June 3 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the June 3 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Domino's Pizza (DPZ) is at all-time highs? Would you buy this name right here, right now?

A: No, I would not even buy their pizza. You would be crazy to buy them right now up here this high. I prefer Round Table, the pizza not the stock. All of these “reopening” stocks are way overextended.

Q: Will the riots delay the recovery?

A: Yes, they will, it could take as much as another 1% off the current GDP growth rate. It’s hitting the already worst-hit sector—retailers. Many retailers will not come back from these, especially the small ones. These businesses were just returning from being closed for two months when they got burned down. But we won’t see it in the macro data for many months because its happening largely at the micro level. If you didn’t like Macy’s (M) before when it was headed for Chapter 11, you definitely won’t like it now that it is burning down.

Q: If airlines like United Airlines (UAL) can’t use the middle seat, do you see ticket prices going up 10%, 25%, or 50%?

A: Yes. In theory, to just cover the middle seat, they have to increase prices 33%. And there will be a whole lot of new costs that the airlines have to endure as part of this pandemic, such as extra cleaning, disinfecting, and temperature taking. So, they’re really going to need to increase prices by 50% or more just to break even. My guess is that the airline industry will shrink in half in the fall when all the government bailout money runs out. So, I've been telling people to take profits on the airlines, especially if you have a double or triple in them, or if you have the LEAPS.

Q: Is Facebook (FB) immune from any big selloff?

A: No, nobody is immune—look how much Facebook sold off in March, some 35%. Mark Zuckerberg seems to be making a deal with the devil, accommodating the president with unrestricted incendiary Facebook posts. And the consequences of a Democratic win for Facebook could be hugely negative, so I am not participating in that one. Mark doesn’t have a lot of friends in congress right now so regulation looms.

Q: What do you think about buying Las Vegas Sands (LVS) or Wynn Resorts (WYNN) on the expectation of reopening?

A: I’m a Nevada resident and get frequently updated on the casino news. They’re only going to be allowed half of peak casino visitors that they had in January, so they will generate huge losses. Almost all companies are being allowed to reopen back to half the level that guarantees bankruptcy in 3-6 months. But we won’t see that in the numbers for many months either. I’m negative on any industry that depends on packing people in, like airlines, cruise lines, and movie theaters.

Q: What are the chances of a mass student debt cancellation?

A: That is a possibility if the Democrats win in November, and it has already been proposed. It is about a $1.5 trillion ticket. If you’re bailing out large companies, small companies, airlines, and the oil industry, why not students? It would have the benefit of adding 10 million more consumers to the economy, who are not current participants because they have massive student debts that are appreciating at 10% a year and have terrible credit ratings. So that would be another great economic stimulus measure. By the way, I paid off my student loans 40 years ago in a lump sum payment with my first paycheck from Morgan Stanley (MS). How much did four years of college cost during the 1960s? $3,000. Such a deal.

Q: What’s the next resistance level on the S&P 500 (SPX)?

A: The target we’ve been looking for is $3,125. I’m looking for roughly $40 points above that level—it should be about $3,165. We’re in uncharted territory here because nobody’s ever seen a market rise 40% in two months, so any technical recommendation has to be bearish except for a very short term, like intra-day or daily views.

Q: Any correlation between the 1918 epidemic and now?

A: Here is your History of Virology Lesson 101 for today. There is some similarity, but the 1918 flu actually originated on a farm in Kansas, had a 2% death rate, took a trip to Europe, mutated, came back months later, and then had a death rate of 50%. We haven't seen that second wave yet, or major mutations. We have seen a couple of different DNA strands out there though, meaning we would need multiple different vaccines when we get them. By the way, it was called the “Spanish Flu” because during WWI, every country had censorship except Spain because it was not a combatant. So, the pandemic was only reported in the Spanish newspapers.

Q: Would you get out of any of the previously recommended LEAPS?

