March 7, 2011 - The February Nonfarm Payroll

Featured Trades: (FEBRUARY NONFARM PAYROLL)

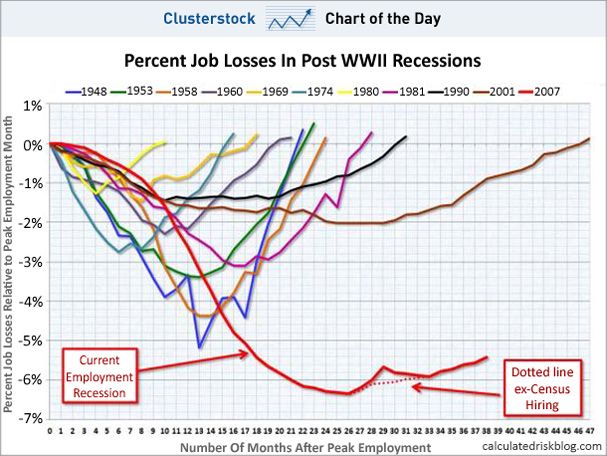

3) The February Nonfarm Payroll. President Obama's political advisors were no doubt popping the champagne bottles on Friday morning when the February nonfarm payroll showed a gain of 192,000. It was the best report in two years. The headline unemployment rate handily dropped from 9.0% to 8.9%. The December and January reports saw revisions upward of another 50,000 jobs.

Private sector hiring leapt by 222,000, with big gains in manufacturing (33,000) and construction (33,000). The good news was partially offset by 30,000 job losses by state and local authorities, a trend which I expect to continue for decades to come. There are still 13.7 million unemployed in the US, including 6 million for six months or more.

I think that best case, the unemployment rate will drop to the 7% handle by the next recession, which will probably begin sometime in 2012. Then we will rocket to new post Great Depression highs. The 25 million jobs we shipped to China and other emerging markets during 2000-2010 are never coming back.

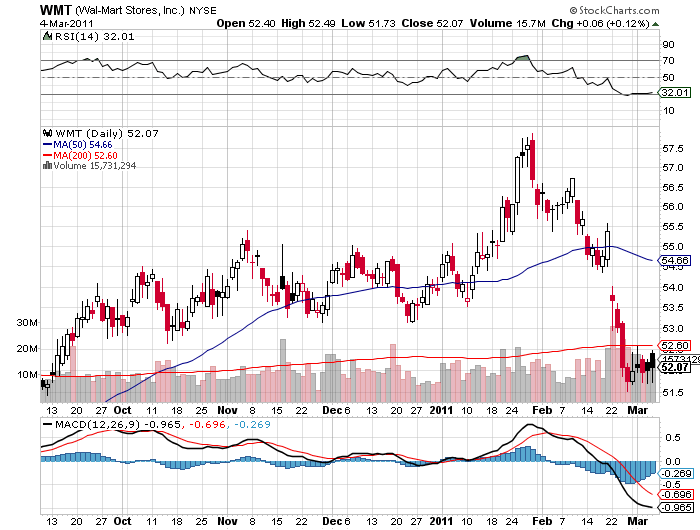

Many of those who lost their jobs then, some 10% of the work force, may be permanently frozen out of the economy and are now part of the structural unemployed. We saw the same thing happen in Germany during the seventies and eighties. This is why I have studiously avoided retail stocks during this bull market. When one tenth of the population permanently drops out of the economy, consumer spending is not going to come roaring back, especially at the low end. This may be what the stock price of Wal-Mart may be telling us.

-

-