June 29, 2009

June 29, 2009 Featured Trades: (TBT), (JAPAN), (CALIFORNIA), (UNG), (WHEAT)

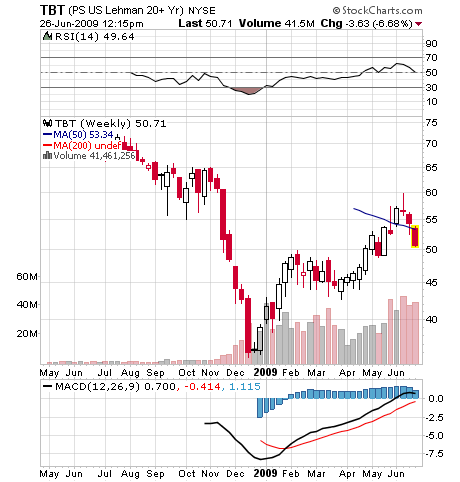

1) For those who missed the 70% move in the TBT this year, the double short Treasury bond ETF, another window is setting up for you to get in. After running up from $35 to a meteoric $60, we have backed off to $50. Similarly, the bond futures, which plunged from 142 to 112, have bounced back up to 118.5. The yield on the ten year has backed off from 3.99% to under 3.50% in just a few weeks. I think the prospect of a retest of this year?s stock market lows triggered a lot of flight to safety buying of government paper in the last few weeks. If we don?t get that retest, which I think is unlikely, then it?s back to the races for the TBT. End of month, end of quarter, and end of half window dressing has also been goosing prices. Things certainly aren?t getting any better on the fiscal front. According to the Congressional Budget Office, the national debt is now growing so fast, that it will reach 100% of GDP by 2023, seven years earlier than was predicted only 18 months ago. Some 90% of the increase came from burgeoning Medicare and Medicaid spending. It seems that hardly a week goes by without Congress passing another humongously expensive package that has wonderful long term benefits for the economy and society, but has to be paid for with hard cash dollars up front. Watch the TBT.

2) It?s sad to see a once great country fall on hard times. It?s like watching a formerly leading hedge fund manager apply for food stamps. I?m talking about Japan, which in 1989 boasted the world?s most valuable stocks, largest banks, and strongest currency. Oh, how the mighty have fallen. This week the Ministry of Finance published the trade figures for May showing a 42% YOY drop, and that the cataclysmic fall in exports continues unabated, as foreigners keep their money in their pockets instead of buying high quality cars and electronics. Even exports to China fell 29.7%. I?m sure the chart below will be found in business school textbooks for decades to come as proof of the risks of running an overly export dependent economy. Although a giant fiscal stimulus package will start to hit in the second half of this year, most economists have GDP forecasts for the year of minus 6.8% or worse. This would take GDP back to the 2004 level, and make our economy look positively bubbliscious by comparison. This is all happening when the numbers of those retiring is going through the roof, causing welfare payments to skyrocket. Taking a page out of Obama?s playbook, the government is borrowing to meet these costs, so the national debt is expected to reach the certifiable nosebleed territory of 197% by next year! Prime Minister Taro Aso has so far fought off increased consumption taxes, but it is just a matter of time before those efforts are tossed out the window. Continued deflation is a no brainer. Real estate prices are still stuck at 30% of their 1990 levels. This is what an ?L? shaped recovery looks like up close and ugly. In the meantime, the yen strengthens, making exports ever more expensive and uncompetitive. Better to stand aside from the Land of the Rising Sun and watch with tears. Is the US next?

3) The Wall Street Journal made some prescient comments yesterday about how the flood of hedge fund capital into commodities is fundamentally changing the nature of those markets, confounding the old timers. The Northeast is experiencing the coldest summer in 27 years, and you would expect Natural Gas to crater (see my June 2, 2009 Newsletter). But chart buying by the proliferation of new NG ETF?s out there has been holding it up. Excessive rain has delayed wheat plantings, normally a very positive development for wheat prices. But traders are obsessing over weather Chinese stockpiling of food is leveling off, knocking prices for a loop (see my June 16, 2009 Newsletter). I avoided trading the soft commodities for most of my life, because, basically, making a bet on the weather always seemed like a loser to me. Better to bet on two flies crawling up a wall.?? The pros relied on Cray supercomputers processing complex algorithms and historical data to come up with forecasts that were wrong half the time. I actually prefer the new order. I rather place bets on what the Chinese are up to than Mother Nature any day.

4) As the California budget battle reaches white hot temperatures, Fitches has cut the rating on the state?s debt to A-, and placed it on ?credit watch?, a warning of further downgrades. The move is a delayed recognition of reality, as is the rating agency industry?s practice. The legislature tried, but failed to pass $12 billion in budget cuts, which governor Arnold Schwarzenegger said he would veto anyway, because they didn?t meet the full $24 billion tab (see my previous dispairing piece here). In the package were increases in motor vehicle registration fees, $1.50 a pack in additional tobacco taxes, cancellation of health insurance for one million children, a production tax of 9.9% for in-state pumped crude oil, the firing of thousands of teachers, firefighters, policemen, and probation officers, and more smoke and mirrors accounting shenanigans that kick the can into the future. Some of the changes were only possible through a redefinition of the English language that turned ?taxes? into ?fees.?As California goes, so goes the nation, as many states will follow the Golden State into financial Armageddon. In a new era of soaring unemployment, restrained consumption, high savings, and crashing stock and property prices, states dependant on taxes on incomes, sales, capital gains, and property appraisals don?t do well. Make sure those muni bonds are insured. Why do I get the sickening feeling that I am watching a rerun of Thelma and Louis?

QUOTE OF THE DAY

?Recession-Plagued Nation Demands New Bubble to Invest In,? says The Onion in a headline, a satirical publication.