March 24, 2010 ? Lumber Futures Are On Fire

Featured Trades: (LUMBER), (SUGAR), (PALL), (PPLT)

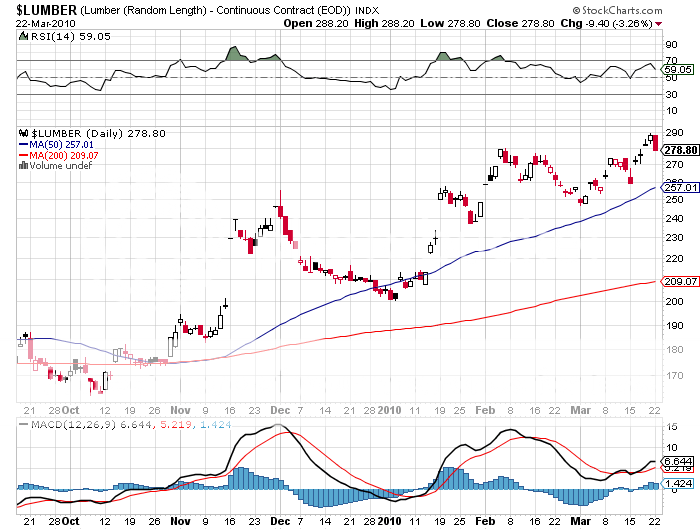

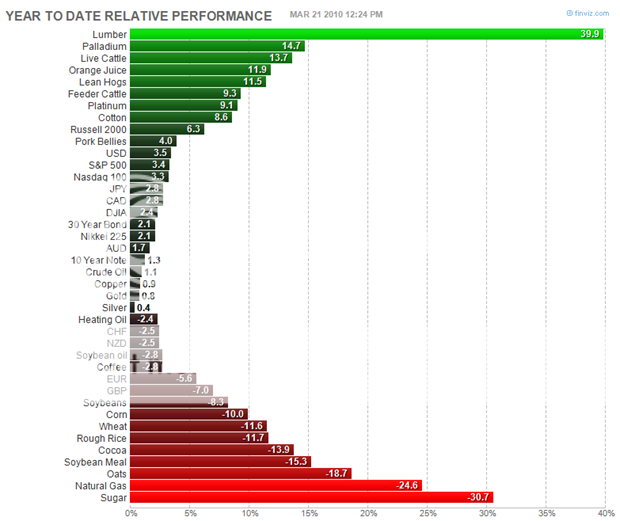

2) Lumber Futures Are On Fire. When I recommended that you take profits on lumber in my February 25 piece (click here ), after pleading with you to buy it for the past year, I hope you were all in a coma in intensive care, spending a weekend in Paris with your mistress, or on a long distance hike on the Appalachian trail (Is that redundant?). Lumber futures have been far and away the top performing asset class of 2010, bringing in a blistering 39.9% year to date, and a healthy 16% gain since my call to take the money and run. Please check out the chart below of asset class returns this year, which I lifted off of Paul Kedrosky?s Infectious Greed website. All of the reasons to own the aromatic commodity kept coming through by the rail car, including decades of production downsizing, huge Chinese buying, and waning competition from Canada because of a strong loonie. No one ever got fired for taking a profit, but they do get sacked for being an idiot, or worse these days, being too conservative. At least I avoided the temptation to buy sugar, now down 31.7% YTD, the year?s worst performing investment. And I did catch palladium (PALL), the year?s number two performer, with a 14.7% gain, and platinum (PPLT) (Remember that killer pair of lowriders?), up 9.1%.