May 30, 2023

(MAY 24, 2023 WEBINAR SUMMARY – BIG TECH MELT UP)

May 30, 2023

Hello everyone.

Lunches:

July 6, 2023, New York

July 13, 2023, Seminar at Sea (Aboard the Queen Mary)

July 19, 2023, London (walking distance from Piccadilly in a private military club)

Performance:

May – 2.70% MTD

64.24% so far this year

113.84% trailing one-year return.

Positions:

Short Strangle

Risk on (TSLA) 6/120-130 call spread (idea here is belief it won’t go below 130)

Risk off (TSLA) 6/210-220 put spread (idea here is belief it won’t go above 210)

Now 80% cash. 41-44 positions have made money.

Method to My Madness

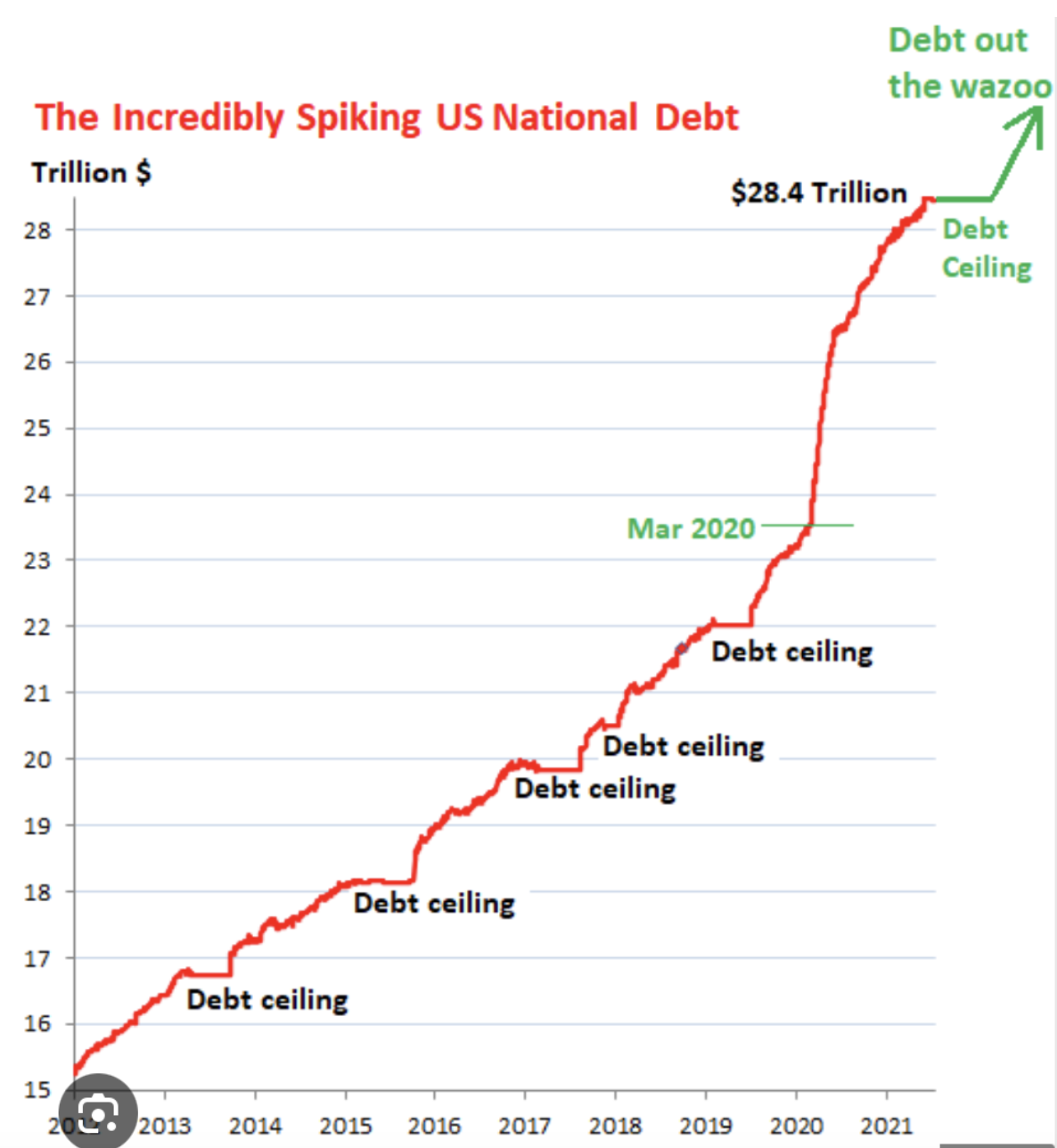

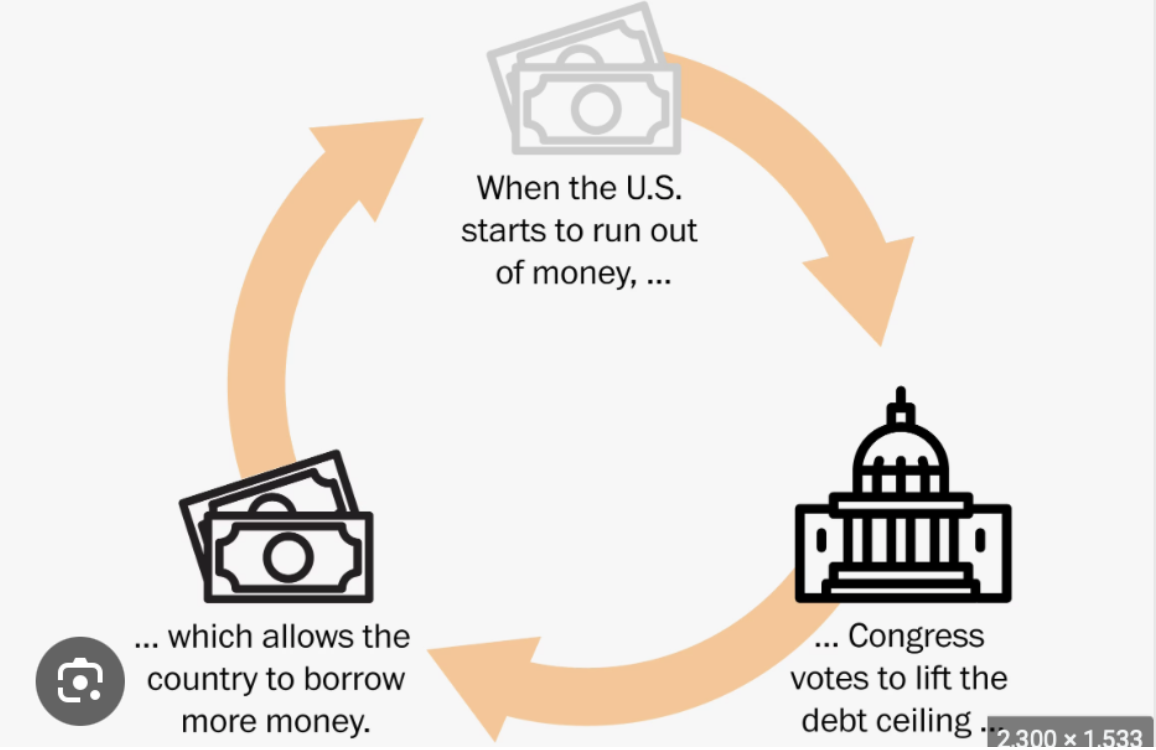

The debt ceiling drama has frozen all markets. Lower volatility has managed to recover to $21.

Bond yields have jumped to 3.75%.

Markets are flashing red = reduce risk-taking.

Trading volumes are down.

Summer will be the time to buy.

Put precious metals and commodities at the top of the list.

If there is a default, there may be a 50% stock market correction.

The follow-up would be that it would get defaulted in days.

AI will take the DOW average from 36,000 to 240,000 over the next 10 years.

AI will automatically triple the value of any company now using it even though it may take years for the stock market to catch up. Of course, regular earnings growth will be a boost here also.

NVDA goes up seven times from here to well over $1000.

Mad Hedge recommended NVDA on a split adjusted basis around $20.

Global Economy – Rolling over.

CPI hits 4.9% YOY after the 0.40% report for April.

Leading economic indicators gave up 0.6% in April, to 107.5 (2016 is the baseline at 100) as rolling over economic data heightens recession risks.

Philadelphia Fed Manufacturing Index collapses, down from 20 to 10.5, approaching a three-year low.

Retail sales drop 0.4% in April.

Market Timing Index at high-risk territory.

Risk at 7 months high.

DO NOT BUY here.

Weekly Jobless claims are falling.

Stocks

There is a 1,000-point drop in the market waiting to happen. And that happens when the market rallies on a Biden McCarthy debt ceiling deal, which McCarthy’s own party then votes down.

Equity allocations are at 15-year lows, with massive amounts of cash in 90 days T-bills. Look for money to pour into stocks in the second half.

Insiders are loading the boat with regional bank shares.

First Solar rockets 26% on an easing of U.S. Treasury rules on what defines “Made in America.”

FANGS to rise 50% by year-end, says Fund Strat’s ultra-bull Tom Lee.

All charts on tech shares are looking the same.

In the following list of stocks two-year LEAPS are a possible play at these prices.

