May 6, 2010 - Yesterday, the lemmings discovered the Law of Gravity

Featured Trades: (SPX), (BP)

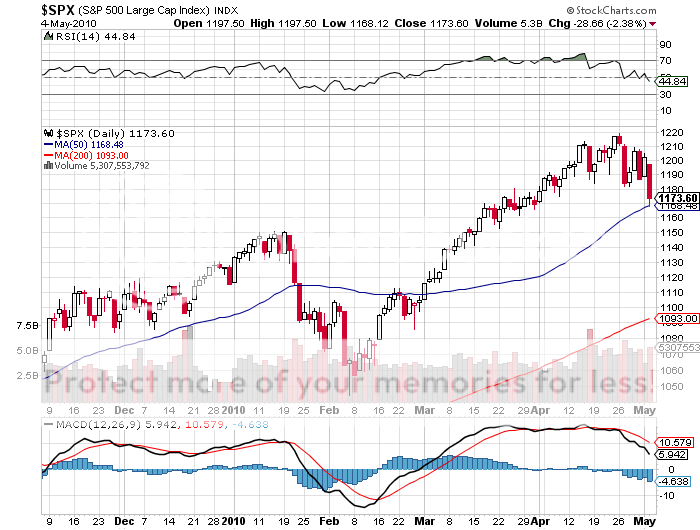

1) Yesterday, the lemmings discovered the Law of Gravity,and the plaintive squeals of the dying mammals could be heard throughout the financial markets. European finance ministers must be depressed that their $140 billion bailout of Greece only bought them 24hours of grace in the eyes of investors. The European finance ministers might as well drown themselves in the seas of red on my screen. Only the Vix and British Petroleum (BP) are green. How perverse. Oil down$3.50! Boiiing! Silver off a buck! Kaboom! The ten year Treasury at 5.59%! Pow!It also looks like the oil spill in the Gulf of Mexico could make a sizeable dent in US Q2 GDP. You all know that I have been negative on equities for a while now (click here for my piece on buying cheap downside protection). The global nature of the sell off across all asset classes also came as no surprise (click here for that prediction). The flight to quality has given another shot of adrenaline to the dollar against my core shorts, the yen and the euro,both of which broke down to new lows for the year today. Most fascinating is that my April surprise came through too (click here for the report). The withdrawal of the Fed at the beginning of the quarter as the sole purchaser of real estate debt in the market, led not to a crash in bond prices, but a huge six point rally, sending yields into the dump. With the coming collapse of the Treasury market the new mantra among traders, it turns out everyone was short! Once again, Shanghai's status as a canary in the coal mine for all global markets is reaffirmed (click here for the explanation). Where am I going to buy the dip first? Shanghai.The hedge fund managers who saw all of these complex pieces fitting together and positioned for it made multiple killings. Those who didn't, have joined their furry cousins at the bottom of the cliff.

A Dead Lemming, RIP