Managing Your Risk Into Year End

To say this was a challenging year would be a disservice to the word ?understatement.?

To beat the indexes, you had to correctly call the outcome and the market impacts of ?the China meltdown, Brexit, the bond crash, and the presidential election.

Virtually no one did this. If they say they did it, they?re telling porky pies.

As a result, more than 95% of active managers and mutual funds are under performing the S&P 500 (SPY) which is up 11.27% on the year.

As much as I hate to admit it, indexers easily beat professional mangers this year, including almost all hedge funds. Once again, sloth and laziness were rewarded, while hard work and diligence were punished.

I hate it when that happens.

Smell the roses while you can all you indexers, closet or otherwise. For to quote a recent Nobel Prize winner, ?The times they are a changing.?

One of the major changes to investing going forward that you?ve heard nothing about so far is that the game is about to change.

Just as we are seeing ?out with the new and in with the old? in stock selection, we are also about to witness a sea change from passive to active investing.

Such are the consequences of the brave new world.

In the coming year, individual asset class, sector, and stock selection will be much more important than in the past. Active managers should have no problem outperforming.

For me, it will be like shooting fish in a barrel with a shotgun filled with number 12 birdshot.

It figures that passive investment in index funds is at an all time high. I have spent a lifetime watching investors buy tops and sell bottoms, and this time is no different.

I dive into writing my 2017 Annual All Asset Class Review over the next two weeks. It will be published on January 5th.

I can?t help but notice that 2016 offers some unusual challenges going into year end. Almost all asset classes are sitting on top of extreme market moves.

Financials (XLF), energy (XLE), materials (XLB), construction stocks (CAT), and small capitalized stocks (IWM) are sitting on top of monster moves up.

Bonds (TLT), gold (GLD), and foreign currencies (FXE), (FXY) have been absolutely slaughtered.

Volatility (VIX) is flat lining.

All tax selling has been cancelled and rolled into the beginning of 2017.

Does that mean we get a slap in the face in the form of a market crash on the first trading day of next year? Or will the selling be offset by new equity allocations from slow moving investors waiting for the New Year to start?

I believe it will be the latter.

To make things really easy, I think that trends in place at the end of 2016 will continue well into 2017, possibly all the way until the spring.

And you can probably tell by the testimonials now pouring in daily that followers were pretty happy with my performance in 2016.

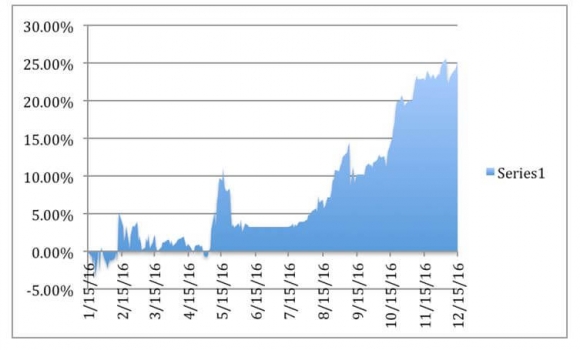

I am up 26.57% on the year, taking me to a new all time high, and up 25.26% YOY.

I am now posting a positive +0.53% for December, bringing in six consecutive profitable months. It is a nice comeback from that big volatility hit I took last week.

Some 17 out of the last 20 Trade Alerts have been profitable, producing a success ratio of 85%. Most of the trades were immediately profitable.

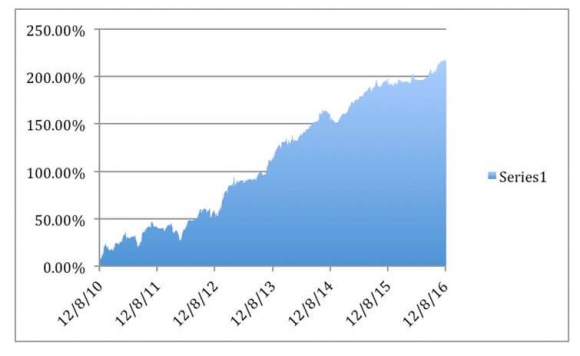

My six-year return now stands at 218.25%, bringing the average annualized return up to 36.37%.

So, given these outsized, industry beating numbers, I am inclined to be cautious here, minimize trading, and keep my positions small.

Remember, I am trying to pay for my own yacht, not my broker?s.

Markets have a nasty habit of turning back and biting the hand that feeds them, seizing recently granted rewards.

I?ll still be watching the markets over the next two weeks. The problem will be execution.

When it?s ten below zero at 10,000 feet in a snow drift in the High Sierras with 50 knot winds, your hand tends to immediately freeze the second you take your glove off.

That makes the typing of Trade Alerts an effort, to say the least. Better to just take a break.

25.26% Trailing 12-Month Return

218.25% Six-Year Total Return