Masayoshi Son's Vision to Take Over the World

The wild west of the data wars is spawning into an all-out, gun slinging shoot out with a winner takes all mentality.

This slug fest is reminiscent of the unregulated 19th century American oil barons whose clout and complete control of the supply of oil fueled the industrial revolution that drove America's economy to the top of the global food chain.

Yes, data has become the oil of the 21st century. It is the oxygen of the next leg of the Internet revolution.

And there is one man moving early to stake out the premium real estate of our futures: Softbank's Masayoshi Son. His $100 million Softbank Vision Fund is not only creating waves in Silicon Valley, but tidal waves.

Many countries, like Iran, Saudi Arabia, and Russia, still rely on petroleum for the lion's share of government revenues. Even though oil is still integral to the growth of the global economy, there is a new sheriff in town: big data.

Cut it up anyway you want, data is simply information, the "zeros" and "ones" that make up the digital world. The information that commands mouthwatering premiums these days can be unraveled by computers.

Computer deciphered data can show behavioral and consumer trends in stark daylight, helping companies ferret out business strategies are proving immensely powerful.

There is an exponential hockey stick effect going on here. As the quantity of data accumulates, the more valuable it becomes.

The types of data being collected are personal data, transactional data, web data, and sensor data used for IoT (Internet of Things) products.

Who is the major player vacuuming up this data?

Masayoshi Son, the CEO of Softbank (SFTBY), an ethnic Korean who grew up in a small village in Japan. He transferred to the San Francisco Peninsula Serramonte High School as an ambitious youth and graduated in 3 weeks.

Son ventured on to UC Berkeley majoring in economics and computer science. He is one of the most dynamic people in the World and has amassed personal wealth of around $25 billion.

A few of his brilliant pre-emptive strikes were seed investing in Yahoo, creating Yahoo Japan, and $20 million for a stake in Alibaba (BABA) in 1999. These investments increased more than 100-fold in value.

Son is on a mission to own or control assets that are the linchpin to global growth nourished by Artificial Intelligence in selective industries such as transportation, food, work, medicine, and finance.

The anchor that ties all these firms together is the massive hordes of data they harvest, which are central to directing how future automated robots and machines perform.

His goal envisions the construction of responsive robots that will emerge as the cash cow in 2045. The construction, utilization, and high performance of these machines will be the key to his vision.

Instead of splurging for premium human data, investors will be competing for the best performing robots and the data derived from them. Accurate human data will provide the springboard to the machine data these robots will generate.

After the first generation of robots endow us with their first batch of data, all human data will be irrelevant. Human information is the test case that robots are founded on.

Once the first cohort of robot data comes to market, the 2nd generations of robots will be derived off the 1st generation of robots. Humans will become irrelevant.

Once you marry the treasure trove of data with A.I., the results will enter the realm of today's science fiction. Imagine being the first CEO to bring functional robots to mass market and how valuable that first batch of robot data would represent.

In short, Son is positioning himself to organically engineer the highest-grade robots catalyzing the next gap up in global competition.

This year, Son is on a global treasure hunt to meld together the most precise "big data" he requires to build his robot squadron that will take over the world.

The fight these days is acquiring the oxygen to power these non-human contraptions. Without pure oxygen, i.e. massive amounts of data, engineers will create faulty robots that under-perform.

Looking at the amalgam of companies in which Son has invested, it is difficult to find any rhyme or reason. That is until you find the commonalty of big data.

