March 7, 2025

(THE BEAR IS GROWLING IN THE FOREST)

March 7, 2025

Hello everyone

Peter Berezin of BCA Research was a Wall Street bear coming into 2025. He believes the U.S. is probably already in a recession.

Coming into 2025, most Wall Street strategists were predicting further gains, however, Berezin was holding a firm bear view of the market.

His year-end S&P500 (SPX) target is 4,450. His worst case is 4,200. That is compared to the 6,500 analysts’ average, and Oppenheimer’s 7,100 top.

Berezin said his research house was among the few that boosted recession probabilities following the U.S. election. He argued that “we did so because we thought that Trump would be disruptive in some positive ways, but also very disruptive in some negative ways, most of which is trade.”

Berezin also negated the argument that tariffs were just a negotiating tool. Instead, he was convinced Trump wanted tariffs because he is “a protectionist at heart” and needs the money because of the sizable budget deficit.

How should investors approach the market right now?

Berezin’s advice is to largely step away from stocks. But if you need to be invested, move your portfolio toward the more defensive sectors, such as “consumer staples, healthcare, utilities to some extent.” He goes on to say that investors should avoid tech, consumer discretionary, industrials, materials, financials, high-yield credit, and crypto.

He comments that you need to own bonds, own more cash, and own more gold. In addition, he mentions buying puts for the protection of your overall portfolio.

What could change Berezin’s downbeat view?

Trump does a complete pivot away from his tariff agenda. But in declaring this, Berezin still believes that stocks would have to go down a lot for Trump to change his position on tariffs.

I have been bearish on the market for quite a while now and indicated bearish targets on S&P 500 charts during my February Zoom meeting. I was also bearish in January. I have recommended selling down a lot of your positions in the stock market or selling some stocks completely. In a scenario such as this environment, it is better to be cashed up, so you can go shopping when there is “blood in the streets.” In other words, have cash at the ready after stocks have been hammered and are in great territory for LEAPS. Warren Buffett has built an enormous store of cash over the last few months, so he is ready to scoop up bargains when the time is right. Heed Buffett’s actions and Berezin’s advice.

For insurance to protect your portfolio, you can buy (SH) Pro Shares Short S&P500 exchange-traded fund (ETF). If the market rallies again, an option trade on SH is another insurance vehicle.

