Market Outlook for the Week Ahead, or Feeding the Geese

"Feed the geese when they are quacking."

That is the motto I heard on a daily basis while running a trading desk at Morgan Stanley for a decade. What it means is that when investors want to buy stocks, you give them to them. And gave them we did.

There seem to be a lot of squawking geese flying around Wall Street these days, and records are being broken like clay pigeons on an Olympic skeet sheeting final.

It has been the strongest start to a year in two decades. Last year, the stock market rose every month for the first time in 70 years!

In the meantime, the sell signals have started popping up like poisonous mushrooms in the aftermath of a San Francisco Bay Area rainstorm.

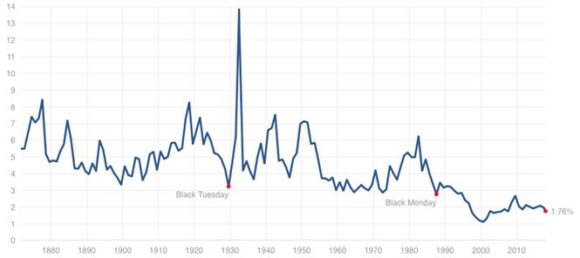

This week, the inversion of the yield curve continued its relentless advance, like "The Blob" that ate New York. The two-year Treasury bill yield surpassed 1.98%, exceeding the S&P 500 dividend yield for the first time since 2009.

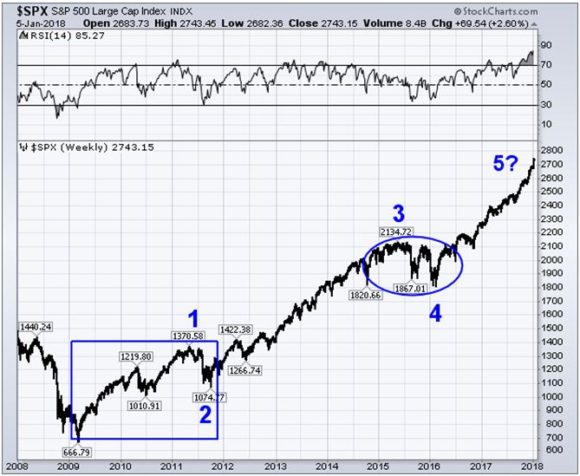

My friends over at Stockcharts.com have observed that we are now in the fifth (and final) Elliot Wave move up in a bull market that started in 2009.

Not that you should worry about any of this today. Just add it to your "I told you so" diary, which you can start showing to your friends in about 18 months.

I could go on and on. But I don't want to say anything that might prompt readers to sell shares prematurely. As I have noted many times, tops can take years to form, and early sellers always look foolish.

Traders were selling short the Nikkei average from 1985 onward, and dotcom stocks from 1995, both times with grievous results.

When you throw bad news on a market and it fails to go down, you buy the daylights out of it.

That was certainly the case when the December Nonfarm Payroll Report came out Friday at a flaccid 148,000. The headline unemployment rate held steady at 4.1%. This should have been an excuse to pause and let reason have its say.

Instead, feverish investors afraid of getting left behind took the Dow Average up some 225 points.

Health Care added a robust +31,000 jobs as we baby boomers besiege our Medicare covered doctors. Construction added +30,000 as Homebuilders race to meet a structural shortage of houses. Manufacturing picked up +23,000 jobs.

What was truly gob smacking was the loss of -20,000 jobs by Retail in what is normally the strongest month of the year. The year on year number is now a mind numbing -67,000. Macy's (M) has already announced the closing of another dozen stores this week. Clearly, the Amazonification of the economy continues full speed ahead.

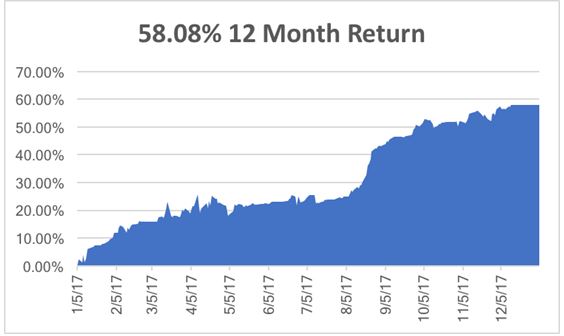

My own trading performance continues to flat line at an all-time high at +58.08% on a trailing twelve-month basis. With virtually every asset class overbought after the New Year feeding frenzy, there is nary a sweet spot entry to be found. Just give it time.

After last week's fireworks on the jobs front, the coming week's economic data points will be painfully dull by comparison.

On Monday, January 8, at 3:00 PM EST, November Consumer Credit is published, a lagging monthly read on outstanding credit card balances, which have recently been rising.

On Tuesday, January 9 at 8:55 AM EST, we get the November JOLTS Report on job openings, which is already at all-time highs.

On Wednesday, January 10, the weekly EIA Petroleum Status Report is out at 10:30 AM EST.

Thursday, January 11 leads with the 8:30 EST release of the Weekly Jobless Claims.

On Friday, January 12 at 8:30 AM EST the December Consumer Price Index is out, a read on inflation. Given the accelerating improvement of technology the number may actually fall from last month's 2.2%.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

As for me, now that the New Year crazy days are winding down, I'll be headed up to Lake Tahoe to dig into serious research. I might even search for some inspirational leadership by reading Michael Wolf's new book, "Fire and Fury" and see what all the fuss is about, but only if I can tear myself away from the ski slopes long enough.