March 26, 2010 ? Playing Catch Up With Titanium

Featured Trades: (TITANIUM), (TIE), (BA)

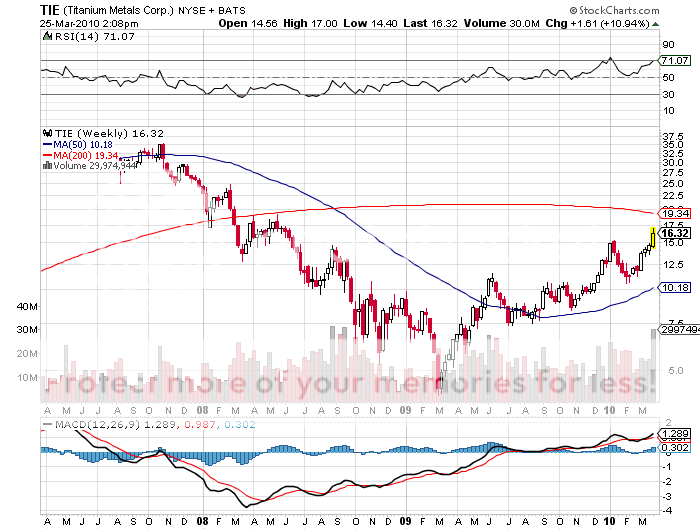

3) Playing Catch Up With Titanium. One of the many sectors I knew would go up a lot, which I just plain didn't have time to write about, is titanium stocks. But the top titanium producer in the US, Titanium Metals Corporation (TIE), has popped 43% in the past month, giving me the one fingered salute, so I feel obligated to bring it to your attention. Titanium is named after the Titans because it is incredibly strong, lightweight, flexible, corrosion resistant, and is a great conductor of heat. The metal of the gods is only 56% the weight of an equal volume of steel. It is also extremely expensive to refine, process, and fabricate. The required Kroll process to make titanium sponge (TiCl4), is tedious, toxic, and time consuming, requiring vast amounts of Chlorine. China is the world' largest supplier of titanium sponge, and the aircraft industry consumes 76% of global production (it is also the key ingredient of the white paint used in all those Chinese furniture imports). That makes the metal a great call on the aircraft industry. With US airlines struggling to make ends meet during good times, and dropping like flies in bad, and military spending on the wane, you would think this is a call that you'd rather turn a deaf ear to. But you'd be wrong. It is in fact yet another call of emerging market prosperity, as aircraft orders from airlines based in the developing world have been skyrocketing. Not only that, the amount of titanium used in aircraft has increased from zero in 1964 to 17% today and is still rising as it brings greater fuel efficiencies. This is all a roundabout way of saying that you should keep TIE on your radar, and buy it on any substantial dips.