March 29, 2010 ? Enter the Golden Age for Hedge Funds

Featured Trades: (HEDGE FUNDS)

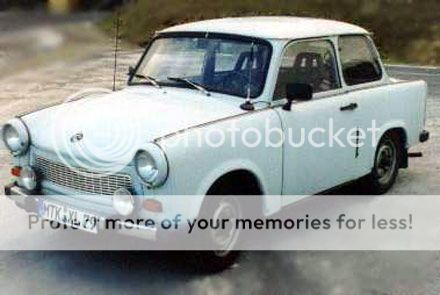

2) Enter the Golden Age for Hedge Funds. I think we are entering a new golden age for hedge funds. I haven't seen as many visible, easy to understand growth differentials since the eighties since the last golden age, when we all made fortunes going long high growth markets and currencies, like Japan and the yen, and shorting low growth ones, like those for US stocks and the dollar. Today, China is growing at 9% a year, the US 2.5%, and Europe 1%, so you buy the FXI and short the euro. Think of it as a race between a Porsche, a '56 Chevy, and a Trabant, that you can bet on, without handicapping. How hard is that? I'm sorry, but I don't have armies of PhD's in math and computer science running warehouses full of Cray computers, like Renaissance does. I have to rely on really simple trading strategies, like sell high and buy low. This is why so many of the currency trades I have been recommending this year have been working so well, like shorting the euro against the dollar, the yen against the dollar, the Ausie/euro cross, and the loonie/euro cross. There are also a huge divergences in industries within single countries. In the US technology and commodities firms are enjoying true 'V' shaped recoveries, while great swaths of the economy, like the auto makers, commercial and residential real estate are comatose, with 'L' shaped recoveries at best. Get the macro and sector calls right, and single stock picks become almost an afterthought. Perhaps this explains why money has been flooding into hedge funds this year. The financial crisis rightly cleaned out a couple thousand wanabees chasing marginal returns with super leverage, and the survivors are certifiably bomb proof.