Keep Gilead Sciences on Your Radar

I am going to continue to use this correction in the stock market as an opportunity to put new names in front of you for inclusion in your investment portfolio.

That way, when the markets turn, you can strike with the speed of a rattlesnake in returning to a ?RISK ON? posture.

Major turnarounds are not the time to engage in deep, fundamental research. It is when you should be pulling the trigger on Trade Alerts, which you have wisely spent time lining up.

This brings me back to my three core sectors for long-term investment, technology, health care, and energy. For a four cyclical play, you can add the financials as an interest rate play.

Which brings me to one of my perennial favorites, Gilead Sciences (GILD). Long-term readers will recall this big momentum name, which I first recommended last December at $75 a share. It hit $125 in June, last week, and could fly as high as $200 in 2016.

Obamacare is proving to by one of the greatest windfalls in the history of the health care industry. More than 45 million new individuals now enjoy government guaranteed payments for health care services for the first time. In addition, millions more are signing up for private insurance.

One of the cleanest shots at this new profit stream is Gilead Sciences. The ticker symbol seems so appropriate for this new Golden Age for the health care industry.

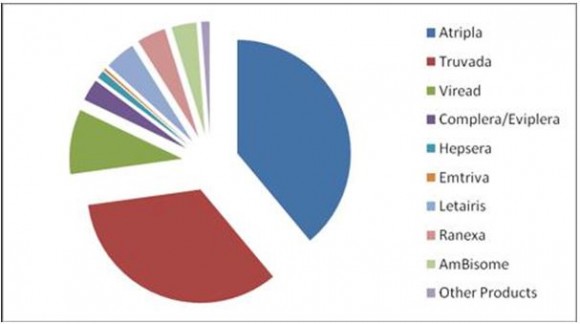

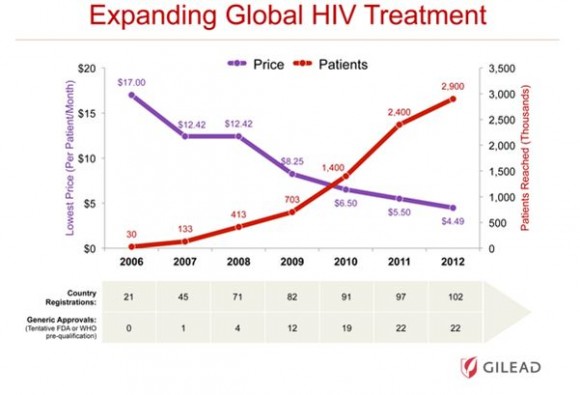

(GILD) is an American biotechnology company that discovers, develops and commercializes treatments for a range of different diseases. The California based firm initially concentrated on antiviral drugs to treat patients infected with HIV, hepatitis B, or influenza.

In 2006, Gilead acquired two companies that were developing drugs to treat patients with pulmonary diseases.

These are all expected to be huge growth areas in the future, and the company has become a favorite of hedge fund traders. Both the shares and the sector have been on fire all year.

Don?t rush out and buy (GILD) today. Rather, I?d wait until the last of the sellers get flushed out in this correction, which will probably not be until well into October.

Take a look at the charts below, and they suggest that the S&P 500 could reach as low as 1,976, or down another 160 handles from here.

That will give us another top to bottom pullback of 12.52%, which certainly qualifies as a healthy correction. This will be the time to load the boat with (GILD).

Keep close tabs on your text message service and email, and I?ll let you know when it is time to lay your cajones on the line once more.