June 26, 2009

June 26, 2009

Featured Trades: (BYDDF), (GMX), (TM), (AMSC), (CVA)

Would you like to receive each post from The Mad Hedge Fund Trader 24 hours earlier than anyone else? Is so, please subscribe to our client newsletter at our store at www.madhedgefundtrader.com. For $29 a month you can get the head start that can make a crucial difference in your trading and investment decisions. In a world when indexes move 10% a day, and individual stocks move 25%, a day can seem like a lifetime. Global research is getting more expensive, especially with a falling dollar. Thanks for your support.

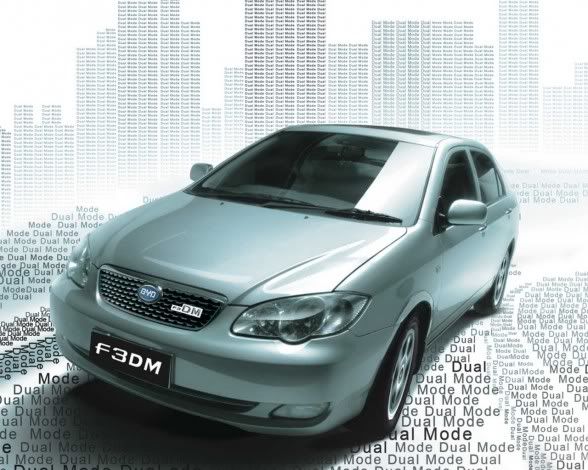

1)Like Paul Revere on his midnight ride, I feel a patriotic duty to warn you of the foreign invasion that is headed our way. No I?m not talking about the British, but redcoats of a more Eastern origin. I?m referring to the Chinese electric car company ?Build Your Dreams? (BYDDF) (see http://www.byd.com/company.php) . CEO Wang Chuan-Fu, who Charlie Munger describes as a combination of General Electric?s (GE) legendary manager, Jack Welch, and inventor Thomas Edison, scraped up $300,000 from relatives to start a knock off cell phone battery company in Shenzen in 1995. He grew the company into a massive, vertically integrated conglomerate, employing 130,000 workaholics at 11 factories, including those in Hungary, Romania, and India (interesting choices). BYD bought a defunct car company in 2003 and re-engineered it to launch the $22,000 F3DM sedan last year, an old technology ferrous oxide based plug-in hybrid that gets 62 miles on a charge. General Motors (GMX) Volt and Toyota?s (TM) plug in Prius, which won?t come out until next year, will only get 40 miles per charge and cost more. All-electric models are coming out this year. Warren Buffet was so impressed, he made a rare foreign investment last year, asking for a 25% stake and settling for 10% for $230 million. Wang, who has already earned himself a place on the Forbes 400 list, intends to build BYD into the world?s largest automaker, and quickly. Why do I feel like this war is over before the first shots were even fired?

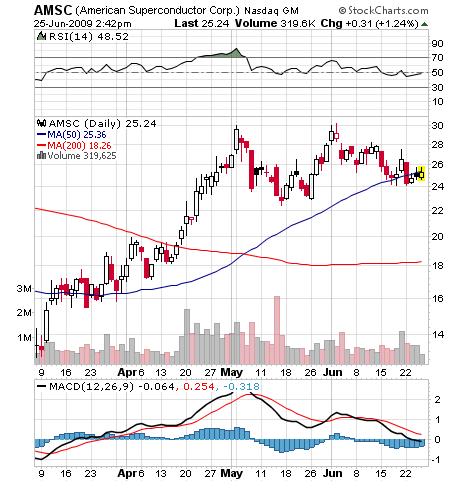

2) If the 2009 Clean Energy Bill passes, it is going to pave the way for major structural changes to the US economy, which few of the non-engineering types voting for it in Congress understand. The bill encourages electric power utilities to switch to renewables, upgrade the electric power grid, and put in place a cap and trade system which places an enormous burden on the power industry to go green (see my June 15,2009 Newsletter). The bill is expected to sail through the House, but faces a major fight in the Senate, where the administration is going to have to get all of their ducks in a row for it to pass. The bill provides the legal structure to spend that $100 billion for alternative energy already passed in the stimulus bill. In his cheerleading press conference for the bill, Obama correctly declared that dependence on hydrocarbons was jeopardizing our national security. He also cleverly described this as a massive creator of high tech jobs that can?t be exported.? I?m not highlighting this because I live in California, wear sandals all year, drive a Prius, or have a refrigerator stuffed as if a giant gerbil does my shopping. Since this economic crisis started, the key has been to buy whatever the government is buying, and since they are going into alternatives in a big way, you want to be right ahead of them (see my solar piece). Time to add more alternative energy names to your list to buy on dips. Look at American Superconductor (AMSC), which is involved in advanced wind turbine designs and electric power grid upgrades. Also take a peek at Covanta (CVA), an established business that profitably burns trash to create electricity.

3) There is an easier, cheaper, and faster way to solve the banking crisis which no one is talking about on Capitol Hill.?? If collateralized debt obligations (CDO?s) are the problem, just get rid of them! Desecuritize them! Just convert them back into the underlying loans. There are $1.4 trillion in CDO?s outstanding, backed by Alt-A and subprime loans in the form of 3,700 individual securitizations of perhaps 3.7 million loans. Over 68% of the loans backing these bonds are current.?? Mark to market rules are forcing the banks to carry this paper on their balance sheets at 50%-80% discounts. The problem is that mark to market is a meaningless accounting fiction when there is no market. If you break up these securities and place the underlying loans back on the banks? balance sheets, the good mortgages can be valued at 100% of face, and those behind in their payments, or in default, can be discounted to maybe 70% of face because they are still secured by the value of the homes. This would boost the entire asset class from the current 20-50 cents up to 90 cents on the dollar. Restored balance sheets would enable banks to resume lending. Of course it would be a massive admin job unwinding the rats? nests behind some of these securities, but Heaven knows there is abundant subprime and Alt-A expertise available for hire these days. Just sift through the ashes of Lehman Brothers and Bear Stearns. Why aren?t people talking about this?

4) Another green shoot bites the dust as weekly jobless figures jumped 12,000 back up to 627,000. They started offshoring hedge fund managers years ago.?? And now South Carolina governor Sanford tells us that his state has started offshoring mistresses. Where will it all end? Is there no shame? Please pray for me, Argentina.

QUOTE OF THE DAY

?You can?t produce a baby by getting nine women pregnant for one month,? said Oracle of Omaha, Warren Buffet, revering to Obama?s multifaceted attempts to revive the economy.