March 24, 2025

(MARKETS ARE DEFINED BY UNCERTAINTY)

March 24, 2025

Hello everyone

WEEK AHEAD CALENDAR

Monday, March 24

8:30 a.m. Chicago Fed National Activity Index (February)

9:45 a.m. PMI Composite preliminary (March)

9:45 a.m. S&P PMI Manufacturing preliminary (March)

9:45 a.m. S&P PMI Services preliminary (March)

Tuesday, March 25

9:00 a.m. FHFA Home Price Index (January)

9:00 a.m. S&P/Case-Shiller comp. 20 Home Price Index (January)

9:05 a.m. New York Federal Reserve Bank President and EO John Williams speaks at the 2025 New York Fed Regional and Community Banking Conference.

9:10 a.m. New York Federal Reserve Bank Director of Research and Head of the Research and Statistics Group Kartik Athreya speaks on the National Economic Outlook.

9:30 a.m. New York Federal Reserve Bank Head of Microeconomics Research and Statistics Group Jaison Abel speaks on the Regional Economic Outlook.

10:00 a.m. Consumer Confidence (March)

Previous: 98.3

Forecast: 94.0

10:00 a.m. New Home Sales (February)

10:00 a.m. Richmond Fed Index (March)

10:15 a.m. New York Federal Reserve Bank Head of the Supervision Group Dianne Dobbeck moderates panel discussion: Views from Community Bank C-suite

Earnings: McCormick & Co

Wednesday, March 26

3:00 a.m. UK Inflation Rate

Previous: 3.0%

Forecast: 2.9%

8:30 a.m. Durable Orders preliminary (February)

Earnings: Dollar Tree

Thursday, March 27

8:30 a.m. Continuing Jobless Claims (03/15)

8:30 a.m. GDP final (Q4)

Previous: 3.1%

Forecast: 2.3%

8:30 a.m. Initial Claims (03/22)

8:30 a.m. Wholesale Inventories preliminary (February)

10:00 a.m. Pending Home Sales Index (February)

11:00 a.m. Kansas City Fed Manufacturing Index (March)

Friday, March 28

8:30 a.m. PCE (February)

Previous: 2.5%

Forecast: 2.7%

8:30 a.m. Personal Income (February)

8:30 a.m. Michigan Sentiment final (February)

10:00 a.m. Fed Vice Chair for Supervision Barr discusses at the 2025 Banking Institute, Charlotte, North Carolina

The market has a cloud of uncertainty hanging over its head.

Trump’s policy agenda is driving markets – and they are showing an unsteadiness as they endeavour to navigate the dynamic landscape.

Investors won’t get clarity on tariffs until April 2 when the number of levies is expected to take effect.

