(THE TARIFF FIX)

March 19, 2025

Hello everyone

We all know that markets and uncertainty don’t mix well. And right now, there is a lot of uncertainty surrounding U.S. trade policy.

While the Trump administration tariffs on Mexico and Canada have been delayed for a month, the 10% tariff on Chinese goods has gone into effect. The move has rattled markets, leaving many American businesses and consumers wondering what comes next.

Tariffs are a double-edged sword. On the one hand, they can serve as a powerful negotiating tool, as President Trump has pointed out. The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By imposing tariffs, the U.S. can pressure trading partners into more favourable deals and protect domestic industries from unfair competition.

On the other hand, tariffs raise costs for businesses and consumers. About half of America’s annual imports – more than $1.3 trillion annually – come from China, Canada and Mexico.

We know that certain sectors will be impacted harder than others. The automotive industry, for instance, relies heavily on parts from Mexico and Canada. Energy prices could spike as well, given that over 70% of U.S. crude oil imports come from these two countries. Let’s also not forget about gas. Just in the Midwest alone, gas prices could rise by as much as $0.50 per gallon, according to the Council on Foreign Relations. And then there’s something we all rely on – food. Mexico supplies over 60% of the fresh vegetables and nearly half of all fruit and nuts consumed in the U.S. Higher import costs could mean higher prices at the grocery store.

A historical perspective on Tariffs

Historically, tariffs used to be a major source of government revenue. Between 1798 and 1913, they accounted for anywhere from 50% to 90% of federal income.

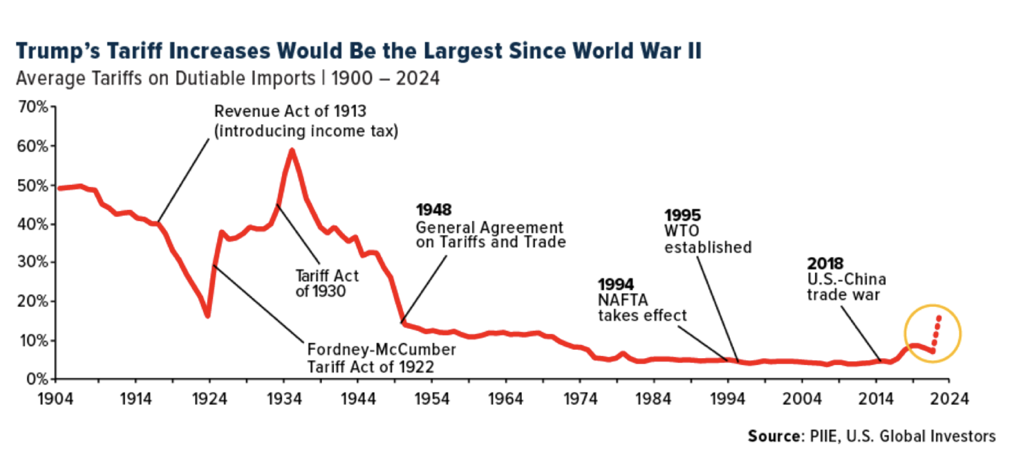

Then, times changed. Over the past 70 years, tariffs have rarely contributed more than 2% of federal revenue. Free trade was the typical landscape.