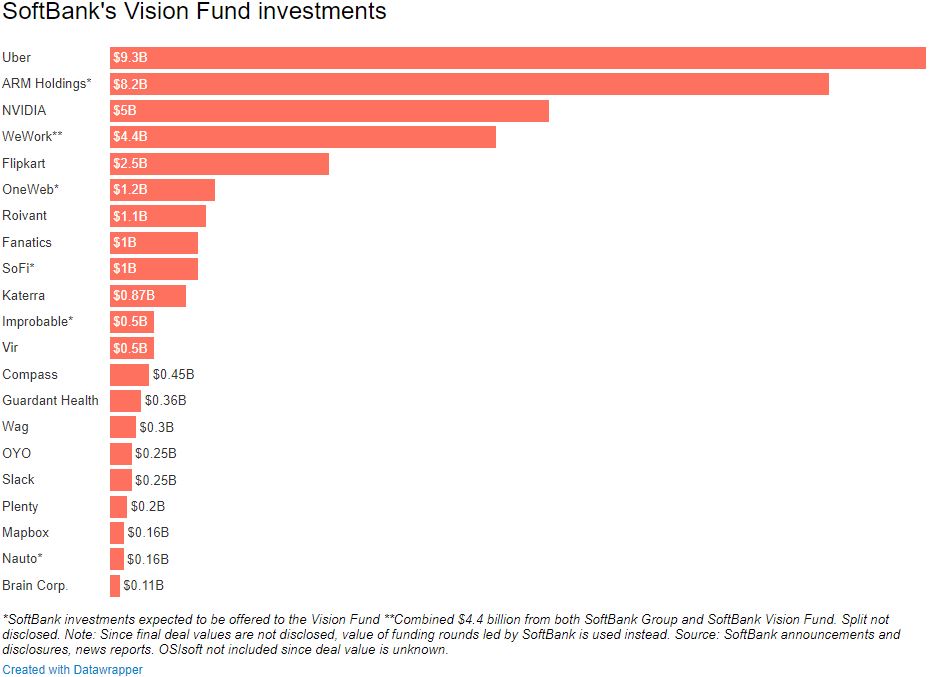

Son invested $200 million in "Plenty" in July 2017, a company developing indoor farms. If indoor farm data is not diverse enough, then how about the $300 million he showered on San Francisco dog-walking app called "Wag".

The biggest holding in the Softbank Vision Fund is Uber. Uber is ubiquitously known as a ride sharing company that shuttles passengers from spot A to spot B.

Sweetening the deal was a substantial discount the Vison Fund received on a private placement of Uber shares. Uber is now worth about $70 billion and may someday become a FANG in its own right.

Supplementing this transaction is the custom online map app Mapbox, founded as a competitor to Google Maps. Some of Mapbox's partners include Snapchat, Lonely Planet, and The Weather Channel.

Vision Fund's second largest position is ARM Holdings, which is an English semiconductor chip company that has carved out a large segment of the Android and laptop market.

They produce simple CPU's (central processing units) and much more advanced GPU's (graphics processing units) that are placed in smartphones, TV's, tablets, and computers.

Son has shelled out $8.2 billion through the Softbank Vision Fund and the remaining 75% stake is owned by parent company Softbank Group. ARM is one of the shining beacons of European tech and Softbank has pegged its future to its success.

Unsurprisingly, Nvidia (NVDA) is the 3rd largest weighting and the $5 billion Softbank investment into Nvidia (NVDA) represents a 4.9% stake in the company. The Nvidia commitment is logical considering ARM licenses their chip designs to Nvidia.

As autonomous vehicles will be one of the first benefactors from the cross pollination between big data and automation, these investments completely justify Son's long-term vision.

Son has also snapped up other ride sharing entities such as Didi Chuxing in China, Ola in India, Grab in Southeast Asia, and "99" in Brazil.

Some 31% of the global population is without Internet connectivity. Thus, Son bought OneWeb, which pioneers low cost, high quality satellites striving to grant Internet access for the people still without access. This maneuver will surely see his net data load increase.

In many of the Mad Hedge Technology Letters, we often offer readers the creme de la creme of public stock symbols, but this time it is different.

First, the major holdings in the Softbank vision fund, aside from Nvidia, are privately held companies that do not trade on any stock market.

However, it is very important to watch what he buys, as it gives insights into the best performing and fastest growing sub-sectors of technology.

Or you could just buy Softbank itself, whose shares have doubled over the past two years.

Son won't just flip these companies for a 30% or 50% profit. Tenfold, or hundred-fold gains are the order of the day.

In reality, Son's ultimate goal is to leach out the future aggregate data spewing out from his underlying portfolio and cross-pollinate it with A.I. and automation to revolutionize the world.

This year is a period of jockeying with other venture capitalists to positions themselves accordingly for the next 30, 40 and 50 years.

Welcome to the future.