May 1 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 1 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

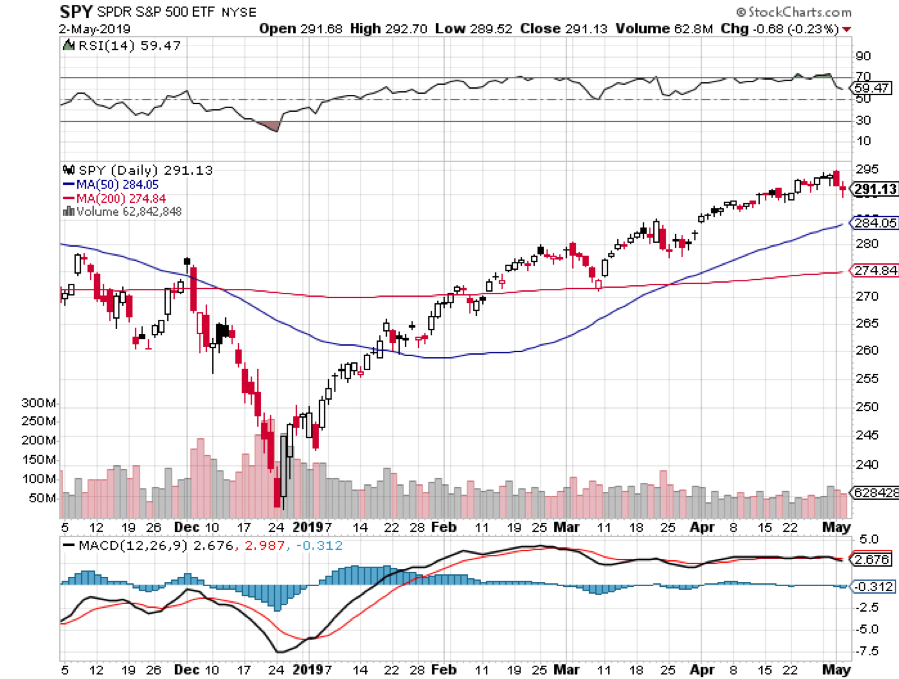

Q: Your old target for the (SPY) was $292.80; we’re clearly above that now. What’s your new target and how long will it take to get there?

A: My new target on the S&P 500 (SPY) is $296.80. You’re looking at $295 on the (SPY), so we’re almost there. However, we’re grinding up too slowly so I can’t give you an exact date.

Q: Will Fed governor Jay Powell give in to pressure from Trump who wants him to drop rates? Does he have any sway over the process?

A: Officially he has no sway, but every day Trump is tweeting: “I want QE back, I want a 1% rate cut.” And if that happened, the economy would completely blow up—an interest rate cut with the market at an all-time high and 3.25% GDP growth rate would be unprecedented, would deliver a short term gain and long term disaster.

Q: What do you think about the Uber (UBER) IPO?

A: I wouldn’t touch it with a 10-foot pole—they’ve been cutting valuations almost every day. At one point they were going to value the company at $120 billion dollars, now they’re at $90 billion and they may even lower it from there. The last car sharing IPO (LYFT) dropped 33% from its high. I would stay away from all of the IPOs once they’re listed. The rule is: only buy these things when they’re down 50%. Warren Buffet never buys IPOs, nor do I.

Q: What do you think about buying or selling Lyft?

A: I would wait a couple of months for Lyft to find its true price. Then you’ll have something to trade against.

Q: Do you think the bad news is over on Tesla (TSLA)? Is it time to buy? Or is it going bankrupt?

A: The whole world knew that the electric car subsidy would be cut in January, so what customers did was accelerate their orders in the 4th quarter, which took us all the way up to $380 in the shares, and then created a vacuum in the Q1 of this year. It reported the first quarter last week—they were disastrous orders, and the company is cutting back overhead as fast as possible as if it’s going into a recession, which it kind of is. The question is whether or not sales will bounce back in Q2 with the smaller subsidy. I happen to think they will. But we may not see 2018 Q4 sales levels again until 2019 Q4.

Q: Why has healthcare (XLV) been so awful this year?

A: There’s an election next year and both parties promise to beat up on the healthcare industry with drug control pricing and other forms of regulation. Of course, the current president promised free competition in drug prices; but then he moved to Washington DC and found the drug industry lobby, and nothing was ever heard again on that front. It’s a very high political risk sector, but there is some great value at these levels in the healthcare industry in the long term. I’m about to start the Mad Hedge Biotech and Health Care newsletter imminently.

Q: Should I buy the (TLT) $120-$123 call spread now?

A: That's a very aggressive trade, I would wait and go with strikes for in the money, and then only on a big dip. Don’t reach for a trade when the market is at an all-time high.

Q: Should I be shorting Tesla down here?

A: Absolutely not, your short trade was at $380, $350, $330 and $300. Down here, you run the risk of a surprise tweet from Elon Musk causing the stock to go $50 against you. Buy the way, he’s already announced that he’s buying $10 million worth of shares in his next capital raise.

Q: What do you think about CRISPR stocks long term, like Editas Medicine (EDIT), Sangamo Life Sciences (SGMO), and Cellectis (CLLS)?

A: These are probably the best bunch of 10 baggers long term. Short term they are afflicted with the same problems impacting all of healthcare—promises of regulation and price control on all of their products ahead of an election. So, hold for the long term; short term I’d only be buying the really big dips. Did I mention that I’m about to start the Mad Hedge Biotech and Health Care newsletter imminently?

Q: Is your May 10th market top forecast still good?

A: Well we’re getting kind of close to May 10th. I made this prediction based on an inverting yield curve two years ago. However, that target did not anticipate interest rates topping out for the 10-year US Treasury bond at 3.25%. Nor did it consider the Fed canceling all interest rate hikes for the year. Without the artificial stimulus, the market would certainly have already rolled over and died. That said, I still have a week to go.

Q: Should I be selling my long term holds in the FANGS, like Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT)?

A: For the long term, no. However, we know from December that these things can get hit with a 40% drawdown at any time. As long as you can handle that, they always bounce back.

Q: What will happen to Venezuela? Any trades?

A: The only related trades would be in the oil market (USO). If we get a coup d’ etat which installs a new pro-American president, which could be at any time, that could lead to a selloff in oil for a couple of days as 1 Million barrels of crude per day come back on the market, but probably no more than that.

Q: With current national debt and budget deficits, when will interest in gold kick in?

A: Very simple: when the stock market goes down, you want to buy gold. It’s the hedge that everyone will chase after, and inflation is just around the corner.

Q: Do you need me to place any Kentucky Derby bets?

A: Me being the cautious guy I am, I pick the horse with the best odds and then I bet him to show. That almost always works.

Q: What about pot stocks?

A: I’ve never liked them very much; after all, how hard is it to grow a weed? The barriers to entry are zero. All of these pot companies coming up now are not really pot stocks as much as they are marketing companies, so you’re buying their distribution capability primarily. That said, I’m having breakfast with the CEO of a major pot company next week, so I’ll be writing about that once I get the inside scoop.

Q: Will the Fed be the non-event?

A: Yes, as stated in the Mad Hedge Hot Tips this morning, it will be a non-event and the news is due out in about an hour.