March 5, 2010

Global Market Comments

March 5, 2010

Featured Trades: (JAPAN), (YEN), (YCS),

(GOLD), (GLD),(NEM),

(NATURAL GAS), (UNG),

(HEDGE FUND RADIO), (BARTON BIGGS)

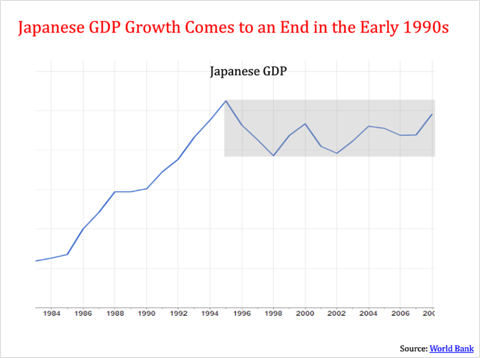

The national debt has rocketed to 190% of GDP, and 100% when you net out government agencies buying each other?s securities. Japan has the world?s worst demographic outlook. Unfunded pension liabilities are exploding. Other than once great cars and video games, what does Japan really have to offer the world these days, but a carry currency?

Until now, the government has been able to cover up these problems with tatami mats, because almost all of the debt it issued has been sold to domestic institutions. Now that this pool is drying up, there is nowhere else to go but foreign investors. With Greece and the rest of the PIIGS at the forefront, and awareness of sovereign risks heightening, this is going to be a much more discerning lot to deal with.

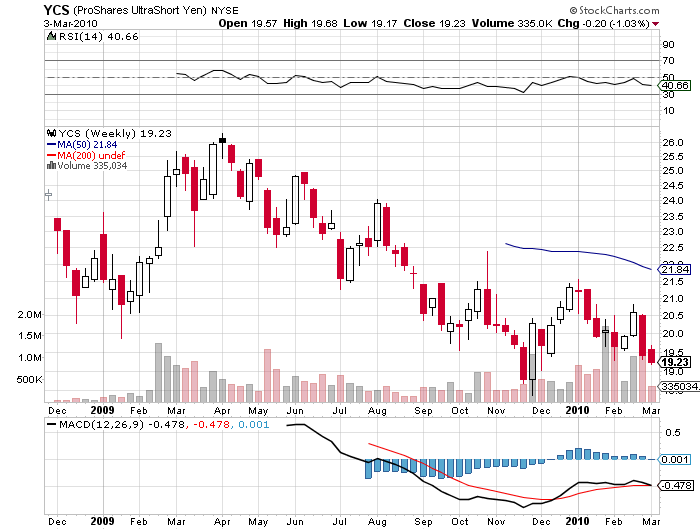

That great bell weather of global risk taking, the Euro/Yen cross is telling us that the mother of all carry trades has already started. On the release of Friday?s surprisingly positive nonfarm payroll numbers, the cross popped from ?120 to ?123.5, sending shorts scampering. You also see this in the Ausie/Yen cross, and outright yen markets. I have been piling clients into short positions since Thursday at the ?88 handle, and they have already bagged an instant profit of ?2.

You could dip your toe in the water here around ?90. In a perfect world you could sell it as it double tops at the 85 level. My initial downside target is ?105, and after that ?120. If you?re not set up to trade in the futures or the interbank market like the big hedge funds, then take a look at the leveraged short yen ETF, the (YCS). This is a home run if you can get in at the right price.