UPS United Parcel Service

CAT Caterpillar

FCX Freeport McMoran

DIS Disney

X United States Steel Corporation

UNP Union Pacific

AMGN Amgen

GS Goldman Sachs

MS Morgan Stanley

BAC Bank of America

SCHW Schwab

BLK Blackrock

BRKB Berkshire Hathaway -buy on any dips – it’s a long-term play.

Bonds

Waiting for a capitulation sell-off in the TLT which will be triggered by inaction in Washington.

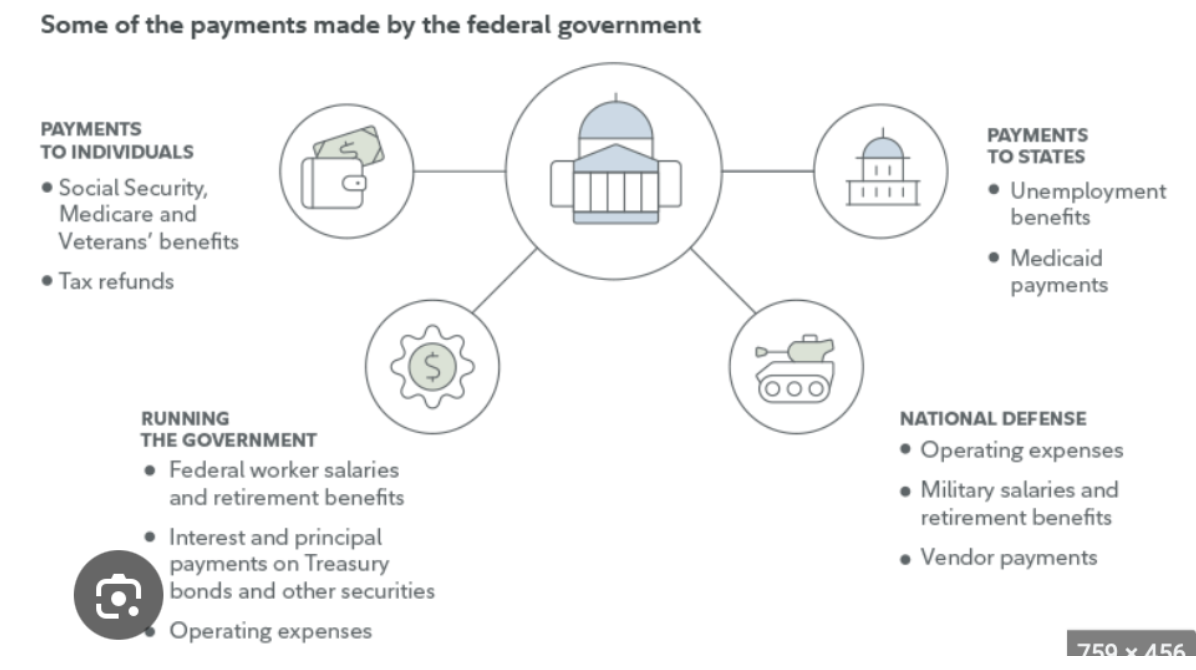

When a deal is done, it will unleash a new onslaught of bond selling by Treasury – now limited by the old debt ceiling and lower lows on bonds.

Rising interest payments by Treasury = less money to pay other bills and earlier debt ceiling deadline.

If TLT hits $95 we will be issuing recommendations for call spreads and LEAPS.

Treasury to issue $700 billion in T-bills within weeks of a debt ceiling deal, pushing short-term yield ups. The question is with a TLT at a $100 handle, a 2023 low, how much is already in the price?

Keep buying 90-day T-bills, now pushing a 5.2% risk-free yield.

Junk Bond ETFs are great high-yield plays (JNK) and (HYG).

Buy SDS for protection against long-term positions.

Foreign Currencies

Expect the dollar to fade soon. Dollar sell-off will accelerate on any debt default. Any strength in the dollar will be temporary. New lows by end of 2023.

Buy FXE, FXY, FXB, and FXA on dips.

Energy and Commodities

The Oil Collapse is signaling a recession as is weakness in the other commodities, even lithium.

It has been the worse-performing asset class of 2023.

Buy (USO) on dips on an economic recovery play.

Look for UNG to triple in the next year.

FCX – a golden cross is setting up.

Precious Metals are resting for the moment.

Gold is headed for $3000 by 2024.

Drivers – soon to be falling interest rates and demise of crypto.

Silver is the better play with a higher beta.

Buy GOLD, GDX, SLV, SIL.

Real Estate

This sector is showing signs of life. A tidal wave of millennial buyers is under the market.

Some borrowers are moving to 40-year mortgages to lower monthly payments. New home sales hit 13 months high up 4.1% in April.

Median home prices are down 8.2% YOY.

CCI Crown Castle International 5.4% yield. It’s also a LEAPS candidate at this price.

Wishing you all a great week.

Cheers,

Jacquie