June 28, 2017 - MDT Pro Tips A.M.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

CURRENT POSITIONS:

GOGO Long at $19.93

Total Premium Collected $1.95

ASNA Long at $14.20

Total Premium Collected $0.75

DUST Long $4.50

Total Premium Collected $0.70

DYN Long at $12.55

Premium Collected $0.48

VRX Long at $13.69

VRX Short June 30th-$16.50 call at $0.30

APA Long Oct $47.50 Call at $3.45

APA Short Oct $52.50 Call at $1.10

..........................................................................................

With all the recent contractions the market has been experiencing, we have been looking for an expansion. And yesterday we got it.

However, not to the upside, but to the downside.

The S & P 500 ended up closing at 2,419.38, down 19.69 points. The range for the day was 20.77.

Yesterday's range certainly exceeded the average true range (ATR), which now reads 14.07. And it certainly qualified as an expansion due to the fact that yesterday's range was almost 50% greater the ATR.

The high for the day was 2,440. This also happens to be right at the lower end of the resistance level from last week's weekly price bar. The area I mentioned was the 2,440 to 2,442 range.

Not to sound redundant, but when that area was violated in the morning, it should have become resistance. And that is what transpired.

The S & P 500 also broke through our minor resistance level, which was 2,433.60. After the gap down open, the S & P 500 stopped at 2,432.68. This was within a point of the short term support level I mentioned yesterday.

Then the market bounced up to 2,440.15 and it sold off the balance of the day.

As this was happening, the VIX had one its bullish spike, closing almost 12% to the upside on the day.

The close for both the S & P 500 and the VIX are significant.

For the S & P 500, this was the first close under 2,421.88. This now sets up a scenario where if the S & P does close under that level today, the downside objective becomes 2,375.

I do need to mention that short term the S & P 500 is oversold and a bounce is likely.

Likewise, the VIX is overbought. And I would still expect resistance at 12.50. And yesterday, I mentioned that I did not feel that the VIX would take out 10.94 on a bounce and it did.

This sets up a scenario where I would expect another rally in the VIX should it sell off today.

Does this kill the July 4th rally? I still think we will get one.

Continue to follow the resistance levels.

Here are the Key Levels for the Markets:

$VIX:

Minor level: 14.45

Major level: 14.06

Minor level: 13.67

Minor level: 12.89

Major level: 12.50

Minor level: 12.11

Minor level: 11.33

Major level: 10.94 ***

Minor level: 10.55 <

Minor level: 9.77

Major level: 9.38

The VIX would need two closes above 11.33 to move up to 12.50.

10.55 should be minor support. And 11.72 could be resistance.

$SPX:

Major level: 2,500.00

Minor level: 2,484.38

Minor level: 2,453.12

Major level: 2,437.50

Minor level: 2,421.88 <

Minor level: 2,390.62

Major level: 2,375.00

Minor level: 2,359.38

Minor level: 2,328.12

Major level: 2,312.50

2,429.70 could be minor resistance. The S & P 500 would need to close above 2,421.88 to avoid a further slide.

2,414 could offer minor support.

QQQ:

Major level: 146.87

Minor level: 146.09

Minor level: 144.53

Major level: 143.75

Minor level: 142.97

Minor level: 141.41

Major level: 140.63

Minor level: 139.85

Minor level: 138.28

Major level: 137.50 <

Minor level: 136.72

The QQQ dropped more than the S & P 500. It dropped 1.81% versus .81% for the S & P 500.

I would expect support at 137.50. 139.84 should be minor resistance.

IWM:

Major level: 143.75

Minor level: 142.97

Minor level: 141.41

Major level: 140.63 <

Minor level: 139.85 **

Minor level: 138.28

Major level: 137.50

Minor level: 136.72

Minor level: 135.16

The IWM closed one cent under the minor 139.85 level. A close today under 139.85 and the objective should be to 137.50.

137.50 should offer support. 140.63 should be resistance.

TLT:

Major level: 131.25

Minor level: 130.47

Minor level: 128.91

Major level: 128.13 **

Minor level: 127.35 <

Minor level: 125.78

Major level: 125.00

Minor level: 124.22

Minor level: 122.66

Major level: 121.88

The TLT sold off over 1% after hitting the objective.

126.56 is minor support. A break under this level and expect a further drop. A close today under 127.35 and I would expect a retest of 125.

GLD:

Major level: 125.00

Minor level: 124.22

Minor level: 122.66

Major level: 121.88

Minor level: 120.32

Minor level: 119.53 ***

Major level: 118.75 <

Minor level: 117.97 ***

Minor level: 116.41

Major level: 115.63

The GLD closed just above 118.75. To move higher, it will need two closes above 119.53. 120.31 should be resistance.

XLE:

Minor level: 69.53

Major level: 68.75

Minor level: 67.97

Minor level: 66.41

Major level: 65.63 <<

Minor level: 64.85 ***

Minor level: 63.28 <<

Major level: 62.50

Minor level: 61.72

63.67 is a minor support level. If the XLE closes under that level, I would expect a drop to 62.50.

64.84 is minor resistance.

FXY:

Minor level: 87.89

Major level: 87.50

Minor level: 87.11 **

Minor level: 86.33 <

Major level: 85.94 **

Minor level: 85.55

Minor level: 84.77

Major level: 84.38

Minor level: 83.60

Minor level: 83.20

Major level: 82.81

The FXY had it's first close under the 85.94 level. A close today under that level and the FXY could drop to 82 to 83.

Minor support is at 85.55 and yesterday's low came within two cents of it. A break under this level also confirms further downside.

Continue to trail a stop if you followed the short scenario I have been outlining.

AAPL:

Major levels for Apple are 162.50, 156.25, 150, 143.75, and 137.50

Apple closed 2 cents under the 143.75 level. 142.97 should offer minor support.

Short term Apple is oversold.

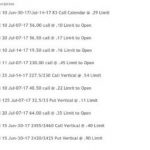

WATCH LIST:

Bullish Stocks: REGN, TSLA, AGN, HUM, FDX, BDX, ANTM, UNH, ANTM, CI, EXPE, NVDA, BABA, WYNN, JNJ, CELG, VRTX, KMB

Bearish Stocks: BWLD, AAP, CASY, CLB, CVS, DG, DLTR, SLB, TSCO, TGT, FL, SFLY, DKS, BGS, HAIN, DVN

Be sure to check earnings release dates.