Market Outlook for the Coming Week

I?m presently dancing to the song ?Believe? by Cher, my former next-door neighbor, and the top hit of 1999 that dominated the airwaves.

I am not particularly a fan of late twentieth century music, even by Cher.

However, I definitely think the markets are replaying the years 1998-1999.

That means stocks keep rising for a least another one to two years on the back of improving corporate earnings, ultra low interest rates, and expanding price/earnings multiple.

Dow 21,000 is a chip shot, as is S&P 500 2,400. The great bull market will extend well into 2018 and maybe even 2019.

You heard it here first.

Much more fascinating, to me anyway, were asset class reactions to the August Non Farm Payroll released on Friday.

There is no doubt that the 151,111 print was a big disappointment, well below the 180,000 consensus forecast.

The headline unemployment rate stayed at a decade low 4.9%, while the structural unemployment U-6 fell to 9.7%.

Food Services picked up +35,000 jobs, Social Assistance +22,000, and Professional and Tech Services +20,000. Manufacturing lost -14,000, typical of summer layoffs.

?

This should have triggered a major ?RISK ON? move, as the chance of a Fed rate hike on in September was totally obliterated, and interest rates will remain lower for longer.

However, after the first five minutes, we saw a decidedly ??RISK OFF? move ensue.

Stocks (SPY), bonds (TLT), foreign currencies (FXY), (FXE) and copper (CU) all fell in unison. Oil (USO) rose, but it seems to be living in it's own, geopolitically driven world now.

So, even though the short-term risk of a rate rise is now gone, and maybe even a medium term tightening in December, markets seems to be focused on the long term direction of rates which is definitely upward.

Of course, rates will rise so slowly as to be imperceptible, because deflation is still rampant, globally so. So that keeps the bull market in stocks alive and well. This one could run for a record 8-9 years.

Talk about getting to ?Have your cake and eat it too.?

By the way, those who took my advice to sell short the Treasury bond market with my last two Trade Alerts are home free.

We are now probing the bottom end of a two-month trading range and have only nine days left until the September 16 expiration. I just checked prices and we are marking at 70% of the maximum potential profit in our last position.

Well done!

Thanks to Labor Day, we have a mercifully shortened week, with the major economic data reports behind us.

On Tuesday, September 6 at 8:30 AM EST we receive Gallup Consumer Spending which should continue moving from strength to strength. Never underestimate Americans? willingness to spend money, especially on credit.

On Wednesday, September 7 at 10:00 AM we see the Fed Beige Book which will confirm a continuing slow 2% growth rate.

On Thursday, September 8 at 8:30 AM EST the Weekly Jobless Claims should confirm that employment remains at decade highs. We will also get a series of Treasury auctions which should be weak, given today?s market response.

On Friday, September 9 at 1:00 PM EST we wind up with the Baker Hughes Rig Count. Worryingly, the trend has been up for the past two months, driving oil prices lower.

Overall, I expect all markets to continue to trend sideways in narrow ranges until the next Fed Open Market Committee Meeting on September 20.

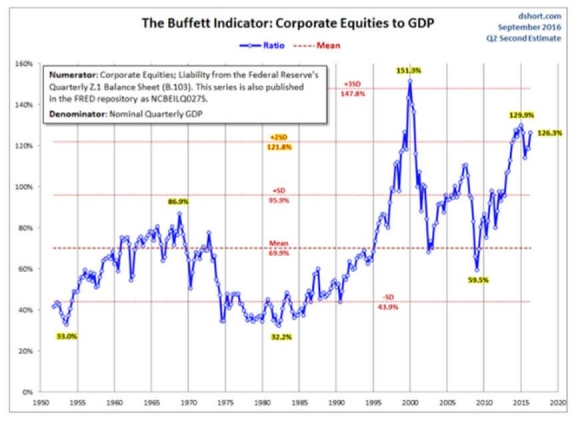

I throw in the chart below that has been circulating on the Internet today showing where we are with the ?Buffet Indicator.? This is the measure of the value of corporate equities to nominal GDP.

Although it is still a few years off, it is approaching the 2000 bubble top high. Of course, near zero interest rates skew everything, so the next high should be much loftier than the last one.

You heard that here first too.

Is that ?Believe? I hear ringing in my ears again?

Pick your poison!