Mad Hedge Fund Trader Hits New All Time High

It?s been a tough-fought battle. I have had to fight tooth and nail for every penny.

For the first time since September 2nd, I have been able to boost the six-year track record of Global Trading Dispatch to a new all time high.

It seems these days, you have to work twice as hard to earn half the money with more volatility.

We had an outrageous August, taking in a lip-smacking 7.52% profit.

?

I began this month with the assumption that financial markets would remain trapped in narrow ranges.

September was problematic, with my Trade Alerts essentially breaking even, up only 0.27%.

So I narrowed my focus to the short-term trading of the violent day-to-day swings we are seeing in the market.

It worked like a charm.

After a long dormancy, the Volatility Index (VIX) climbed out of the basement, seeing single day moves up to 40%. That enabled me to reel in two quick winners with the iPath S&P 500 VIX Short Term Futures ETN (VXX).

My brother in arms, Mad Options Trader ?Whiz?, has done even better on the volatility front.

Since then, I have been trading like a Mad man, fading moves in the S&P 500 (SPY) and the United State Treasury Bond Fund (TLT), and then taking profits in days.

This week, I cast my net over a broader range of asset classes, buying the SPDR Gold Shares ETF (GLD) and selling short the United States Oil Fund (USO) on top of the latest OPEC-induced spike.

Both positions turned immediately profitable.

Keeping a death grip on every dollar I take in, I am now running very tight stop losses. This has lead to an irritating jump in small losses, but has enhanced my profitability over all.

Keep in mind that this is an environment where almost no one is making any money at all.

I tell my financial advisor and long term investor friends to just turn off the TV, as there has been very little net movement in asset classes over all.

Things will be better in a year.

It is impossible for them to catch these short-term moves, let alone explain them to clients.

I expect this state of affairs to continue until the November 8th presidential election.

What we are getting is not a ?price correction,? but a ?time correction?, whereby prices grind sideways before breaking out to the upside.

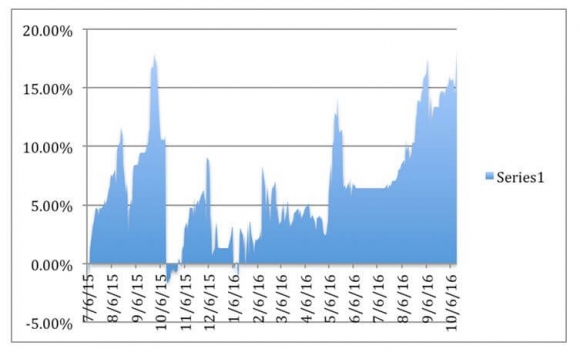

This brings my 2016 year-to-date performance up to an enviable 16.81%, compared with 4.65% for the S&P 500. The trailing 12-month return is 18.25%

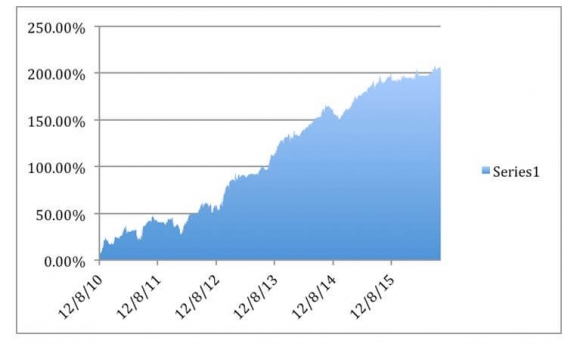

My six-year return now reaches an eye popping 208.49%, delivering an average annualized return of 35.75%.

These are numbers that any financial advisor, hedge fund manager, or retiree trading their retirement accounts from home would kill for. Most are losing money this year, net of fees and expenses.

Those who have made the effort to wake up early every morning, read my witty and incisive prose and actively trade my proprietary alerts have an impressive row of notches on their bedpost to show for their endeavors.

?

My groundbreaking trade mentoring service was first launched in 2010. Thousands of subscribers now earn a full-time living solely from my Trade Alerts, a development of which I am immensely proud.

Some 50% of my clients are over 50 and managing their own retirement funds, fleeing the shoddy, but expensive services provided by Wall Street. The balance are institutional investors, hedge funds, and professional financial advisors.

The Mad Hedge Fund Trader seeks to level the playing field for the individual retail investor. Looking at the testimonials that come in every day, I?d say we?re accomplishing that goal. To read the plaudits, please go to Testimonials.

Our business is booming, so I am plowing profits back in to enhance our added value for you.

To subscribe, please go to Global Trading Dispatch.

And now, for the rest of the year.

I can?t wait!

John Thomas, CEO

Mad Hedge Fund Trader

This is How You Do It

18.25% Trailing 12 Month Return

35.75% Average Annualized Return Over 6 Years

35.75% Average Annualized Return Over 6 Years

35.75% Average Annualized Return Over 6 Years

35.75% Average Annualized Return Over 6 Years