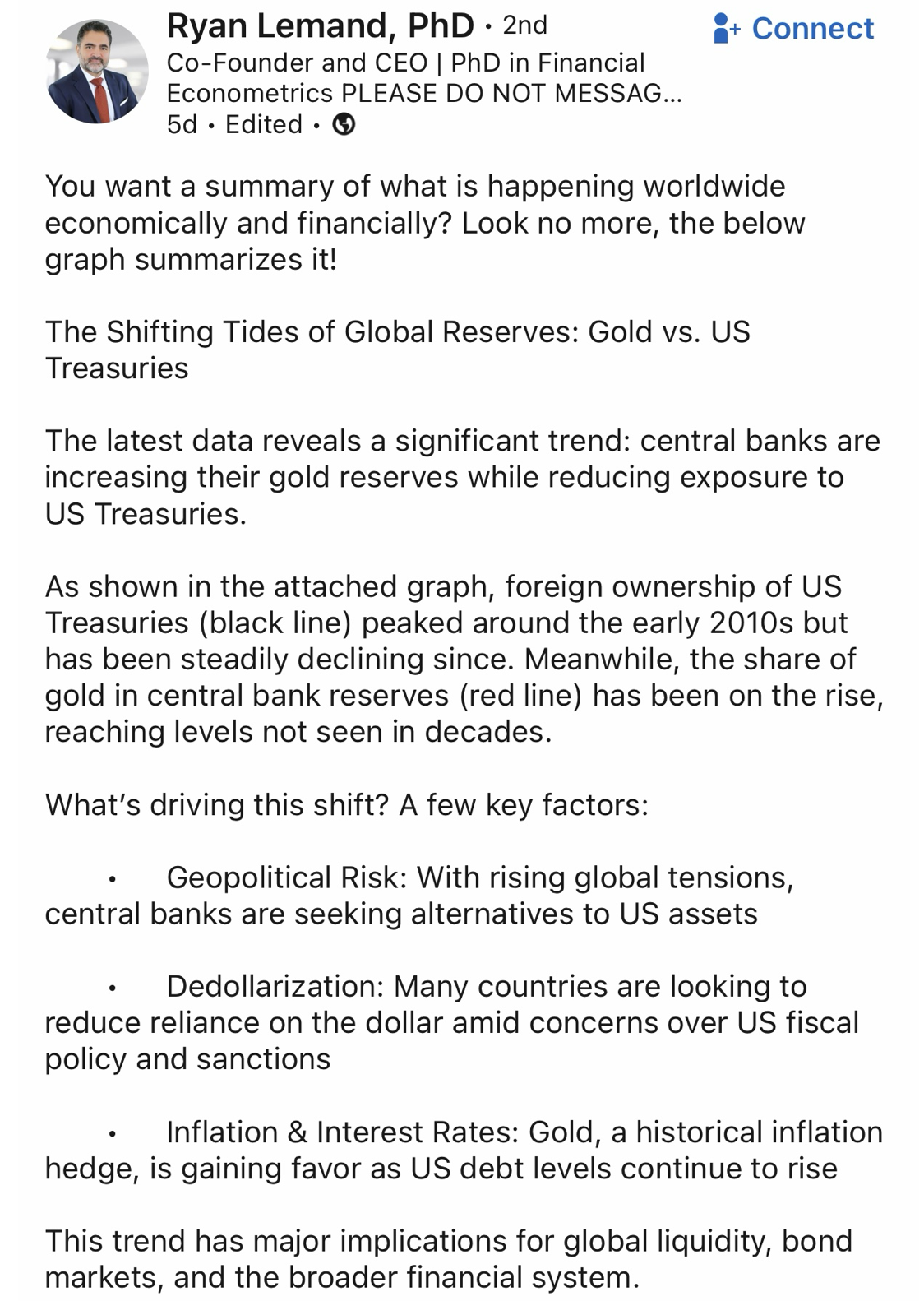

Those worried about a worst-case scenario have allocated more toward Treasurys and gold, as well as other liquid defensive areas.

Also, on deck this week are key economic reports. PCE and several sentiment surveys are also set to be released. The data should be quite telling about the consumer’s health and the perceived impact of Trump’s tariffs.

Economists expect more signs of stalling inflation in the Personal Consumption Expenditures (PCE) release due Wednesday. Economists expect annual “core” PCE – which excludes the volatile categories of food and energy – to have clocked in at 2.7% in February, up from the 2.6% seen in January. Over the prior month, economists project “core” PCE at 0.3% unchanged from January.

