Look at Zendesk for your Next Ten Bagger

At the recent Mad Hedge Lake Tahoe Conference, I pinpointed software companies as a robust group of tech stocks that are the perfect late cycle investment in the economic environment we find ourselves in now.

To add some granularity about my thesis, I would like to start elaborating on an up-and-coming software stock that I find compelling and in the middle of a growth sweet spot.

And with the rapacious pullback, the tech sector has experienced as of late, this high-octane growth stock is poised to rev back up, albeit with more than your average volatility attached to its stock symbol.

If you can stomach the volatility, then Zendesk (ZEN) is the company for you to dip your toe in.

Zendesk is a customer service software offering solutions to clients through a flexible platform revolving around customer service tickets.

This $6 billion market cap tech firm thriving in the dodgy San Francisco Tenderloin district only need to be reminded of how fast a tech firm can be disrupted by stepping out of the office and experiencing ground zero of the San Francisco homeless movement in the scruffy Tenderloin.

I usually get lambasted for the lack of time I spend following budding tech firms, but you cannot blame me when the bulk of this year’s stock market gains have been extracted by the biggest and mightiest tech titans.

That does not mean all small tech is dead, but they certainly do have heightened existential risk because of the Amazons (AMZN) and Microsofts (MSFT) of the world, spreading their network effects far and wide.

International Business Machines Corporation’s (IBM) purchase of cloud company Red Hat (RHT) underscores the value of applying M&A to grow the top and bottom line, and the chronic bidders of these smaller minnows are usually the Amazons and Microsofts themselves who have the cash to dole out.

Salesforce (CRM) is always adding to its arsenal of integrated software companies that can scale up in the cloud, and Marc Benioff’s M&A strategy has thrived to devastating effect boosting the bottom and top line.

I must admit, tech does get the rub of the green over other industries because of the scaling effect afforded to profit poor tech companies.

The ample time to prove to investors they can snatch a growing user base, enhance product offerings, and develop an eco-system intertwined with recurring subscription products is not fair to other industries who are judged on different metrics mainly profits and profits now.

Well, life isn’t fair.

The addressable market is usually massive causing investors to stick with these burgeoning tech firms through thick and thin.

Zendesk is another company burning money, but let me tell you, they are no Snapchat (SNAP).

Operating margins are marching towards positive territory, meaning this outfit is well-run.

It was only at the beginning of 2015 when Zendesk’s operating margin registered -53%, and since then, they have dramatically reduced it to -36% at the end of 2016 and now -24% in 2018.

Gross margins next quarter will be hit a bit with its acquisition of Base CRM, headquartered in Mountain View, California and R&D offices in Krakow, Poland, offering a web-based all-in-one sales platform featuring tools for email, phone dialing, pipeline management, and forecasting.

Improving service offerings in the tech world usually means nabbing niche cloud companies that can easily be integrated into the larger eco-system and Base CRM, even though it has lower margins than Zendesk, is a nice pickup for the company boosting the top line while expanding cross-selling activities.

