June 24, 2009

June 24, 2009 Featured Trades: (SPX), (EURO/YEN CROSS), (VENTURE CAPITAL)

1) All eyes will be on the Fed interest rate decision today, but your time will be better spent watching the NBA finals, the US Open, or Wimbledon, which you have wisely Tivo?d for days like this.?? US industrial capacity utilization is terrible, and still falling, while unemployment is still rising at a record pace. Sure, commodity prices have doubled this year, but the give back there has already started. The buying that did occur happened because investors were looking for an alternative to the sick dollar, not because there is huge underlying demand by end users. This is one of the reasons why I became cautious about all of my long positions last month. So I can say with complete confidence that the chances of an interest rate hike are less than zero for the foreseeable future.

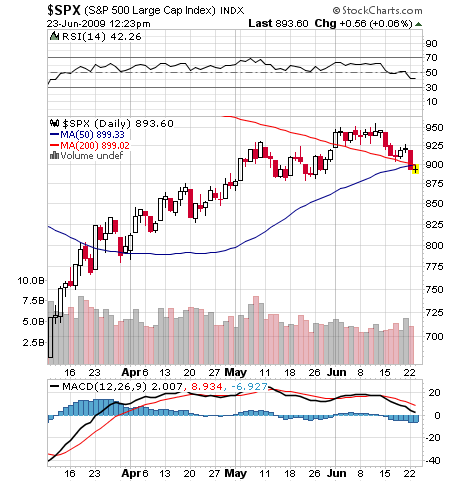

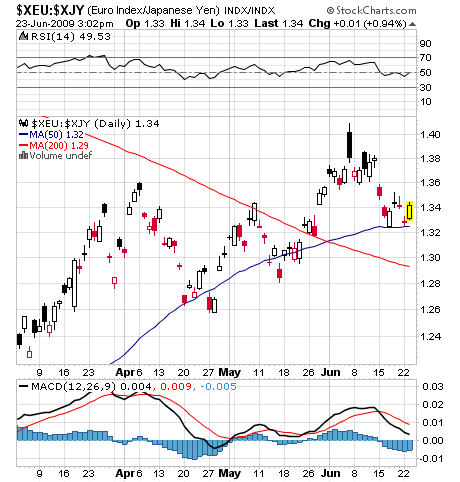

2) I warned readers that pain was on the way eight days ago, and one of the big reasons was a major reversal in the euro/yen cross rate, a great barometer of global risk taking by hedge funds. After trading as high as ??170 in 2007, it plummeted to a low of ??114 earlier this year. It then took off like a scalded chip three weeks before the S&P 500 made its prophetic 666 low on March 9. Look at the charts for the euro/yen and the SPX and you?ll see the correlation has been huge. This is a valuable and highly predictive cross rate to track, because the big boys can finance positions for free by borrowing in yen and investing in other high yielding, commodity producing currencies, like the Australian, New Zealand, and Canadian dollars. After a spike up to ??141 on June 8, euro/yen reversed all the way back to ??132 warning that a tempestuous round of deleveraging and risk reduction was on the way. For mere mortals, this translates into selling of everything across the board and is why trades as diverse as copper, crude, stocks, and BRICS have suffered vicious sell offs. Watch the euro/yen cross as a wizened old sailor keeps a weather eye on his barometer.

3) If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.? The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds. Thank Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s movie National Treasure. The balanced scales in the seal are certainly wishful thinking and a bit quaint. Study the buck closely, because there are going to be a lot more of them around.

4) These are indeed dark days for Silicon Valley?s venture capital industry. With the exit door slammed shut for years to come, new money is staying away, avoiding the high risk multiyear lock up. Angel investors have gone back to heaven. The deterioration of the economy has been so rapid that the rationale for many start ups is no longer there. Countless web 2.0, next generation models for social networking sites, video sharing sites, wikis, blogs, and folksonomies never made it to profitability, and will be swept away. Unfortunately, this means there will be an untold number of great ideas that will never see the light of day. Alternative energy is one of the few areas where business plans are getting any traction. Many investors are bracing themselves for reports of losses on their existing holdings, once the industry?s arcane accounting makes that possible. Expect a lot of once hard to get office space on Palo Alto?s Sand Hill Road to become available for cheap soon.

QUOTE OF THE DAY

?While there?s an energy shortage, we have no shortage of energy,? said John Hofmeister, former CEO of the US operations of Shell Oil.