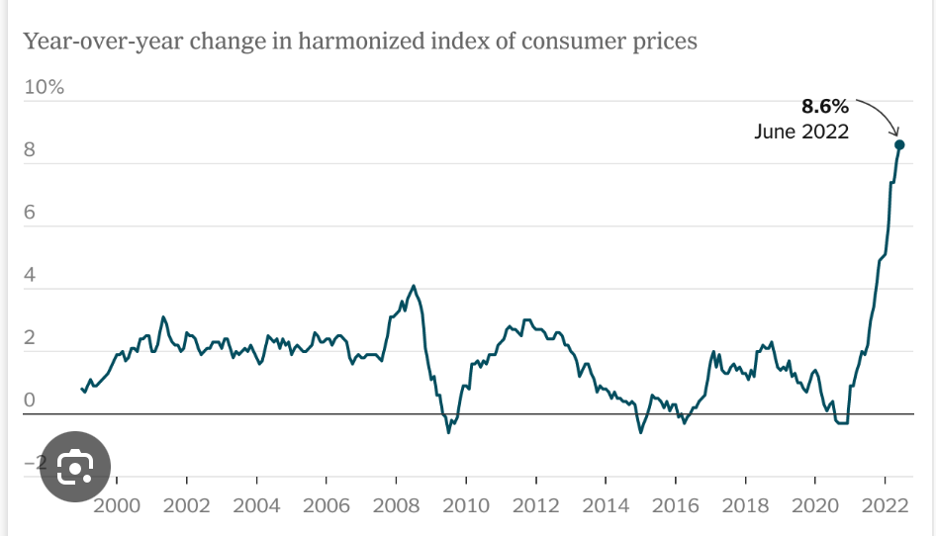

Eurozone inflation rises to 8.6%, the highest ever – The New York Times

Even though the US paused on raising rates last Wednesday, it seems that further rate rises are to come worldwide before peaking next year. When and by how much rates are cut will differ in each country, but the US market appears to be pricing in rate cuts as early as later this year. Let’s see if Mr. Market is correct.

Have a great week.

Cheers,

Jacquie

The president of the European Central Bank, Christine Lagarde, spoke in Frankfurt, Germany last Thursday.