May 5, 2009

May 5, 2009

Featured Trades: (BIDU), (GOOG), (NTES), (SINA), (SOHU), (EEM), (TBT)

1) Has anyone noticed how boring things have gotten, or is it just me? After enduring 1,000 point daily ranges in the Dow, a volatility index at 88%, and blue chips stocks going to zero, maybe my nerve endings are scarred. Has it suddenly become safe to take my entire net worth out of the coffee can I have buried in the back yard, under the garden gnome? Maybe my inner adrenaline junkie will be appeased Friday morning when the April nonfarm payroll is released. My guess is that we will get a depressing figure showing that another 600,000 plus souls have joined the ranks of the downtrodden. Certainly the markets are bracing themselves for something horrific. If I'm wrong, a less awful number will rally the markets and define a new higher limit to our trading range.

2) If you need further proof of where the future growth in the global economy is coming from, take a look at the Chinese Internet firm Bidu (BIDU), the Google of China, which I strongly recommended on March 6 (check my online archives). It has since jumped 85% to $250, and has been one of my better calls of the year. In the meantime, our Google (GOOG) rose by only 35% to $400, almost in line with the S&P 500. These two hedge fund darlings are best of breed companies, but the Chinese one outperformed the American counterpart by a factor of 2.5:1. This is the consequence of the US economy making a permanent shift from a 5% growth rate to 1.5%-2%, and is a pattern you can expect to see repeated around the world for the next decade. The cruel truth here is that American companies with the drag of a mature economy will never command the same multiples of Chinese ones. Expect huge growth of the four horsemen of the Chinese Internet sector, which?? includes Netease (NTES), Sina (SINA), and Sohu (SOHU), have done as well as BIDU, and who are going to eat our lunch.

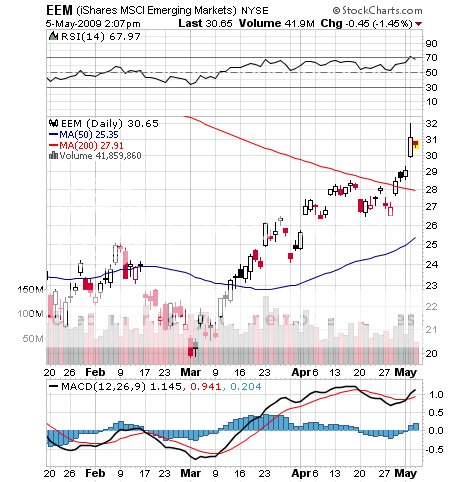

3) We are gathering a head of steam towards our next financial crisis, even before the current ones are solved. The perpetrator will be new financial product du jour, the super leveraged Exchange Traded Funds (ETF's), which are being created at a breakneck rate, sucking in billions of dollars from investors. ProShares has filed for 94 funds, which offer traders 300% long or short plays in markets as diverse as the Russell 1000 Index, the MSCI Malaysia Index, and the Nikkei 225 stock average. Direxion has gathered $3.4 billion with 16 different 3X funds launched since November. There are now more than 800 ETF's, and I have been a big fan of?? those for emerging markets (EEM) and short Treasuries (TBT), which allow investors to take positions in niche sectors and foreign markets which are otherwise difficult or expensive to get into. These also allow mutual funds the only means to go short, and include tax advantages and hedging opportunities. But the leveraged versions include risks that most buyers don't fully understand, even if they parse through the voluminous prospecti with a magnifying class. They promise their triple tracking only for the day you buy it. Beyond that, the tracking error can be huge. The mechanics of these funds force them to be buyers of every rally and sellers of every dip. Over time, leveraged short funds can actually suffer large losses, even in falling markets, and vice versa. It is just a matter of time before one of these goes to zero, wiping out investors. They are already being blamed for an increase in market volatility in the last hour of trading. Gaming sector ETF's has become the new blood sport for nimble hedge funds. You can expect a replay of a movie you've seen before. At the first sign of trouble, liquidity will disappear, auditors will mark them down to nothing, and suddenly the whole world will be for sale. Sound familiar? You have been warned!

4) In case you missed it, the second hand animal market has crashed. Forced to slash budgets by cash starved municipalities, the nation's public zoos have been paring back their collections of living exhibits. The Washington Zoo is trying to offload a 7,000 pound hippopotamus, while the San Francisco Zoo is short some tigers after one ate a visitor last year. The Portland Zoo was able liquidate a portfolio of lemurs only because of the popularity of the recent DreamWorks' 'Madagascar 2' animated film.?? When zoos are forced to economize, they downsize the big eaters first to save on feed costs, hence the absence of elephants in San Francisco (could this be a political gesture?). The hardest to move? Baltimore has been trying to sell its snake collection for two years now. Talk about an illiquid market. Maybe they should try AIG. Snake derivatives anyone?

QUOTE OF THE DAY

'Pass this package by tomorrow, or we won't have an economy on Monday,' said Fed chairman Ben Bernanke at the Treasury's emergency meeting in October.