March 20, 2024

(PALANTIR IS A STANDOUT WHEN IT COMES TO IMPROVING U.S. SECURITY & THE MILITARY)

March 20, 2024

Hello everyone,

PALANTIR(PLTR)

It is a promising AI investment.

It has links to defence and intelligence.

Involved in cyberspace for the government.

Producing AI applications for military and defence.

Holds an Artificial Intelligence Platform (AIP)

Palantir’s future looks bright.

Shares of Palantir jumped nearly 10% on March 6 after Palantir announced its Tactical Intelligence Targeting Access Node was selected by the U.S. Army. TITAN uses artificial intelligence to provide targeting information for missiles.

The bulk of Palantir’s revenue comes through government contracts. Its government segment makes up nearly 56% of total sales. The rest of sales are commercial.

Analysts believe that their strong product portfolio together with AI will produce a meaningful share of a $1 trillion AI Global TAM as enterprise and government ecosystems rush to implement useful platforms for automating complex workflows.

Analysts have given the stock a target of $37.00. Shares of Palantir are up around 41% year-to-date.

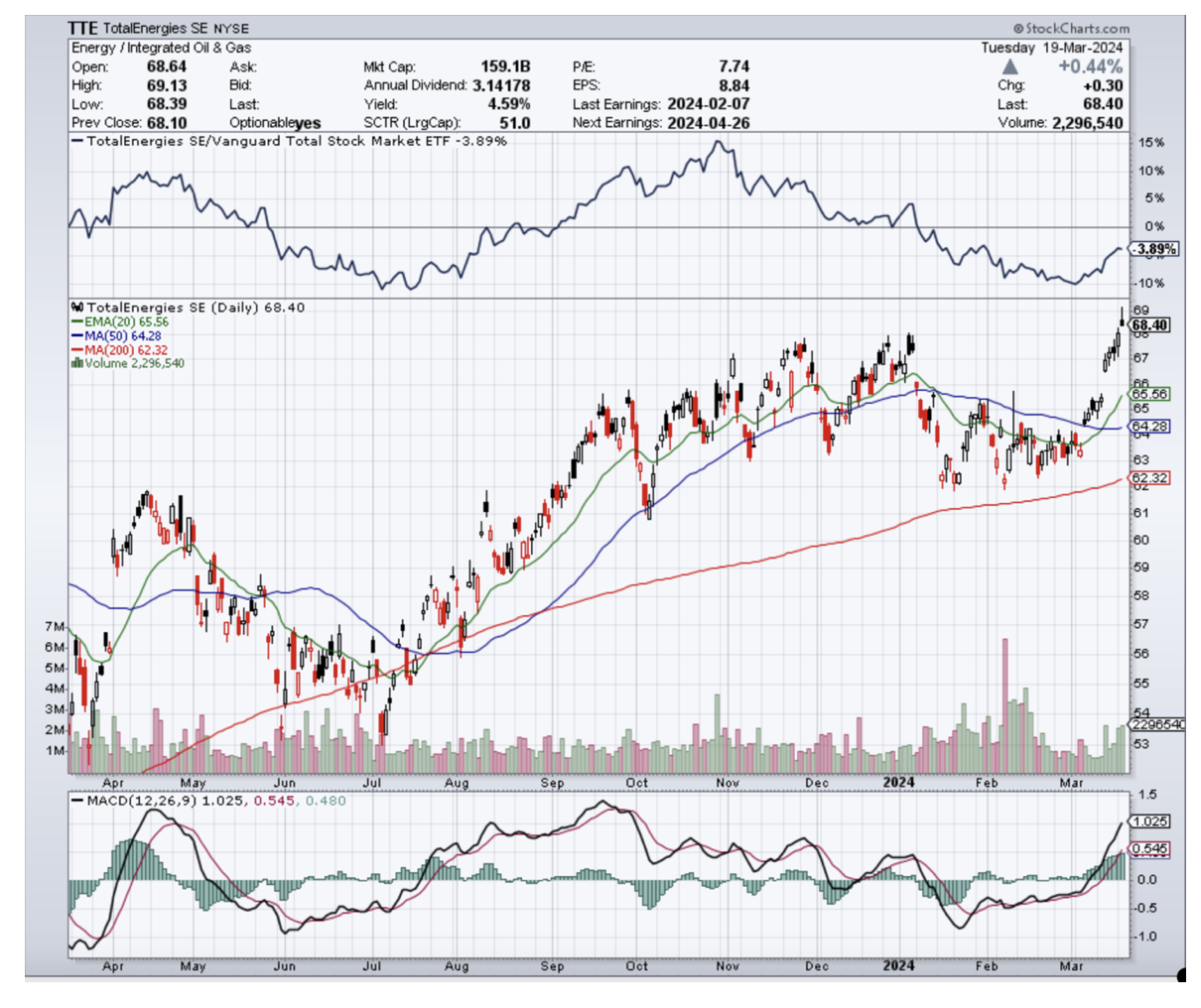

The global energy sector is cheap relative to the broader market. I recommended to everyone to average into this sector earlier in the year. Analysts at Berenberg Investment Bank among others, argue that on a global basis, energy trades at relative valuation levels only seen three times in the past 40 years: the late 1980s, 2000, and 2020.

The bank pointed out that investors in oil and gas stocks on those three occasions outperformed the market by an average of 108% - or more than doubled their money – from the depressed valuation levels.

Analysts at Berenberg used a proprietary metric based on a combination of price-to-earnings multiples, dividend yields, and price-to-book multiples to determine the sector’s valuation.

For investors looking to increase their energy exposure, Berenberg named several stocks as their “top picks.” (Shell (SHEL) ($66.47), Total Energies (TTE) ($68.40), and Harbour Energy (HBR.L) ($274.80).

You can buy any of these stocks in small parcels or choose to pass. You could also choose to do an option instead of buying stock. Or, as I point out next, you could buy an energy ETF. Totally up to you. I know many of you are holding (XOM), that I recommended earlier in the year. Great job!

An alternative to buying energy stocks is to take a position in an energy ETF. The one I am thinking of here is the Energy Select Sector SPDR Fund (XLE) (Price $92.18). This ETF offers exposure to the entire energy sector, including both oil and natural gas companies, as well as renewable energy companies. (XLE) offers a diversified approach to the energy industry.

Here is the link to the Zoom monthly meeting held in early March. Enjoy!

https://www.madhedgefundtrader.com/meeting-replay-march-2024/

Cheers,

Jacquie