June 9, 2009

Featured Trades: (TBT), (CRUDE), ($WTIC)

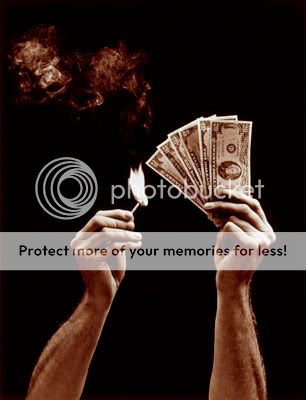

1) Get me out of oil! I love a core long position in this commodity, and expect it to hit $200 before I join the AARP. But we have really gone too far, too fast, and are seriously in overshoot territory. Industry traders have been taking advantage of the greatest contango of all time, buying the front month contract, taking delivery, keeping it in storage, and reselling it forward to reap returns of up to 50%. And that is without leverage! Clever analysts are resorting to Google Earth to spy on storage facilities via satellite. Non industry players have been buying it as a dollar replacement. Crude burns better than dollar bills. As a result, crude in storage has ballooned to record levels. All fine and good when the price is going up. But crude can't stay this high once the sugar high that is sustaining the economy burns off. Better to bail now at $70 and buy it back at $50 once reality sets in. And for Heaven sakes, don't try to get to clever by shorting the stuff!

2) I have watched many countries go bankrupt over the years, as my collection of defaulted bonds hanging on my wall attests. Governments borrow so much that the cost of the debt service exceeds the national budget, so the country has no choice but to quit paying.?? I am starting to see disturbing parallels here. Bush took the national debt from $5 trillion to $12 trillion, and Obama will inflate it to $17 trillion by the end of 2010, boosting it to a frightening 82% of GDP. The cost of the borrowing is rising too. Today a 1% jump in bond yields raises the federal interest burden by $50 billion. The Congressional Budget Office says that figure will explode to $170 billion in ten years. Can you see the same hockey stick, hyperbolic, exponential growth in obligations that I do? Interest rates will soar to double digits, the dollar will crash, and private borrowers will get crowded out of the market, taking the economy into the tank. People blanche when I tell them that my target for the PowerShares US Lehman leveraged short government bond ETF (TBT) is $200, but the logic is inescapable.

3) I met with Dr. Christina Romer, chairman of the Council of Economic Advisors, who practically tore my ear off proselytizing her new found religion, health care reform. Appointed by Obama to advise him on all things economic, Dr. Romer had this hot potato dropped in her lap six weeks ago in one of her daily briefings to the President. With the enthusiasm and ebullience of a new found convert, Dr. Romer laid out goals that were nothing less than revolutionary. She plans not to just 'socialize' medicine, but to fundamentally rebuild the entire health care infrastructure of the US. Tax incentives will be created to encourage value over volume. People can keep existing plans they like. Technology will be applied to cut costs, not only to come up with more complicated and expensive cures. Existing subsidy programs for the poor will be folded into the new plan, offering coverage to 46 million uninsured.?? Providers will get cash incentives for prevention. Individuals will gain the advantages of risk pooling. Pre-existing conditions will be covered.?? All of this will be made revenue neutral through the taxation of employer paid insurance and savings through new efficiencies. If the administration can pull all of this off, the benefits will be huge. An annual 1.5% reduction in health care costs will add 8% to GPD and increase family incomes by $10,000/year by 2040. This will boost corporate profitability and competitiveness, labor mobility, the quality of life, and reduce the budget deficit and unemployment. Failure will see health care spending rocket from the current 18% to 33% of GDP in 30 years, and the number of uninsured explode to 76 million. Romer spewed out statistics as only an economics PhD from MIT can. Oh, and now or the stuff you care about. The economy will shrink in Q2, see no growth in Q3, and turn positive by Q4. The issue doesn't affect me, as I have always avoided health care, insurance, pharmaceutical, and biotech stocks like the plague; they being subject to capricious government approvals, and therefore inherently unpredictable. These are the opening shots of a political dogfight that will ensue over the next three months and dominate the media.

4) America's economy was powered by personal computers in the eighties, the Internet in the nineties, and credit cards and subprime loans in this decade. So what is America's next gig? I think conversion of the global energy grid to alternative sources is the best candidate. If you took this out of the realm of geeky engineering graduate students and high school science projects and made this a national priority and a defense issue, it could become a major GDP driver for decades. Using the broadest possible definitions, the number of green jobs could grow from one million today to 37 million in 20 years, or 17% of the total work force. Since many of these jobs are in local construction and installation they can't be exported. Last year, 8,000 megawatts of wind power was built, the equivalent of seven large coal fired plants, accounting for 42% of all new power generation. If the US develops cost competitive clean energy while China is still stuck using the expensive dirty stuff, it will have a competitive advantage that could reverse the terms of trade with the Middle Kingdom. The US would also have superior technology that it could sell to the rest of the world. I can tell you that green energy is one of the few themes that gets a hearing with venture capitalists these days, and this will be a major stock market driver down the road. I know this is all long term stuff, but remember buying Apple (AAPL) at $4 in the early eighties?

QUOTE OF THE DAY

'In a social democracy with a fiat currency, all roads lead to inflation,' said legendary hedge fund manager Bill Fleckenstein.