March 8, 2010

Global Market Comments

March 8, 2010

Featured Trades: (FEBRUARY NON-FARM PAYROLL), (YEN), (EUROYEN CROSS), (SPX), (GOOG), (AAPL), (GS),

(BARTON BIGGS),

(OEF), (MSFT), (INTC), (CSCO), (ORCL),

(FXI), (PIN), (EWY), (THD), (EWT), (EWH),

(TUR), (PLND), (RSX), (EWZ), (USO).

?

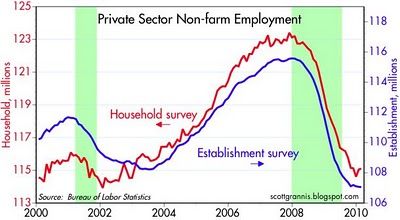

1) Something Amazing is Happening With the Payroll Figures. The February non-farm payroll showed a further loss of 36,000 jobs, versus an expected loss of 75,000, and the unemployment rate remained unchanged at 9.7%. December was revised up by 41,000 and January was revised down by 6,000, so netting everything out there was essentially no change. Those hired now exactly equal those fired, about 3 million a month. There were continued big losses in construction, and decent gains in temps. This month I decided to take advantage of former Labor Secretary Robert Reich?s course on labor statistics which I took at UC Berkeley, and dig through the supporting data at the Bureau of Labor Statistics website (click here for the link at http://www.bls.gov/? ). Something amazing is happening. There is a barbell effect in the labor markets which no one seems to see, which is rendering the aggregate payroll figures meaningless. There is a barbell effect taking place, where the 40% who have been jobless for more than six months, who worked in the bubble industries of real estate, housing, and? construction, are never going to see their jobs come back. The 60% who are short term unemployed, who recently lost jobs in finance, accounting, and health care, are getting rehired very quickly. In fact, 20% of the jobless are getting rehired in only six weeks. There is another effect at work. While the employment rate for those with no high school diploma is 16%, the kind of worker who lost their manufacturing jobs to China, the jobless rate for those with college degrees is only 4.5%. This is proof that the dying sectors of the US economy is delivering the highest unemployment rates, and that America is clawing its way up the value chain in the global race for economic supremacy. It is what America does best, creative destruction with a turbocharger. There is a third influence here, which could be huge. The BLS only contacts existing businesses for its survey. It doesn?t survey companies operating out of someone?s garage in startup mode. Given the huge ongoing dislocations in our industrial structure and the incredible advances in software, the Internet, and cloud computing, this could be one of the biggest job creators of all. So far, it is not being counted at all. The bottom line is that payroll figures are much better than they appear at first glance. Red Alert! The markets don?t know this.

