March 21, 2023

Fed Action Dominates the Week

March 18th, 2023

Hello everyone,

How have you dealt with the volatility in the market over the past week?

Have you been frozen to the spot, did you sell bank shares, did you buy the big banks as John told you to, or did you turn everything off and put headphones on to just zone out?

Poor management doomed Silicon Valley Bank and created a new banking crisis.

Taxpayers nervously await the cost of the bailout.

Banks were not the only sector on sale. The Technology sector has been really good value of late as well. But some investors are just too distracted by the ongoing turmoil to see that there are plenty of quality buying opportunities.

Take Apple, for instance. There is the reaccelerating iPhone and Services growth, record gross margins, two new product launches, and the potential introduction of an iPhone subscription program. While the present macro backdrop looks rough, patient investors will be rewarded. Apple shares are up almost 20% since the start of the year.

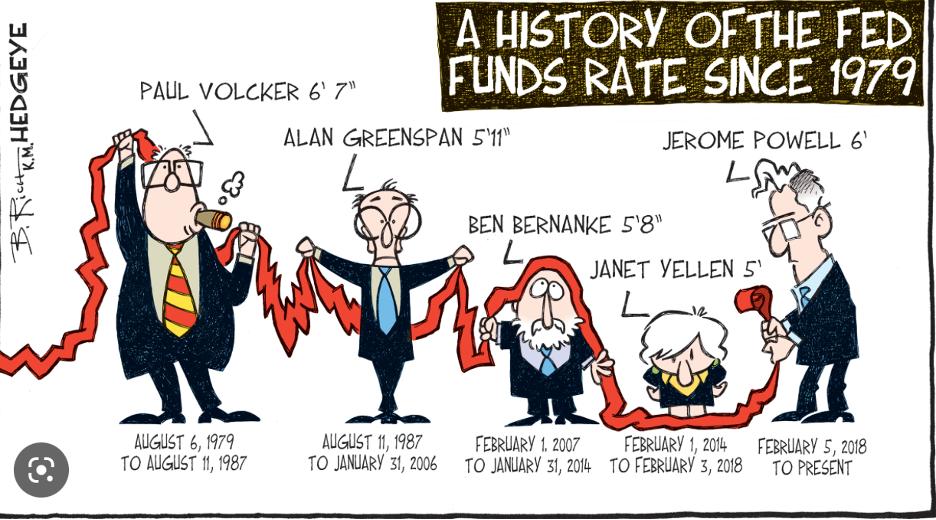

We have the Fed meeting on March 22. After the recent volatility, the Fed may stand still or raise only .25%. The comments after the announcement also tell an important story as to what we can expect going forward – dovish or hawkish.

Mr Trump is expected to be arrested on Tuesday as a New York grand jury investigates his connection with a hush-money payment to a porn star. If he is indicted, Trump, a 2024 Republican presidential candidate, would become the first former president ever to face criminal charges.

Bitcoin rallies 60% as investors rediscover its appeal as an alternative to the banking system.

Bitcoin’s outperformance amid a crisis in the traditional banking system had some wondering if the price rallied on a potential narrative shift. Though Bitcoin was initially designed to be digital cash and an alternative financial system, it spent much of last year trading like a speculative asset. Last week, it even fell with risk markets and bank stocks amid the uncertainty surrounding Silvergate Bank.

That shifted this past week however, following the closures of Silicon Valley Bank and Signature Bank, giving the appearance that investors were trading it on its core value proposition, the ability to “be your own bank.”

Investors will continue to monitor the banking crisis and the regulatory landscape in the week ahead. Bitcoin’s rally could remain in place if the Fed opts to end its tightening cycle and wait and see what happens next with banking turmoil. It seems that traders are pricing in rate cuts this summer already, so we will see what happens if the Fed opts to remain focused on inflation and deliver another quarter-point rise. A pause and Bitcoin could have the potential to make a run towards the $30,000 level.

Wishing you all a wonderful week.

Cheers,

Jacque