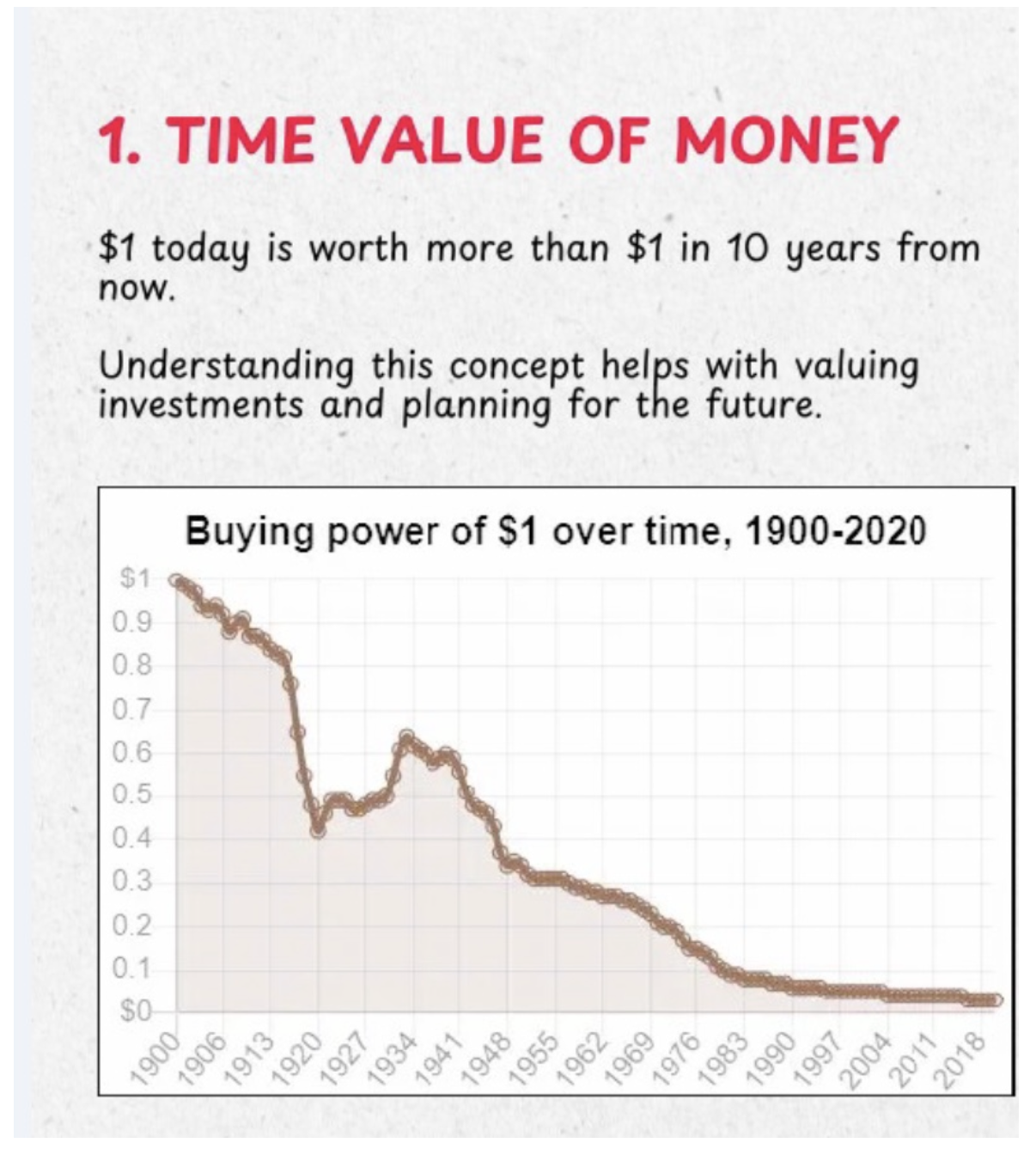

Inflation remains a big hurdle for consumers, and the sticky price pressures are likely to linger longer than expected.

MARKET UPDATE

S&P500

The index remains higher from the Mar 13th low at 5505. The bounce could continue. Any break over $5790/15 area would argue at least another few weeks of gains, while remaining below argues further downside. The long-term view of a major top remains. Any bounce, even a deep bounce, will be seen as a correction & part of the significant topping pattern.

Resistance: $5745/$5825

Support: $5500/10 area

GOLD

Gold is overbought after the recent surge since November. Nearing the end of this rally – rising risk of a top for at least several months. We may see marginal new highs and/or more consolidation before the topping formation is complete.

Resistance: $3058/63

Support: $2988/$2951/$2915

BITCOIN

Bitcoin is still undergoing a correction. There is scope for more choppiness and further lows first, before we see new highs.

Resistance: $87.0/$87.5K and $$90.9k/$92/$93k

Support: $79/$80 and $76/$77/$74.

