May 12, 2011 - Give Dr. Copper an A+ for Accuracy

Featured Trades: (COPPER), (CU), (CAT), (FCX)

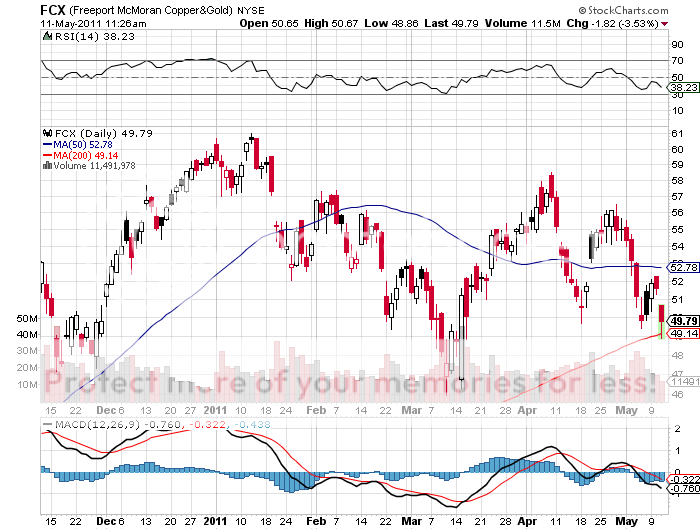

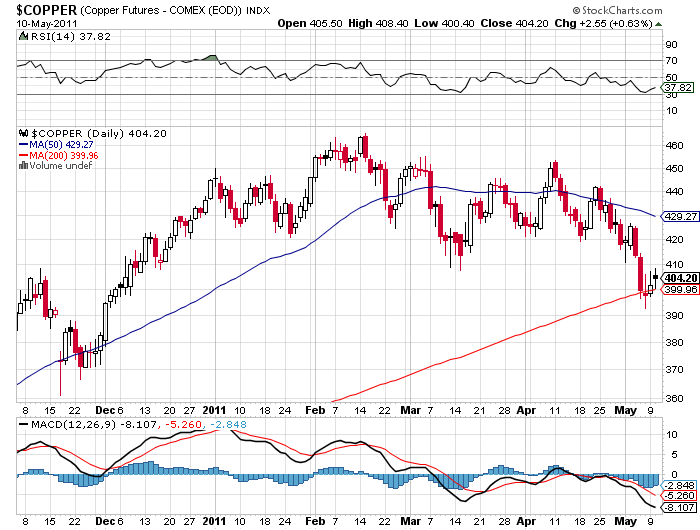

2) Give Dr. Copper an A+ for Accuracy. No one has been singing louder the praises of the predictive power of copper prices (CU) louder than me this year. They call the red metal 'Dr. Copper' because of its uncanny ability to forecast the future direction of the global economy. Look at the charts below and it is clear that the eminent professor has been crying 'watch out below' since February. Ditto for top copper producer, Freeport McMoRan.

So it is with the greatest interest that I picked up some comments this coming from my old friend, FCX CEO, Dan Adkerson. He believes that the recent weakness in copper is not the beginning of a new bear market, but merely short term profit taking driven by speculators. Chinese tightening has been a drag, which accounts for 35%-40% of global demand. It's clear that the sudden sell off in crude has also created some spill over selling in other hard assets.

However, Adkerson argues that the long term case for copper is still compelling. The Chinese drive for a higher standard of living is irresistible, and that requires enormous amounts of copper for roads, construction, and shipbuilding. A burgeoning global hybrid and electric car industry is also increasing demand for copper.

Adkerson's big challenge is how to meet all this demand. The enormous capital requirements and long lead times essential for the opening of new mines means that his company must think not in terms of weeks, months or even years, but in decades. He has no problem making those commitments. FCX already produces 4 million pounds of copper per year. With a current production cost of $1 per pound, it can easily handle the recent decline from $4.70 to $3.92.

There is no doubt that copper has been leading the charge to the downside in this global 'RISK OFF', environment. But when it runs its course, copper and FCX are going to be some of the first positions that I step back into.

-

-

Which Way Now, Chief?