March 7, 2011 - An Update with Technical Analyst to the Stars, Charles Nenner

Featured Trades: (UPDATE WITH TECHNICAL ANALYST CHARLES NENNER)

2) An Update with Technical Analyst to the Stars, Charles Nenner. If you have not made your year by now, you are dead meat. Many of 2011's big moves have occurred, and there aren't going to be many fireworks for the rest of the year. Many asset classes are about to settle down into boring, predictable trading ranges.

That was the gist of my conversation with my old friend, Charles Nenner, who flew over from Europe to spend a weekend jamming with fellow musicians in the Big Apple. The wily Dutchman is looking forward to a week of media appearances and consulting with his major hedge fund clients.

Charles is not yet ready to short the US stock market. While the rally is definitely showing advanced signs of age, the upside momentum is impressive, so he would rather stand aside. His extreme, best case target for the S&P 500 is 1356.

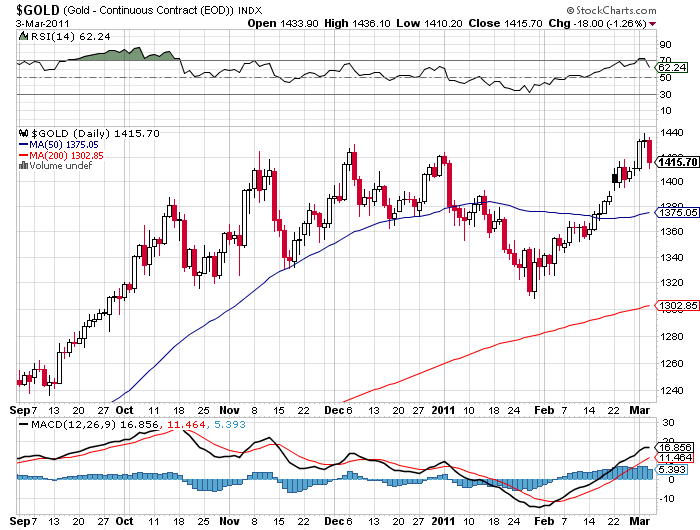

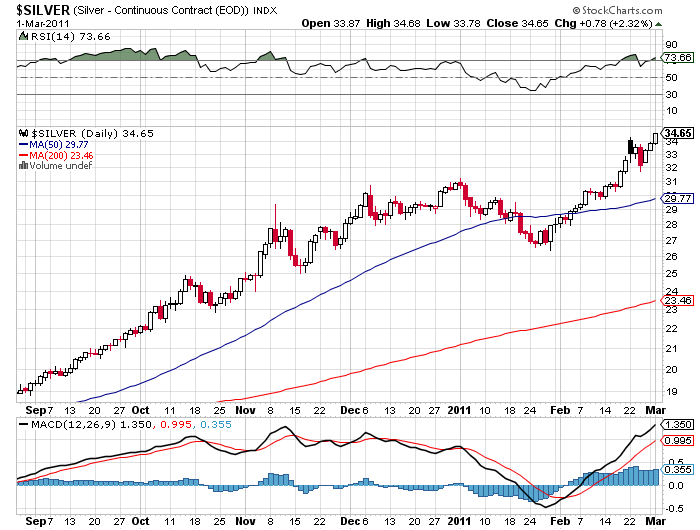

Nenner caught a short play in gold earlier in the year, on which I was able to ride the coattails. Now that we are back up to all times highly he is looking for a repeat. Ditto for silver. I'll let you know when he pulls the trigger.

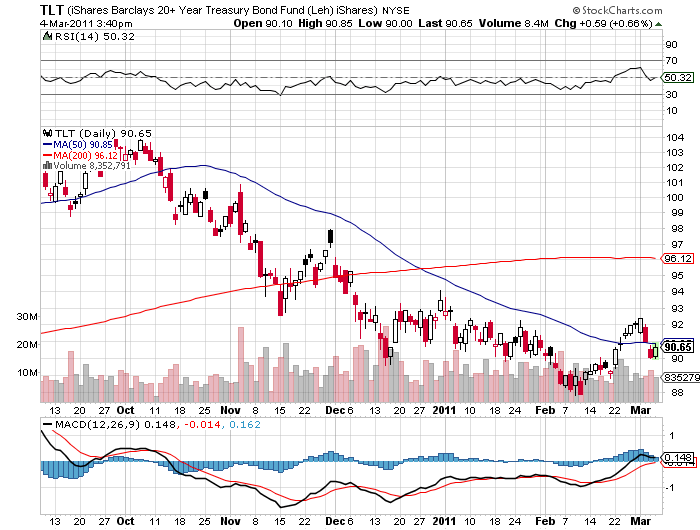

Charles is looking for further weakness in bonds, but doesn't see a crash. His preferred play is a short volatility one whereby he shorts puts on both the 10 year and 30 year September bond futures contract at the 110 level. That equates to a yield of 4.2% on the 10 year and 5.2% for the 30 year. If yields don't get that high, he keeps the entire premium from the short put trade. If he goes in the money, he is quite happy owning bonds at these levels, which he can then sell on the next rally.

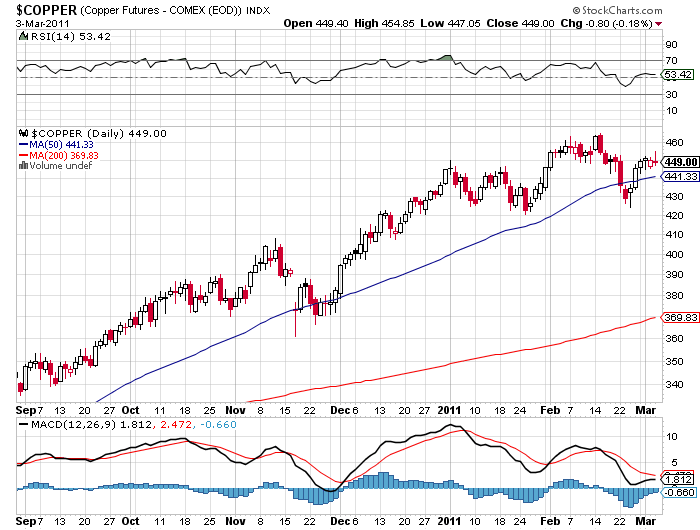

He agreed with my own view that we are in the midst of a major long term bull market for the grains and commodities. His next target is $4.84 for copper, up 5.6% from today's level of $4.49. The food sector is getting an assist from high oil prices, as all types of farming have substantial energy inputs. He promised to get back to me on specific targets for corn, wheat, and soybeans. Suffice it to say, that you better be stockpiling your seven years of plenty.

We agreed that our previous bet over Cisco (CSCO) was a push. I was right, in that I was able to capture a quick double of my capital on my call spread, and then scampered. He was right when an earnings disappointment ultimately caused the stock to crash once again. We may well put on the same bet again, for the fiery case of the Dutch liquor, Bols, when I strap this trade on again after the next generalized equity sell off.

I always end every one of our conversations by pinning Charles down on the one trade he would pull the trigger on today with new money. Wait for the Euro to hit $1.40 against the dollar, and then go short, with a $1.4050 stop. At that point the European currency will have had an impressive 12 cent rally against the greenback and will be well overdue for a correction. European Central Bank president Jean Clause-Trichet has shot his wad with his promise today of rate hikes, and from here traders will want to see the color of his money. But break the $1.4050 stop and you should run for the hills, as the next target is $1.46.

I promised to take him wave hopping in my plane on his visit to the West coast. He agreed, as long as I promised not to do it upside down.

-

-

-

-

-

-

Oops, Forgot That Promise!