May 9, 2011 - Taking Another Shot at the Garlic Eaters

Featured Trades: (TAKING ANOTHER SHORT AT THE GARLIC EATERS)

3) Taking Another Shot at the Garlic Eaters. If you have to name one beneficiary of QE2, the collapse of the dollar, and a seemingly never ending 'RISK ON' trade, it has got to be the euro.

All of this strength has come from an interest rate differential of a measly 25 basis points over the dollar, the result of a modest snugging the European Central Bank executed a month ago.

Never mind that outside of Germany much of Europe is bankrupt, their banks are engaging in accounting acrobatics to obscure their negative net worth, and there is a giant crisis brewing in the widespread crossholding of sovereign debt. Did I mention that the EC may split into rich and poor halves?

So I am going to start taking shots at the euro from the short side once again. The markets are much more extended than they were before, so this time it should work.

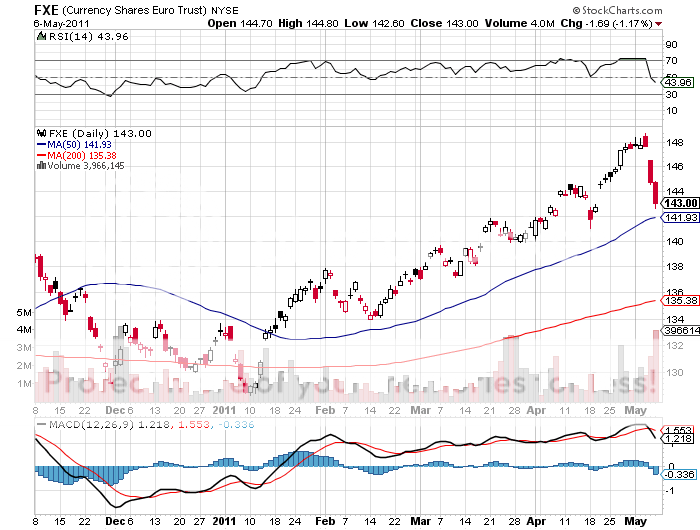

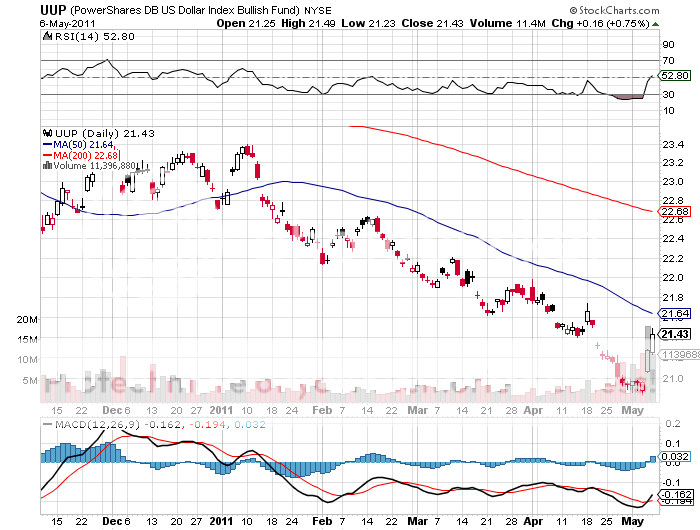

If you can't do options, you might consider going short the (FXE). If you can't, or don't want to go short, you might consider the (EUO), a 2X short euro ETF. A lower risk option would be to buy the (UUP), a non-leveraged long of the dollar against a basket of foreign currencies. Look at the chart below and you will want to salivate. The initial target should be the old break out level of $1.425.

UPDATE: Since I wrote this piece just two days ago, a lot has happened. The ECB did not raise interest rates as expected, Greece threatened to withdraw from the euro, and the 'RISK OFF' trade found the euro with a vengeance. The European currency collapsed from $1.49 to $1.42 in a heartbeat. We are now overdue for a snap back rally.

I would sell into this. I think that the low for the year is in for the dollar. The change in market sentiment is that the Europeans have quit raising rates and will hold them level, while the US will continue doing the same. This has broken the euro's upward momentum and is hugely dollar bullish.

-

-