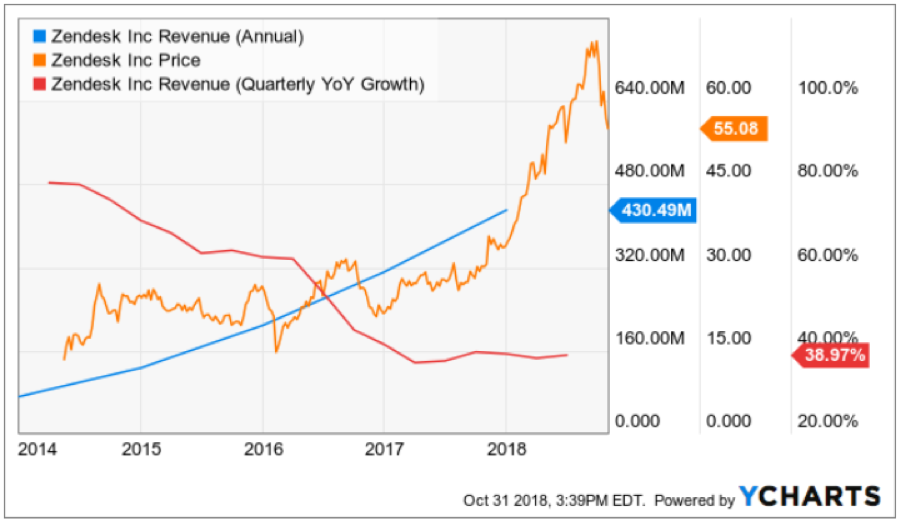

Then there is the sales revenue growth demonstrating all the hallmarks powerful software companies live up to with its 39% quarterly revenue growth.

Zendesk’s management has remarked that they fully expect to hit $1 billion in total sales by 2020 which is more than double the 2017 annual revenue of $430 million.

This year, Zendesk is forecasted to post just shy of $600 million in sales.

Large clients keep piling in hoping to modernize their customer service operations and wean themselves off the siloed legacy systems.

Disruption by some fresh newcomer in a disruptive industry that they operate in is usually the trigger forcing companies to spruce up their customer service software.

This path of migration will healthily continue for Zendesk reaffirming management’s thesis of $1 billion in sales by 2020.

Zendesk, flaunting off their innovation skills, identified the universal popularity of messenger app WhatsApp as an effective platform for its services and rolled out a product that integrates Zendesk services with WhatsApp.

This will allow businesses to manage customer service interactions and engage with customers directly on WhatsApp.

The customized integration links conversations between businesses and their customers on WhatsApp within Zendesk.

This move will allow Zendesk to stretch their tentacles further and wider while being able to provide faster support for customer service tickets which are incredibly time-sensitive.

Since management highlighted that WhatsApp is the go-to messenger in Asia Pacific and Latin America, there was no reason not to extend their offerings in a way that captures this vital userbase.

The WhatsApp pivot has been a nice addition with Zendesk’s management remarking that they “handle over 20% of our order status inquiries daily with WhatsApp and Zendesk, which is much faster than traditional methods.”

Omnichannel support within Zendesk’s platform will be key to securing the growth it needs to reach its $1 billion of sales milestone.

Innovation is the crucial ingredient in constructing the perfect products that can maximize customer service performance.

Its overseas exploits are not just a flash in the pan with its services supported in 30 languages and offices in 15 different countries. It all makes sense considering half their revenue is outside of America.

With IBM’s recent acquisition of Red Hat, buyers are still hunting for the right pieces to add to their portfolio.

The Red Hat purchase proved that demand still eclipses supply by a far margin.

Zendesk is one of those in the queue for a big buyer to swoop in with a mega offer.

It’s no guarantee that a company will pay a 63% premium like IBM did, but some sort of premium will be definitely warranted.

Zendesk offers the type of robust growth and premium cloud services that could easily fit into a bigger cloud player looking to improve their assortment of cloud tools.

This type of tailwind itself will naturally boost the stock by 5-10% alone if the macro picture can somehow manage to gain footing for the rest of the year.

As with the rest of tech, Zendesk dipped about 20% in the last 30 days but by no means does that mean this is a bad company with a weak future.

I would very much argue the opposite.

The weakness in sales offers a prime entry point in a fast-growing company that is part of the software and cloud movement that I have incessantly harped about.

If this company can show continued operating margins growth, maintain sales growth of above 30% YOY, and demonstrate product innovation, this stock will break out to higher levels.

As of now, that is exactly the road they are headed down.

Business abroad is doing so well that Zendesk recently splurged on a Europe, Middle East and Africa (EMEA) headquarters in Dublin, Ireland coined as the “the tech capital of Europe.”

Zendesk started with two employees in Dublin in 2012 and now boast over 300 employees occupying 58,000 square feet in a new office costing $10 million.

By 2020, Zendesk expects to build their Dublin branch to over 500 employees implying that the overseas pipeline is ripe for the taking.

I am highly bullish Zendesk and recommend that readers check out this attractive growth story.

SNAZZY NEW HEADQUARTER IN DUBLIN