March 25, 2010 ? Cash in Your Yen Shorts

Featured Trades: (YEN), (YCS), (TM),

(NSANY), (SNE), (EUROYEN CROSS)

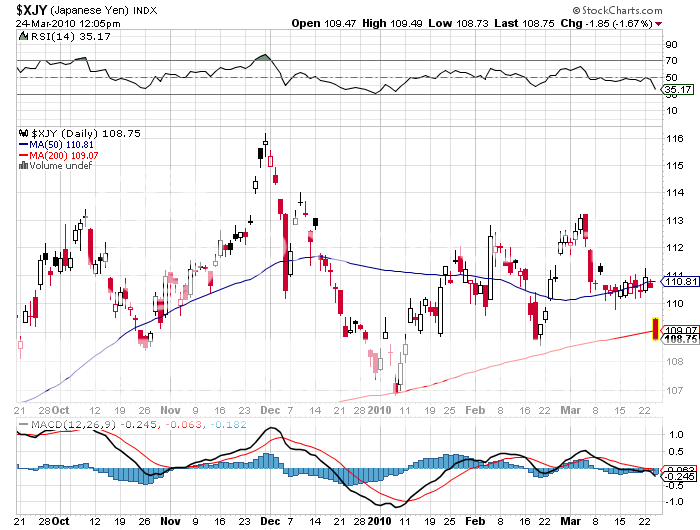

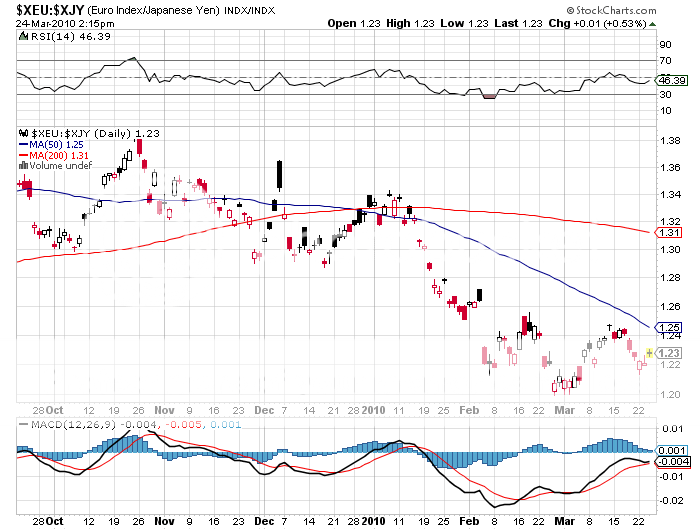

1) Cash in Your Yen Shorts. Paid subscribers who took my advice to clamber into short yen positions at ?88.5 on March 4 were richly rewarded with a major breakdown in the Japanese currency today to ?92.5 (click here for the call in my March 5 letter). Repatriation of yen by Japanese banks and institutional investors magically levitated the yen in a narrow sideways trading range around ?90 for the past two weeks. However, as we approach that April 1 deadline, support is falling away like a dress off a prom date. There is another development that will work to your advantage with this short position. The recent risk reversion in the global markets drove the yen to artificial highs, as hedge funds unwound their carry trades by buying yen and selling everything else. This has driven the premiums on calls to unnaturally high levels, and left puts ridiculously cheap.? Now the hedge funds are going the other way. When the Japanese yen starts to burn down, this will add a lot of fuel to the fire. This also makes the euro/yen cross a decent buy here at ?123. I don?t have to tell you that the Japanese government absolutely hates the yen at this level because it is killing exporters like Toyota Motors (TM), Nissan Motors (NSANY), Sony (SNE), and Nippon Steel. They?ll move Mount Fuji if they have to in order to get their currency lower. I understand that Bank of Japan governor Masaaki Shirakawa is taking private lessons from Alan Greenspan on how to collapse a currency (Alan, baby, you were so good at it!). There is another vulture circling over the yen. When all of the angst about Greece resolves itself, the world?s credit sharks are going to hunt for a new victim. They?ll be looking for a country whose soaring debt equals 100% of GDP, suffers a terrible demographic outlook, and pays zero interest rates. Using these criteria, Japan looks like an incredibly ripe piece of fatty blue fin tuna sushi. This is why credit default swaps on Japanese debt have doubled since last summer. Of course, I only speak Japanese, spent a decade living in Japan, another decade running a Japanese prop desk, a third decade managing a Japanese hedge fund, and published three books on the Japanese financial system, so what do I know? But if I?m right, there is a baseball sitting on top of a T-ball stand just begging to be smashed out of the park. Look for the yen to move to ?95 very quickly, then ?100 to the dollar in months, followed by ?120, and ultimately ?150. If you want to get into the beginning of a major trend, instead of the middle, or the end, like everyone else, this is your big chance. Buy the short yen ETF (YCS).