March 11, 2011 - Roll Call of the Dead

Featured Trades: (ROLL CALL OF THE DEAD), (SPX), (QQQQ), (EEM), (EFA)

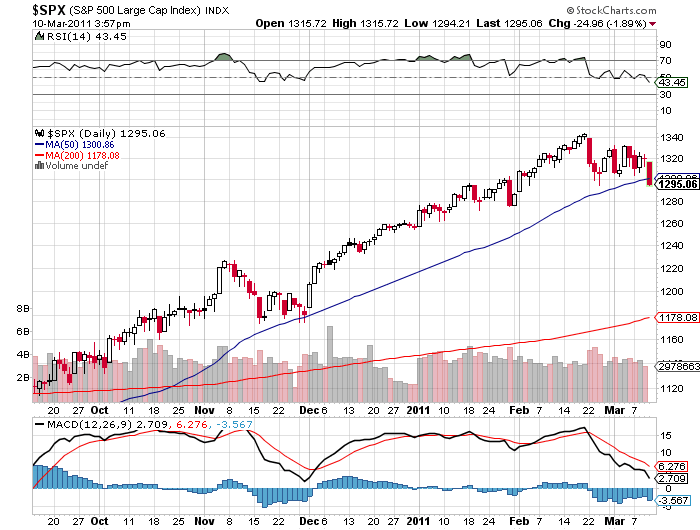

3) Roll Call of the Dead. I guess that market didn't like my prediction yesterday that they were gearing up for a sell off (click here for 'Are the Equity Markets Headed for a Fall'). What a difference a day makes!

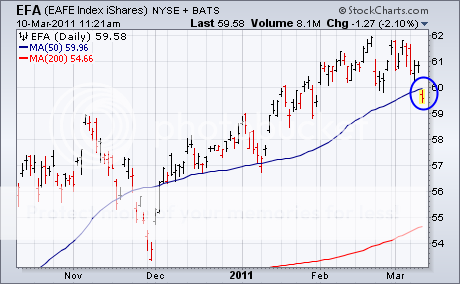

Today, the number of indices that have broken 50 day moving averages is really quite impressive. They big kahuna, the S&P 500 (SPX) closed well below the key 1301 level. The technology ETF (QQQQ) closed neatly below its support level. Emerging markets (EEM) took it on the nose too. To show you the global, 'RISK OFF' nature of the selling, take a look at the EAFE Index iShares (EFA), which also broke down.

A surprise trade deficit reported by China was chiefly to blame. The only thing I don't understand is the 'surprise' part. With the cost of the Middle Kingdom's largest imports soaring, crude, iron ore, and food, it was only a matter of time before this was going to happen. In the meantime, the value of their exports trailed off. China is caught in the same squeeze we are; rising input costs and falling realized end product sales prices.

The collapse in oil prices was also responsible. Energy stocks of every flavor, from the majors, to service companies, coal, pipeline companies, and drillers, have been the recent market leaders. Puncture the bubble in Texas tea puts the entire space in sell mode, dragging down the indexes.

Since I am now short stocks, the euro, the Japanese yen, bond volatility, and long stock market volatility, the next few days should be particularly interesting.

-

-

-

-

The Markets Have Suddenly Become the Land of the Walking Dead