Mad Day Trader Jim Parker is up 39% in 2015

Mad Day Trader Jim Parker has been absolutely knocking the cover off the ball this year, delivering a blistering 39% profit so far for followers.

He was in and out of the Apple (AAPL) melt up twice. He was early and big in the biotechnology sector, trading around ZIOPHARM Oncology (ZIOP), Therevance (THRX), and Zoetis (ZTS).

He played the Japanese economic recovery through the Wisdom Tree Japan Hedged Equity ETF (DXJ). And for good measure, he was playing oil (USO) from the short side.

The current rapid ?RISK ON/RISK OFF? environment is tailor made for Jim?s disciplined, quantitative approach to the markets. In other words, Jim thrives on volatility.

And the best is yet to come. Jim is expecting the rest of 2015 to offer plenty of volatility and loads of great trading opportunities. He thinks the scariest moves may be yet to come.

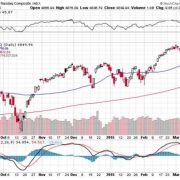

He sees a massive rotation out of large caps (SPY) into small caps (IWM), as investors flee the adverse effects of the euro collapse on American corporate profits. That is bringing the (SPY) 200 day moving average at $199. Key support for all equity markets will be found when the NASDAQ hits 4,265.

Sector leadership could change daily, with a brutal rotation, depending on whether the price of oil is up, down, or sideways.

The market is paying the price of having pulled forward too much performance from 2015 back into the final month of 2014, when we all watched the December melt up slack jawed.

Jim is a 40-year veteran of the financial markets and has long made a living as an independent trader in the pits at the Chicago Mercantile Exchange. He worked his way up from a junior floor runner to advisor to some of the world?s largest hedge funds.

We are lucky to have him on our team and gain access to his experience, knowledge and expertise.

Jim uses a dozen proprietary short-term technical and momentum indicators to generate buy and sell signals.

If you are not already getting Jim?s dynamite Mad Day Trader service, please get yourself the unfair advantage you deserve. Just email Nancy in customer support at support@madhedgefundtrader.com and ask for the $1,500 a year upgrade to your existing Global Trading Dispatch service.