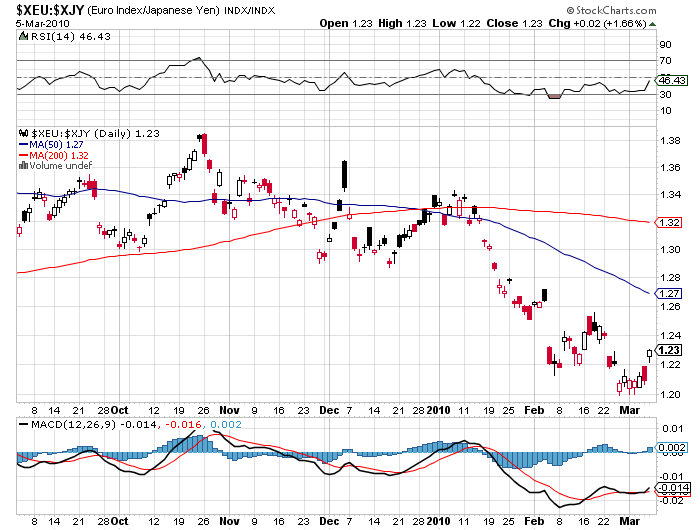

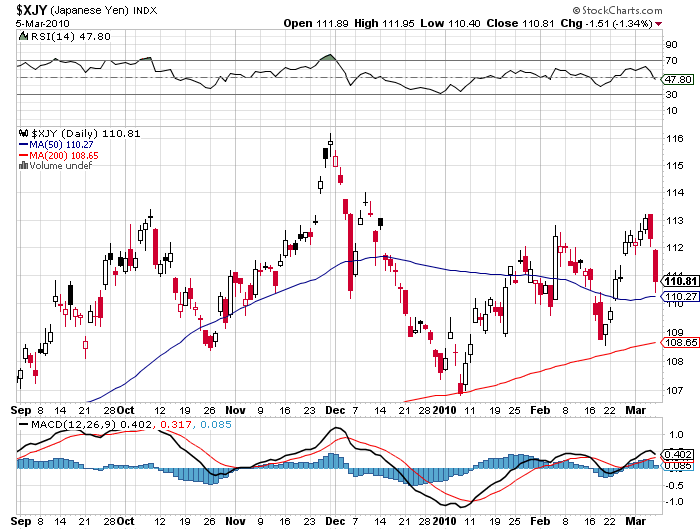

2) Is a Big Global Risk Reversal Underway? Has the Mother of All Carry Trades Begun? The financial markets had been expecting dire payroll numbers, thanks to the huge snow storms that hit the East. I am going to go way out on a limb here and bet that the snow will be gone by June. In fact, without the snow, the February payroll number could have been as high as a positive 100,000, and that we may actually see this in the March figures to be released in a month. I think the current report is spectacularly good news, because it suggests that the rise in jobless claims is now at its apex, and is about to reverse and return to earth. Mind you, we aren?t going back to 5% unemployment anytime soon, but any number showing job gains will have a hugely positive psychological effect. It will be an improvement that the markets don?t expect, don?t believe in, and therefore will catch them seriously off guard. This means that the global risk reversal trade that started on January 11 may be over, and that big hedge funds are about to start adding on positions across the entire range of? financial instruments. That great bell weather of global risk taking, the Euro/Yen cross is telling us as much, having popped from ?120 to ?123.5 on the payroll news. You also see this in the Ausie/Yen cross, and outright yen markets. Those who managed to catch my recommendation to short the yen at ?88.40 on Thursday bagged an instant profit of ?2. This is a trade that could go on for the next year, and you should be selling rallies in the Japanese currency from here. The mother of all carry trades has begun. This is good news for stocks and emerging markets. I?m not expecting anything dramatic here, maybe single digit gains in the indexes, and double that for single stocks. Use Apple (AAPL), Google (GOOG), and Goldman Sachs (GS) as your Sherpas, because they are the current markets leaders. Focus on big cap technology. It will also juice commodities, oil, and precious metals. These numbers put another nail in the coffin of the 30 year Treasury bond, which I have been despising all year.

3) Confessions of a Bull. Barton Biggs, founder of mega hedge fund Traxis Partners, spent an hour outlining his current investment strategy with me. Barton is a man of strong opinions, backed with intensive research, which he communicates with his characteristic gravel voice. I spent the better part of the eighties debating every pebble of the investment landscape with Barton. As I recall, what to do about Japan was the topic of the day, and I was bullish. Today, Barton can say with ?real certainty? that large cap multinational equities are the cheapest they have been in 30 years using sophisticated models that analyze price/sales, price/free cash flow, price/earnings, and a whole host of other metrics. Looking just at price/book ratios, these stocks have been this cheap only three times in the last 120 years. Big cap technology stocks, like Microsoft (MSFT), Intel (INTC), Cisco (CSCO), and Oracle (ORCL) are at the top of his list. Other multinationals with plenty of emerging market exposure are attractive, such as Caterpillar (CAT). The easy way in here is to simply buy the S&P 100 ETF (OEF).The market is now at a 15-16 multiple, discounting S&P 500 earnings for 2010 at $75/share. A stronger than expected economy will take that figure as high as $90/share, which the market is not expecting at all. Barton sees the US as half way through an economic recovery, and the main benchmark indexes could surprise to the upside, as they have such heavy big cap weightings. He would avoid domestic companies, such as those in real estate, as the environment for stocks generally is poor. He foresees a ?new normal? of a lot of volatility in stocks for the next 4-5 years. Longer term he sees US GDP growth downshifting from the heady 3.8% annual growth rate of the la

st decade to only 2.5 % in this one. But big cap multinationals should be able to bring in a reliable 5%-6% annual return on top of inflation. Looking at the world as a whole, Barton thinks Asia is the place to be. A bubble may be developing in China, but it is at least 3-5 years off, and there will be plenty of money to be made until then. India is another big pick because it is ten years behind China, and has yet to experience its big growth spurt. South Korea, Thailand, H-shares in Hong Kong, and Turkey are also lining up in Barton?s sites. Looking at a 1%-1.5% growth rate, things look grim for Europe, with the possible exceptions of Poland and Russia. Traxis is short Brazil, because it has already had a great run, and because the country still faces some severe social problems. Commodities had their run last year, and won?t do much from here, but they aren?t going to crash either. He sees oil grinding up because the cost of new sources is becoming astronomically high. Barton avoids gold because it has no yield or PE, and would rather not be associated with the crazies that inhabit that space. Bonds will be deflation driven for the next year, but are definitely not for your ?Rip Van Winkle? investor, as they represent poor value for money. Real estate is dead money. To hear my interview with Barton at length, please click here

?Rupert Murdoch is very smart and is a great leader, but he?s made a mistake. He?s buried in ink, and in my view, there won?t be any newspaper business ten years from now. Fortunately, we?re buried in television and movies, and they?ll be here forever,? said Sumner Redstone, chairman of Viacom and CBS.