May 23, 2011 - The S&P 500 in 2020

Featured Trades: (THE S&P 500 IN 2020)

2) The S&P 500 in 2020. Dr. Robert Shiller certainly knows which end of a PE multiple to hold up. He is one of the few economists out there who has produced the sort of long term historical and mathematical analysis of financial valuations that is rare on Wall Street.

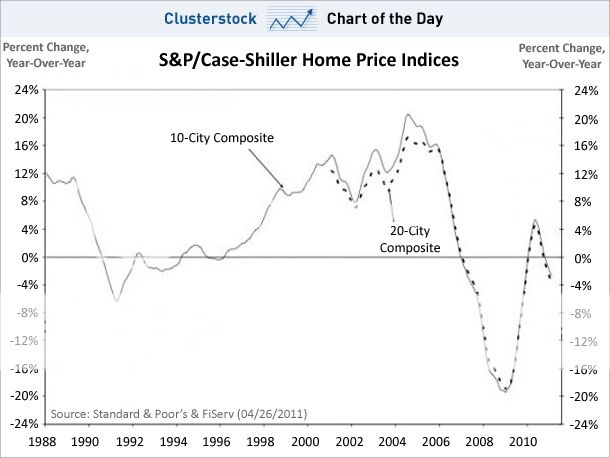

Among his many claims to fame was his forecast of the coming residential real estate collapse in the mid 2,000's, banging every pot and pan as loudly as he could to warn us all. His Case-Shiller index is the benchmark for tracking prices in regional real estate markets.

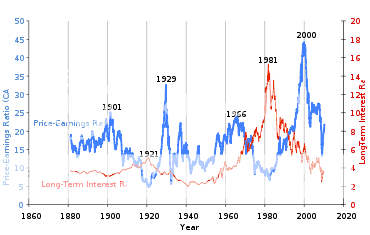

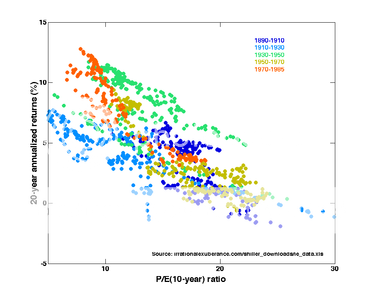

So I have to pay attention when the eminent Yale professor predicts that the S&P 500 will go no higher that 1430 by 2020, a mere 90 points higher than it is today. His data shows that from 1871 to 2008, the multiple has averaged 14, ranging from a high of 45 in 2000 to a low of 5 in 1921. By his calculation, the current multiple normalized over the past ten years is 23, making the market outrageously expensive.

That implies that we are only 17 months into a second lost decade for the stock market. With the country still digesting the housing bust, American standards of living falling, its currency chronically weak, relative global competitiveness shrinking, deficits ballooning, wealth excessively concentrating at the top, and the stimulus pump running dry, what else did you expect?

-

-

-

Rent, Don't Buy