SOUTH-EAST QUEENSLAND WILL TAKE THE FULL BRUNT OF CYCLONE ALFRED

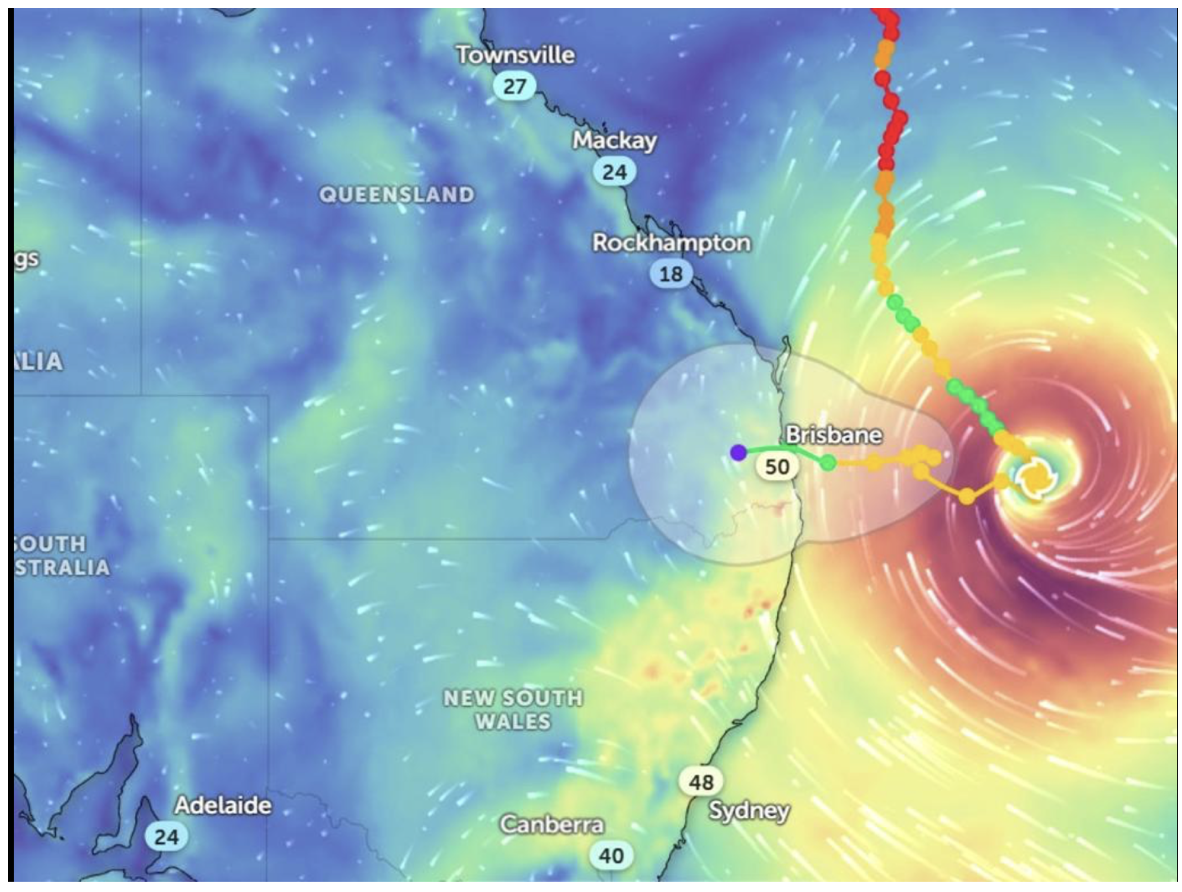

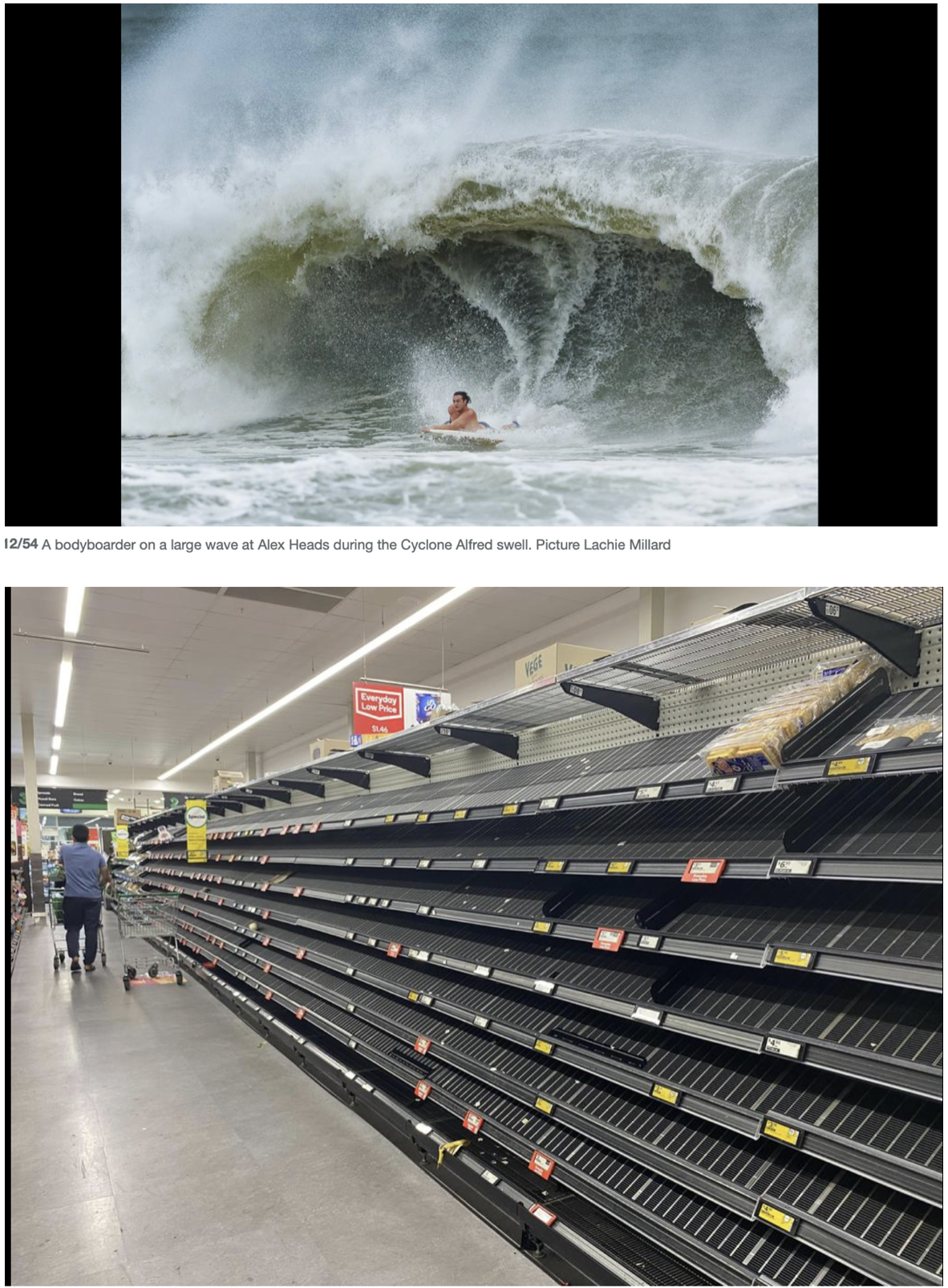

Cyclone Alfred is around 225 kilometres off the Gold Coast and is expected to cross the coast on Friday or early Saturday morning. It is a rare event for this part of Queensland to have a cyclone. It is about 50 years since the last one travelled across our coastline in this southeast Queensland area. Around 655 state schools (1000 schools in all) have been closed in the southeast corner, together with the Brisbane & Gold Coast airports, many businesses as well as some supermarkets. Central Brisbane is almost like a ghost city. Despite the government advising everyone to stay indoors, some surfboard riders have been making the most of the huge swells. Board riders have been towed out past the breaks by jet ski vehicles.

There have been some wave heights of 12 metres and over. And, of course, plenty of broken surfboards.

Supermarket shelves have been stripped bare in preparation for this weather event.

400,000 sandbags have been collected by residents in an effort to protect their homes and businesses.

I have now lost power, so I will submit this while I still have battery power on my laptop.

Cheers

Jacquie