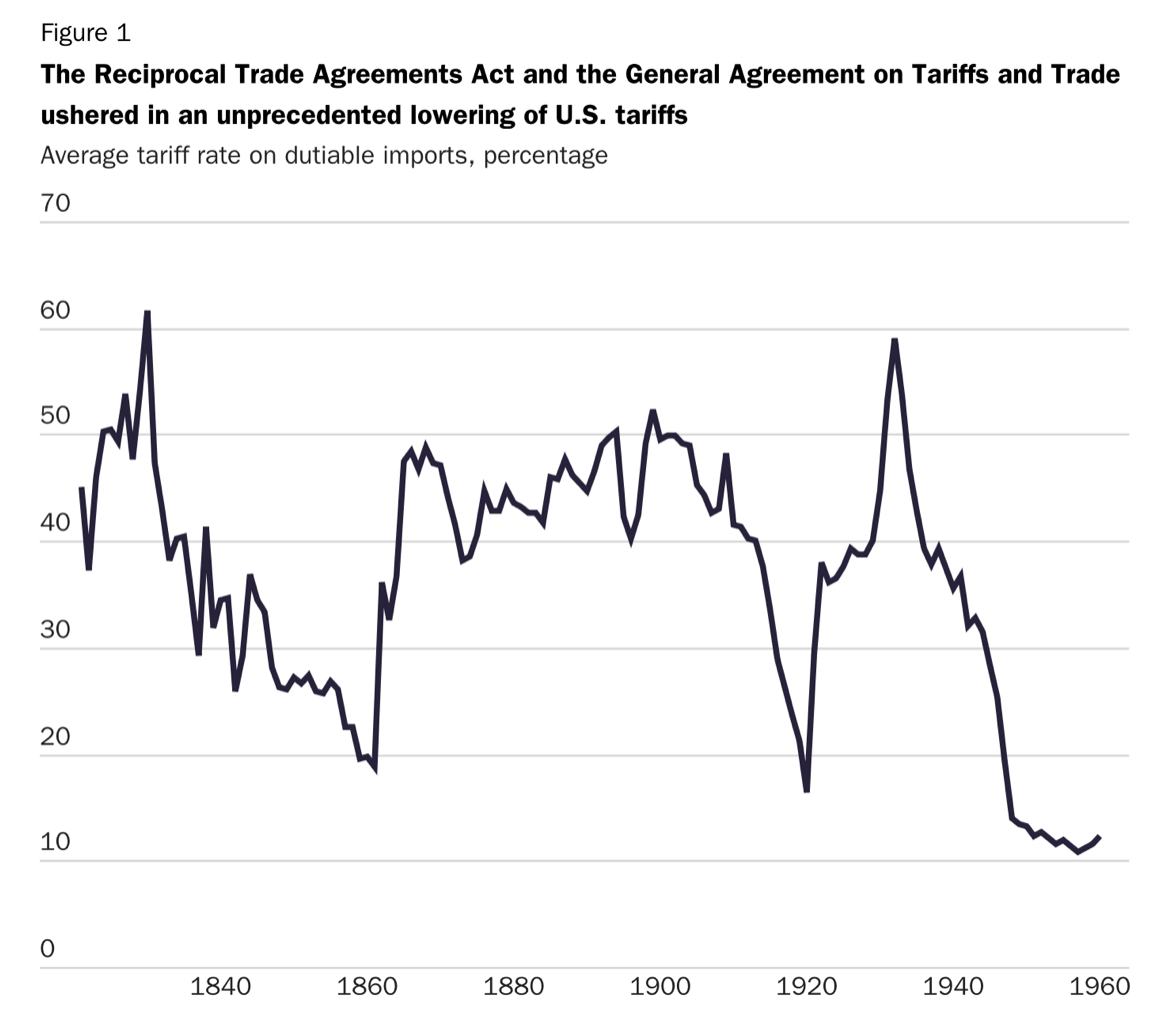

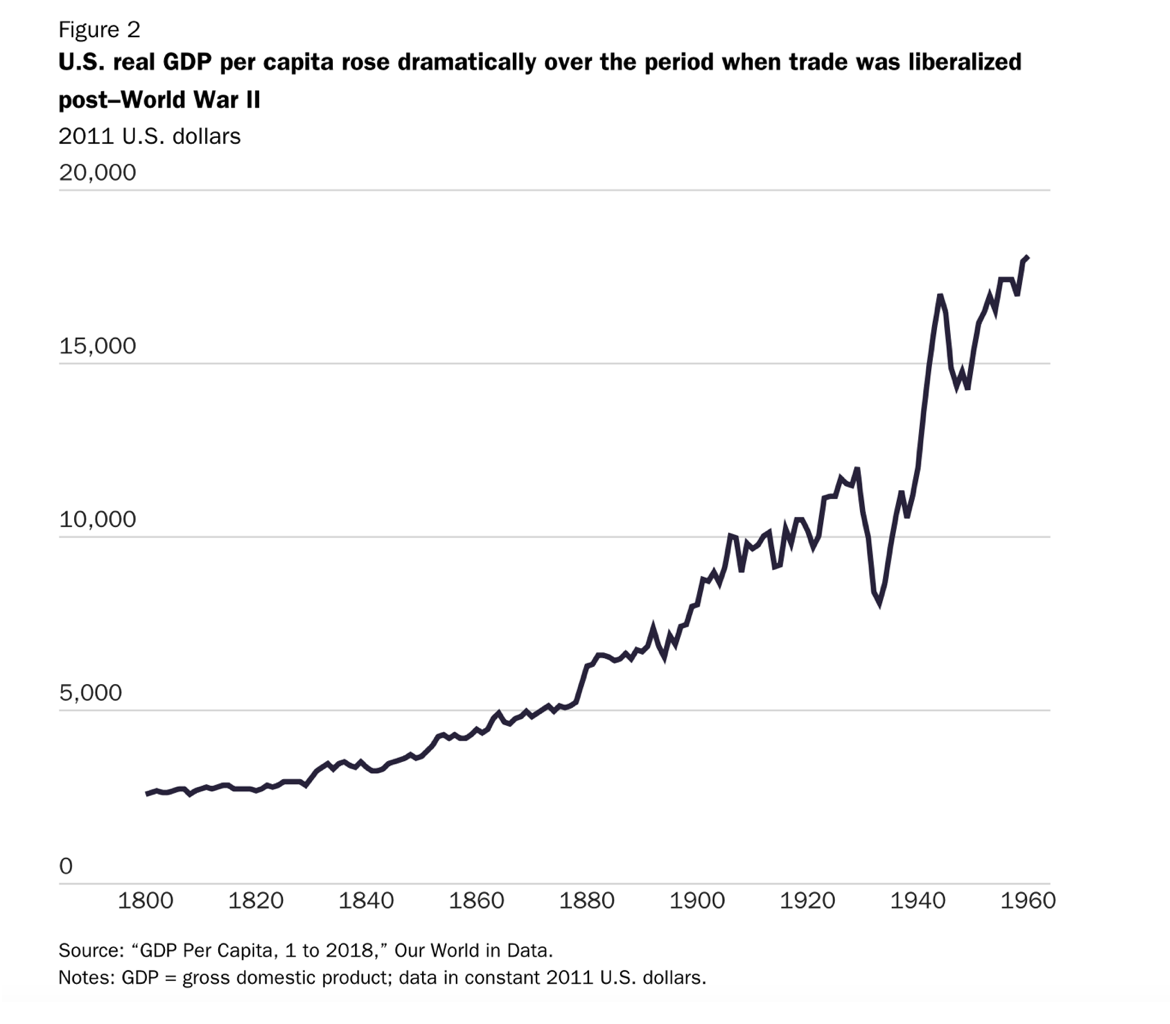

For example, last year, U.S. Customs and Border Protection collected $77 billion in tariffs – just 1.57% of total government income. Since the 1930s, the U.S. has moved away from protectionism in favour of trade liberalization. Agreements like the General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), have dramatically lowered global tariffs. Today, roughly 70% of all products enter the U.S. duty-free.

Trump’s approach marks a shift back toward tariffs as a policy tool. Arguably, the U.S. has more leverage than most countries – as many economies depend on access to the U.S. market – but tariffs aren’t without consequences.

China has already retaliated, imposing its own tariffs on U.S. goods. These include a 15% duty on coal and liquefied natural gas (LNG), as well as 10% tariffs on agricultural machinery, crude oil, and some vehicles. Beijing has also launched an antitrust investigation into Google – likely as a form of economic retribution.

Time will tell how well the U.S. economy navigates the changing trade policy.

Bitcoin and its short to medium-term movement

Bitcoin is attempting to form a base. There is a possibility it could fall to make a third point, (see the trendline drawn above) thereby making two points makes a third pattern, which is usually bullish. Or it could rally from its present position. Another week or so of messy price action is possible before a move to the upside is seen.

Cheers

Jacquie