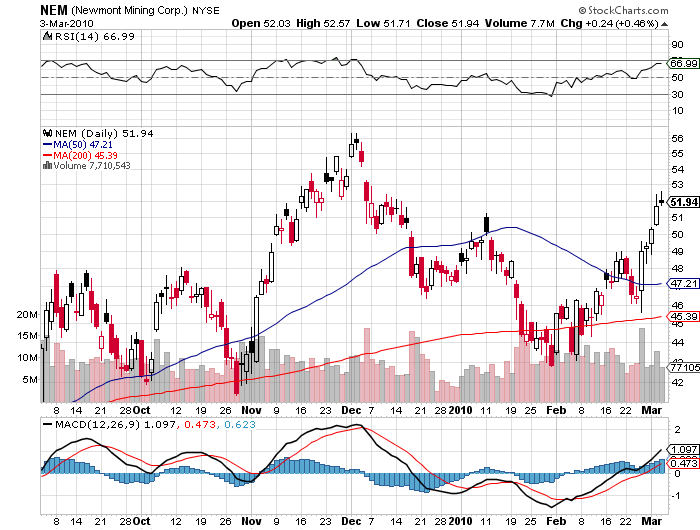

2) If you are wondering where the bull market in gold went, take a look at the chart below of gold priced in Euros. The chart for gold priced in yen look just as healthy. The latest filings with the Securities and Exchange Commission show that the largest hedge funds are still adding to their already substantial positions. Soros Fund Management, with $25 billion under management, tripled its holdings in the gold ETF (GLD) in the fourth quarter of 2009. Tudor Investment Management quadrupled its holding in Newmont Mining (NEM), the largest miner of the barbaric relic in the US. Hedge fund giants, David Einhorn of Greenlight Capital and John Paulson of the Credit Opportunity Fund, have also been boosting substantial positions. These guys are not day traders, and are clearly in for the long haul. With some technical analysts arguing that gold still has several more months to go to digest the massive 80% gain it made off of the October, 2008 $680 low, that may be the wise approach to take.

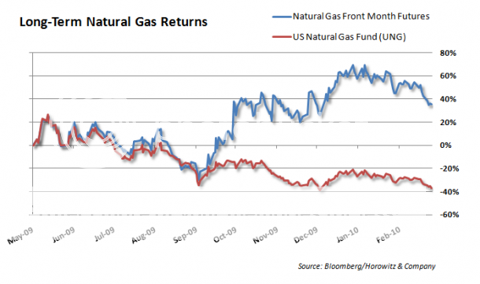

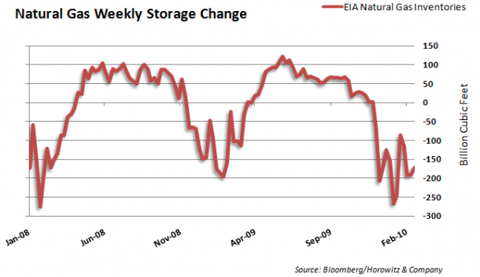

3)The poster boy for everything that can go wrong with an ETF? is undoubtedly? the one for natural gas, the (UNG). If you had studiously done all of your homework in September and concluded that natural gas was severely oversold and about to go up 40%, you would have been dead right. If you then went out and bought the UNG you would have then lost 40%, as you can see from the chart below. You would think at first glance that this is a chart for an inverse gas ETF, which it isn?t, because such an instrument doesn?t exist. This dreadful state of affairs was brought about by the intricacies of contango, where far month contracts in the futures markets are trading at premiums to the front month. As each month expired, the managers of UNG bought fantastically rich forward contracts, and then rode them all the way down to spot, as they were mandated to do by their prospectus. They then repeated this exercise every month. If the contango continues indefinitely, the UNG will eventually approach zero. Since we are discussing CH4, I have to tell you that the outlook does not look great. We are just coming out of one of the worst winters in history, and NG only managed a rally from the $2.40 low to six bucks and change. Gas in storage is about to rise again, and gas producers are racing to out produce each other in the hope of offsetting falling prices with increased volumes. This is all happening with new discoveries occurring almost daily, thanks to the new miracle fracting technology. It seems that now one only need poke a straw in their backyard to obtain a lifetime supply of clean burning energy. And I read today that Poland is about to lead the charge deploying fracting technology in Europe. They must be sweating bullets in Qatar, which just invested $50 billion in gas exporting facilities. Moral to the story: don?t just punch in a symbol and hit enter. Read the damn prospectus first.

4) My guest on Hedge Fund Radio this week is Barton Biggs, founding partner of mega hedge fund Traxis Partners. Barton is a former colleague and mentor of mine at the Wall Str

eet giant, Morgan Stanley, where we spent nearly a decade sparring with each other over the international investment landscape. Barton is an ex Marine officer (semper fi) who went to business school, earning an MBA from New York University. He started in the business in 1961, when he joined brokerage house EF Hutton, and went on to start one of the first ever hedge funds.? Barton then joined Morgan Stanley in 1973, were he was a managing director for 30 years, founding Morgan Stanley Investment Management. He eventually served on the firm?s board of directors. Barton was rated, more than once, the number one global strategist by Institutional Investor Magazine. He left Morgan Stanley to start Traxis Partners in 2003. Hedge Fund Radio is broadcast 24/7 around the world for free. To access this online program and archives of past shows, please go to my website by clicking here

QUOTE OF THE DAY

?When you have a wave of bank crises, it is often followed by a wave of sovereign debt crises. There are a lot of countries with elevated debt levels, a lot of countries at risk??.It?s amazing how many countries have amnesia about their default rates,? said Dr. Kenneth Rogoff, a Harvard professor and former Chief Economist at the IMF.