QI CORNER

HISTORY CORNER

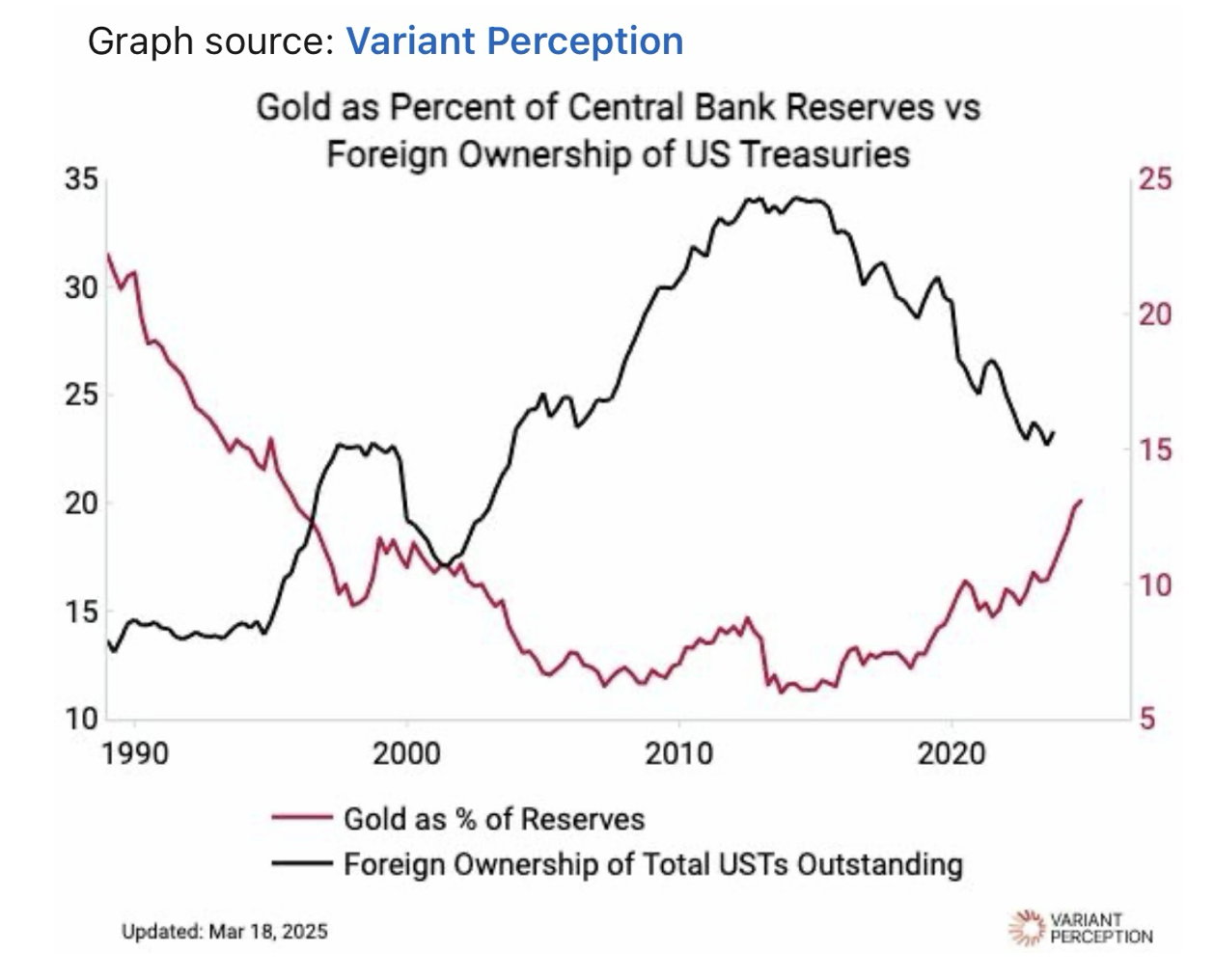

On March 24

SOMETHING TO THINK ABOUT

Cheers

Jacquie