Market Outlook for the Week Ahead, or Front Running 2018

Investors have started to front run 2018 big time.

If you want a handy crystal ball to look into how asset classes will perform in 2018, merely surmise what took place last week.

Banks (BAC) took off like a rocket, industrials (X) outperformed FANG's, bonds (TLT) got crushed, and the US dollar (UUP) went from strength to strength. Expect these newly born trends to carry well into the New Year.

Banks in particular are a no brainer. They trade at discount earnings multiple to the market (15X vs 18X). They benefit when interest rates rise (they are). And they are huge beneficiaries of deregulation that has already started.

It turns out that a short position in the bond market is quite a nice thing to have when congress is threatening to shut down the government and default on its interest payments. The Friday deadline was missed by hours, thanks to temporary measures, and the new deadline for Armageddon is December 22.

As for the FANG's (AAPL), the only real argument for them to rise faster than their earnings growth is that their multiples are still only a fraction of the 2000 dotcom highs.

Some of the new action can be traced to a tax bill that may pass eventually. But the big driver will be an expansion of corporate earnings continuing for a ninth year. A lot of this is just traditional late cycle stuff.

The good news is that the S&P 500 is up 18% on the year, and 21% with dividends.

The bad news? I only have seven days to lose ten pounds so I can fit into my winter weight suits I will wear at my upcoming December 27 and 28 Chicago and Minneapolis strategy luncheons. To buy tickets please click here.

Running around doing my last-minute Christmas shopping, I find an economy that is the strongest in 20 years. Nary a parking space is to be found at the malls. The lines are endless. And good luck finding an empty seat on an airplane anywhere.

The November Nonfarm Payroll Report, up 228,000, certainly gives credence to this view. The headline Unemployment Rate stayed level at a decade low at 4.1%, while wage growth was almost nil.

Speaking on the phone to clients around the world, it is clear than many made fortunes following my trading and investment advice this year. I am hearing stories of mortgages paid off, college degrees financed, and once in a lifetime vacations enjoyed.

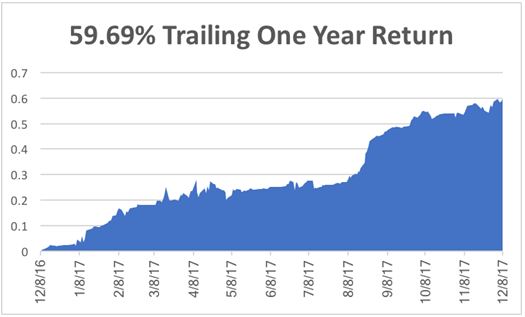

It's all music to my ears because I do this not for the money, but to give the regular guy an unfair advantage in the markets. It seems to be working. You can see it all in my trailing one year performance, now up a ballistic 59.69%, a decade high (see chart below).

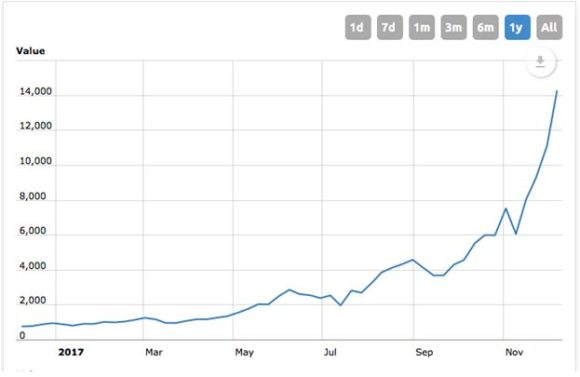

If there is one dark cloud on the horizon it is Bitcoin, whose parabolic move has left long time pros stunned, aghast, and incredulous. Not even 16th century tulips saw this meteoric rate of price appreciation. It hit $17,500 one point last week.

When the total market capitalization of crypto currencies was a mere $50 million niche for Silicon Valley geeks and nerds, veterans could snicker. Now they are worth $500 billion.

If the market size soars to $1 trillion, which it could do in a few months, and then goes to zero, the event could reach the magnitude of the 2008 financial crisis in terms of vaporized wealth. The onset of Bitcoin futures trading this weekend will simply add fuel to the fire.

Bitcoin is now sucking money in from all over the world, and speculators are selling every other asset class on the planet to finance it. The history of this instrument shows that it can pull back by 75% at any time without warning.

I'll be watching Bitcoin from the sidelines, thank you very much. If I am wrong, you can all take me out to dinner with your profits. If I can buy (BAC) with a 1.67% dividend just before it is about to double, I'll take that all day long.

On Monday, December 11, at 10:00 AM EST, the JOLTS report is out on job openings and hiring.

On Tuesday, December 12 the last FOMC meeting of the year begins. At 6:00 AM EST the November NFIB Small Business Optimism Index is published.

On Wednesday, December 13 at 8:30 AM EST, we obtain the November Consumer Price Index. The Fed is likely to announce a 25 basis point hike in interest rates at 2:00 PM EST. The weekly EIA Petroleum Status Report is out at 10:30 AM EST.

Thursday, December 14 leads with the 8:30 EST release of the Weekly Jobless Claims. At the same time, we get November Retails Sales, which should be blistering.

On Friday, December 15 is a quadruple witching for the options market. At 9:15 AM the important November Industrial Production is published.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

And most importantly, it is my last working day of 2017.

As for me, I'll be packing up the car for Tahoe, trying to cram in a few days of skiing and snowshoeing before my winter trip to the Midwest for Christmas and New Year's. I'll be bringing every pair of silk long underwear I own.