A: Yes, I would be taking profits on all of your LEAPS—whether tech, domestic, “recovery”, or whatever else—so if we do get a correction over the summer, you can get back in at better prices, with longer expirations. You can go two years out from say August for example. The risk/reward today is terrible.

Q: Would you hold on to the (SDS) right now, or wait for the pullback

A: No, we have offsetting profits on all of our (SDS) positions, until today—if the market keeps accelerating to the upside, SDS losses will start to offset our profits on the positions, so that’s why I would get out.

Q: Should I buy the ProShares Ultra-Short 20 + Year Treasury Bond Fund (TBT)? I don’t do options.

A: You don’t need to do options, (TBT) is an ETF; anybody can buy that, it’s just like buying a stock.

Q: What is happening with the Australian market?

A: It will trade with the US stock market tick for tick, which means they’ve had a fantastic rally, overdue for a selloff. Wait to buy the next dip.

Q: If markets are going to go down soon, why exit the (SDS)

A: It may go up first before it goes down. And in any case, I have a great profit on the combined position of long (SDS) and short bonds. These days, I like taking big profits rather than praying they become bigger. It’s about risk control and knowing what you can get away with in certain market conditions.

Q: Is now the time to sell the highflyers in tech?

A: Yes, I would be selling Apple (AAPL), Facebook (FB), Microsoft (MSFT), and Amazon (AMZN). Get dry powder, which is worth a lot after you’ve seen a move like this; especially if the economy gets worse, which is likely. My late mentor Barton Biggs taught me to always leave the last 10% of a move for the next guy.

Q: At what point do you buy the ProShares Ultra Short S&P 500 ETF (SDS) outright?

A: Only if there is an immediate collapse in the market, which I can’t foresee with any certainty. When you play these bear ETFs, the costs are very high. You are short double the (SPX) dividend, which is about 5% a year, plus hefty management fees. So, you really have to catch a quick, large move to the downside to make any real money.

Q: Real estate seems like the big winner of the pandemic. Will prices be up by the end of the year or is this just a temporary spike?

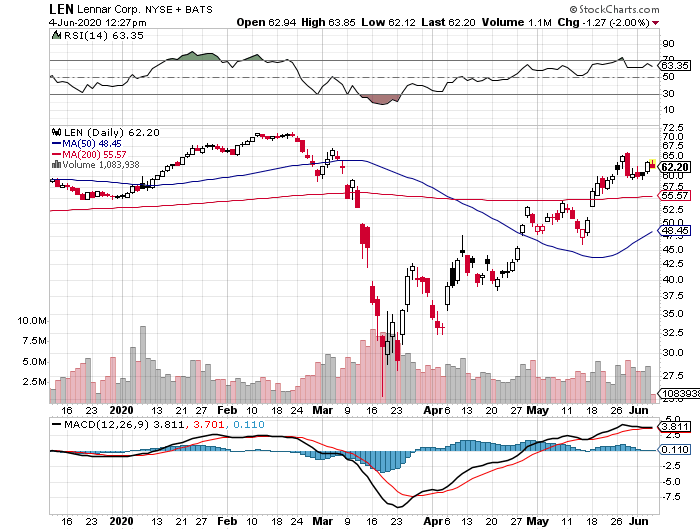

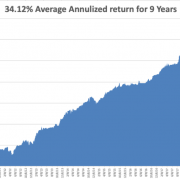

A: They will be up at the end of the year. I have been telling readers all year that their home will be their best investment in 2020 and that is coming true. Real estate has a massive tailwind behind it which has really been in place for a couple of years now, and that is the millennials upgrading and buying houses. The pandemic has really poured gasoline on the fire and triggered a stampede out of the city and into the suburbs. Having 85 millennials ready to upgrade their homes is a huge positive for the real estate market, and I’d be looking to buy the homebuilders on any dip. That’s probably the best domestic play out there. Buy Lennar Corp. (LEN) and Pulte Homes (PHM) on dips.

Q: Post pandemic, will manufacturing have any way of helping US economic growth, or is bringing back the supply chains fake news?

