Mad Hedge 2021 H1 Trade Analysis

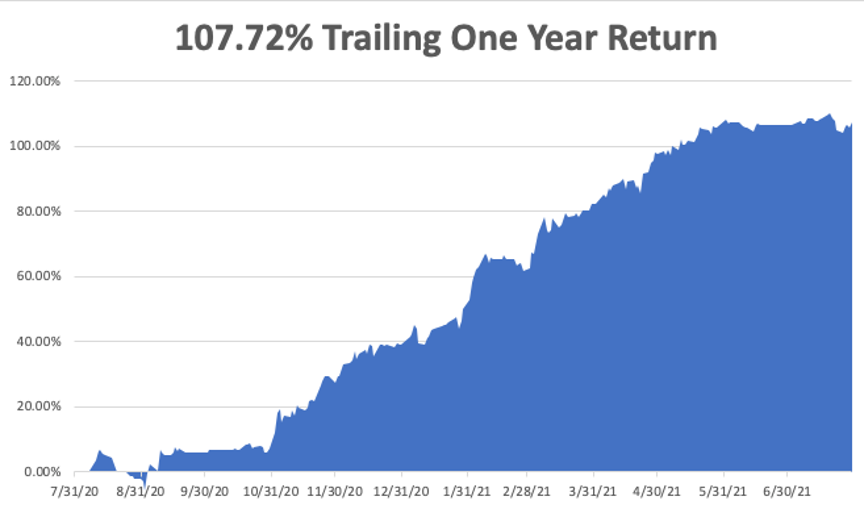

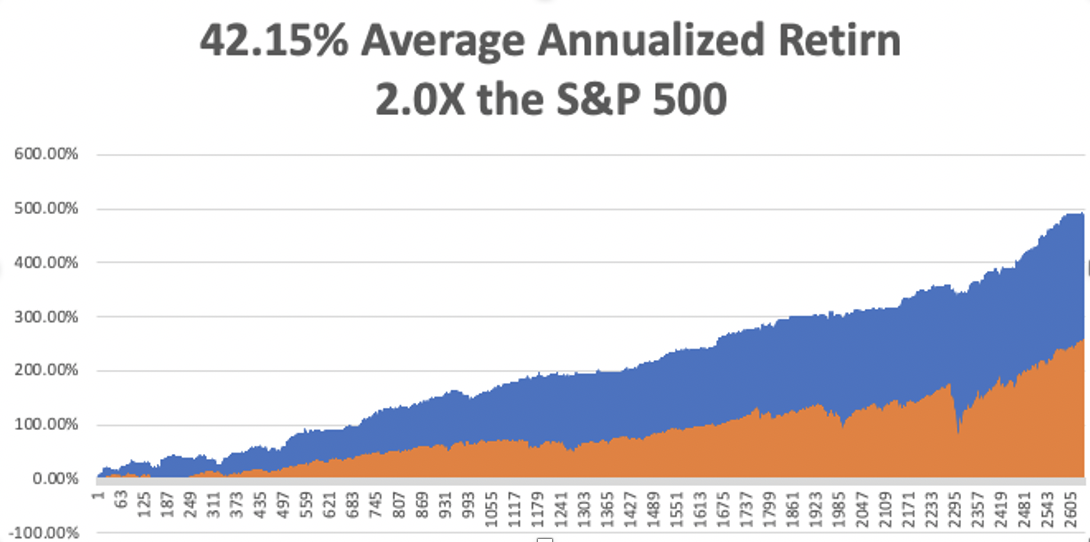

I finally managed to carve out a few hours to analyze my 2021 H1 trades, and what a year it’s been!

From January 1 to June 30, the Mad Hedge Fund Trader sent you 124 trade alerts completing 64 round trips in four asset classes. These generated a profit of 70.59% in six months, more than we made all of last year.

It is the most prolific performance since we launched Mad Hedge Fund Trader 14 years ago.

In my January 6 Mad Hedge Annual Asset Class Review (click here for the link--you must be logged in to the site), I predicted that the Dow Average ($INDU) would rise 30% for the end of the year. This proved immensely valuable.

That view enabled me to go maximum aggressive, full speed ahead, damn the torpedoes. It’s not that I was so certain that the stock market would go ballistic to the upside. But with the Federal Reserve pumping trillions of dollars of quantitative easing into the economy, record deficit spending, and the pandemic coming under control, I was certain that markets would not go down.

So, I looked into my bag of tricks and pulled out a strategy ideal for this scenario, the in-the-money vertical bull call debit spread (click here for the video on how to execute one of these). Such an approach allowed me to make a maximum profit even if the underlying security went up, sideways, or down small. It worked like a charm.

Here are by trades assorted by asset class:

Equities – 44.14%

Bonds – 24.12%

Commodities – 1.52%

Precious Metals – 0.81%

2021 was definitely the year of equities. In fact, the risk/reward for equities was so compelling that it was almost a waste of time to look at anything else. Equity trades accounted for 62.53% of my total profits.

I split my equity selections with my well-known “barbell strategy” with equal allocations split between big technology and domestic recovery stocks. That way, I always had positions that were going up.

Short positions in the bond market (I had only one long trade) accounted for another 34.17% of my performance. This was basically a first-quarter trade where I caught the collapsing bond market by both lapels and shook it for all it was worth, catching a dive from $162 to $132 in the United States Treasury Bond Fund (TLT). I mostly quit bond trading in March, not wanting to visit the trough too many times in an extremely oversold condition. That was a great call.

Commodities delivered another 2.15% of return with a single trade in the SPDR S&P Metals & Mining ETF (XME). I thought exploding economic growth would cause commodity prices to soar, and they did. But there were better plays to be had buying key stocks in the sector directly, such as Freeport McMoRan (FCX).

As an afterthought, I made another 1.15% in precious metals with two trades long gold. I thought gold would go up this year but so far, no luck. The gold (GLD) faded away when US Treasury bonds became the asset class of choice from March onward.

Of 64 round trips, I lost money on only four, giving me a success rate of 93.75%, far and away the best in the industry. One was a short in Tesla (TSLA) in the $800s. It later fell to $550. The next was a long in Tesla. I got stopped out when it fell below $600. That’s OK because I made a 10X return trading Tesla in 2020.

Welcome to show business.

The next hickey came from a long in Microsoft (MSFT) which I got stopped out of. It went straight up afterwards. Then I took a small hit in Delta Airlines (DAL) for the same reason. The higher the market goes, the faster I stop out as part of my risk control discipline.

All in all, it’s been one hell of a year. I cut back my trading dramatically in June and July partly because the market was so incredibly high, but also to give my loyal staff a rest. Imagine working double overtime for a year and a half! How about sending out 13 trade alerts out in one day!

We are now all refreshed and well-rested ready to take on all comers in H2. The harder I work, the luckier I get. It really is true.

As I tell my beginning traders, work in, money out.

To download the entire 2021 H1 trade history, please click here.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Capturing Peak Profits