June 9, 2014 - MDT Pro Tips A.M.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Current Positions

Short Euro ?????????????????????????? ? ?? 136.31????????????? 136.85?? GTC

Long? JJG??? ????????????????????? ? ? ? ??? 46.95??????????????? 46.00?? Stop Close

.......................................................................................

Today's Working Orders

No working orders

.......................................................................................

Stocks...?

IBM...185 is the 200 DMA support.

?

Bonds...

Bunds...146.30-40 is resistance.

FX...

EUR/JPY...price action over 140.25-30 in this cross will keep a firm undertone to the Euro.

GBP/USD...167.90 is neutral for the Pound. Good above/Negative below.

Commodities...

Corn...needs to close above 4.58 to confirm a bottom.

JJG...I just want to see this maintain over 46.70 close (200 DMA)

General Comments orValuable Insight

The U.S. Treasuries have been sold on the spread against their European counterparts. We'll be monitoring these spreads to see if this will translate into Euro weakness.

Many instruments have had big 2 1/2 week rallies. Spu's have hit our initial tgt of 1950 published a couple of months ago.

We have a higher swing count from the last low in April targeting the mid 1980's, however it wouldn't be surprising for the short sellers to give it a go over the next few days.

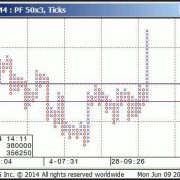

Both the Nasd 100 & Spu longer term point & figure charts are in need of some back and fill after the recent one way trade with no retracement.

I.E. Nasd 100 has rallied from 3560 without backing off over the past 3 weeks.

It might be a little early for the Grains to start a summer push higher but the level is a low risk area to start a position.

Opening Range Time Frame Trading again today.

?

Short Term View...

Keep trading to make money. The opportunity will be in individual names.

Individual stocks look to be an easier read based off their own technical's.

Nasdaq 100 Futures

For Medium Term Outlook click here.

?For Glossary of terms and abbreviations click here.