A: It is fake news because if companies bring back production, it will be machines and not people making things. Unless you want to pay $10,000 for an iPhone, or $5,000 for a low-end laptop. Oh yes, and the stocks which made these things would be 90% lower as well. That’s what those products cost in today’s dollars if they were made in the United States. I wouldn't count on any repatriation of US jobs unless people want to work for $3 a day like the Chinese do. Offshoring happened for a reason.

Q: How do I hedge a municipal bond portfolio?

A: You might think about taking profits in muni bonds. They’re yielding around 2% and change. And they could get hit with a nice little 20-point decline if the US Treasury bond market (TLT) falls apart, which it will. Then you can think about buying them back. If you really want to hedge, you sell short the (TLT) against your long muni bond portfolio. But that is an imperfect hedge because the default rate on munis is going to be much higher than it is now than it was in 2008-2009, and much higher than US Treasuries, which never defaults despite what the president has said.

Q: What is dry powder?

A: It means having cash to buy stocks at market bottom. In the 1800s before cartridges were invented, black powder got wet whenever it rained causing guns to fail to shoot. That is the historical analogy.

Q: What do we do now if we’re getting started?

A: It will require a lot of discipline on your part as coming in at market tops is always risky. Wait for the next trade alert. Every one of these is meant to work on a standalone basis. I would do nothing unless you see one of these things happen; any 2 or 3-point rally in bonds (TLT), you want to sell short. We’re just at the beginning of a multiyear trade here so it’s not too late to get back into that. Gold (GLD) is probably safe to buy on the dip here since we are at the very beginning of a historic expansion of the global money supply. I wouldn’t touch any stocks unless we get at least a 10% drop and then I'll start putting out call spread recommendations on single stocks. But right here, on top of the biggest bounceback in stocks in market history, don’t do anything. Just read the research and make lists of things to buy when they do dip—something I do for you anyway.

Q: What about Beyond Meat (BYND)?

A: The burgers are not that bad, but the stock is way overpriced and you don’t want to touch it. It's one of the fad stocks of the day.

Q: Can we access the slides after the webinar?

A: Yes, we post it on the website under your “Account” section about two hours after we’re done.

Q: Are you saying sell everything currently profitable?

A: Yes, I would be selling everything on a short term basis, keep tech and biotech on a long term basis. We are the most overbought in history and you don’t get asked twice to sell tops. But yes, it could go higher before the turn happens. From a risk-reward point of view, it’s terrible to do anything right now.

Q: Could we get a pullback to the $260-$270 area in the S&P 500 (SPY)?

A: Yes, especially if we get a second worse wave of corona and the stimulus takes much longer than we thought to get into the economy, or if the rioting continues.

Q: Should you sell CCI now?

A: Yes, I actually would. You have a 57% gain in the stock in ten weeks, so why not? Long term, it’s a hold.

Q: Are any retail stocks a buy?

A: No, they aren’t because a lot of them are going to go under but you don’t know which ones. After shutting down and losing 60% of their revenues, they’re now being burned down. The pros who do well in the sector are bankruptcy specialists who have massive research teams that analyze every lease in every mall and then cherry-pick. You and I don’t have the ability to do that so stay away.

Q: What is the best way to play real estate?

A: Buy a house. If not, then you buy (LEN), (KBI), and (PHM).

Q: Is it too late to get back in the stock market?

A: Yes, I'm afraid it is. Buying, because it has gone up, is a classic retail investor mistake. After this meltdown, maybe you will learn to buy stocks when everyone else is throwing up on their shoes. That's what I was doing in March and we got returns of 50% to 100% on everything and 500% to 1,000% on the LEAPS (TSLA).

Q: Are you buying puts?

A: No, I am not taking outright short positions any more than I have now because we have a Fed-driven melt-up underway with a stimulus that's 20x larger than that seen during the 2008-2009 Great Recession. When I don’t know what’s going to happen, I get out.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader