Market Outlook for the Coming Week

There is only one event this week of any real consequence, and that is the first presidential debate on Monday, September 26 at 6:00 PM EST at Hoftsra University in New York City.

You don?t need to know the channel. It will be broadcast on all of them, as well as streamed live on multiple online platforms.

The venue is well chosen. Hillary Clinton was the US Senator representing the Big Apple for eight years, while Trump runs his global real estate empire from there.

With 100 million viewers expected, it will be the most watched presidential debate in history.

We are about to see the least watched NFL football game in history, the Atlanta Falcons versus the New Orleans Saints, as the? game is scheduled at the exactly the same time.

As Clinton is well ahead in the polls, Trump will have to play offense and take all the risks. A clear Trump win will deliver a 400 point plunge in the Dow Average (INDU) the next day, while a Clinton win might give us a 200 point rally.

Warning: One week after presidential debates, markets are historically down 83% of the time, by an average of 2%. Trading just short of an all time high, markets may give us a similar result.

It is a simple contest between the status quo and radical change, and markets absolutely hate change, uncertainty, and unpredictability.

The debate will tell us whether last week?s frenetic rally in stocks was simply a short covering rally to the top of the recent range at (SPX) of 2,180, or the beginning of a more substantial upside breakout.

One way or the other, I expect stocks to eventually rally to new all time highs by yearend, as I have been predicting all year.

I am going into the Monday evening event long the Volatility Index (VIX) which rallied smartly on Friday.

Watching the overnight futures trade real time during the debate should be one of the most interesting experiences of the year from a trader?s point of view. To do so, please click here.

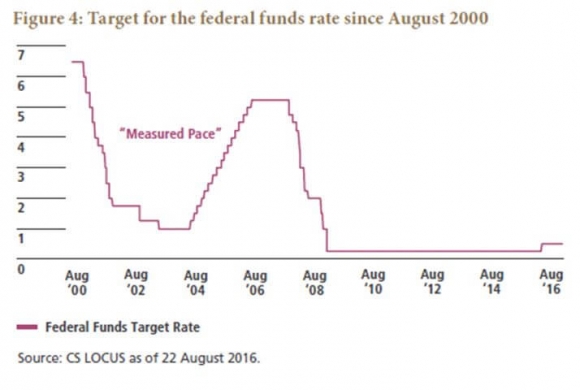

To make this week interesting, no less than 11 Fed governors will be speaking. This speaking schedule should give us a more clear picture of how severe the voting split was on last week?s controversial interest rates decision.

So look for dueling governors every day for December rate hike insights.

On Monday, September 26 at 10:00 AM we get August New Home Sales that should show continued improvement. Also, today starts a three day emergency OPEC meeting in Algiers which no doubt will lead to palpitations in the oil market (USO). Expectations are low.

On Tuesday, September 27 at 9:00 AM EST we learn the June S&P Case Shiller Home Price Index, which should continue to bring us marginal gains at a seven year high.

On Wednesday, September 28 at 8:30 AM EST we get August Durable Goods. The latest round of macro data has shown a definite slowing trend which no doubt contributed to the Fed?s decision to hold on rates.

On Thursday, September 29 we get the third and final read on US Q2 GDP at 8:30 AM EST, with a consensus view at 2.3%. Also out then will be the Weekly Jobless Claims, which should confirm that employment remains at four decade highs.

Friday, September 30 delivers us the Consumer Sentiment at 10:00 AM EST, which should edge higher. We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for 12 out of the past 13 weeks, to the eternal distress of oil prices.

All in all, I expect us to continue trading in narrow ranges with profits accruing only to the quick and the nimble.

Good luck and good trading. ? Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader