Market Outlook for the Coming Week

Ouch!

That one had to leave a bruise.

All of a sudden, two months worth of trendless, sideway-moving markets showed its hand, and it was a definite thumbs down.

At the lows, the Dow Average was off 400 points, the first time it moved more than 1% since early July. The Volatility Index (VIX) exploded from 12 to 17.

It was as if all of the volatility of the past two months bunched up into a single day.

It was a selloff that had many fathers. Point to the North Korean nuclear test, the prospect of a Fed rate rise next week (they?re not), the ECB?s pass on a QE increase, Jeffrey Gundlach?s umpteenth prediction that bonds will fall, Trump?s bump in the polls, or the massive new scandal at Wells Fargo.

None of these events would individually have been market moving. But pile them up together, and you get a long overdue meltdown.

Or you could simply point to the calendar. The big players are finally back from their summer vacation, and the decision has been made to lighten up ahead of the presidential election.

The entire high yield space was taken out to the woodshed and beaten like the proverbial red headed stepchild (with apologies to red heads everywhere).

That would include REIT?s (SPG), junk bonds (JNK), utility stocks (T), and emerging market debt (ELD).

I have been warning readers about the risk in these sectors for over a month, and now the chickens are finally coming home to roost.

Every attempt by investors to offset low returns with greater leverage always ends in tears.

Of course, everyone is going to be holding their breath to see if the selloff has follow through on Monday or whether we bottom out here.

My view is that we are still in a long-term bull market, and this is no more than a 5% correction on the path to new all time highs. There are still mountains of cash on the sidelines, and the economy is modestly improving.

On Monday, September 12 we get no less than three Fed speakers amid a flurry of Treasury bill auctions, ramping up the drumbeat going into the September 20 Federal Open Market Committee meeting.

On Tuesday, September 13 at 8:55 AM EST we receive NFIB Small Business Optimism Index, which should continue a modest uptrend.

On Wednesday, September 14 at 10:00 AM we see the MBA Mortgage Applications which should continue strong in the face of ultra low interest rates.

On Thursday, September 15 we get a cornucopia of data releases. At 8:30 AM EST the Weekly Jobless Claims should confirm that employment remains at decade highs. August Retail Sales and the Empire State Manufacturing Index are also out then. August Industrial Production follows at 9:15 AM

Friday, September 16 is quadruple witching in the options market. We have taken profits on all of our September positions, so we?ll be sitting on our hands.

We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past two months, driving oil prices lower.

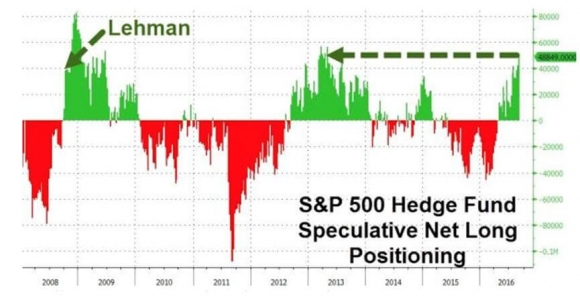

I conclude with the chart below showing Speculative Net Hedge Fund Long Positions at a three year high. Given that hedge funds are the new ?stupid money? you have to be concerned.