Mr. Mario?s Big Bluff

A couple of alleged Tweets, a few rumored phone calls, and what have we got? $2 trillion in new global stock market capitalization in hours. That was the bottom line after the purported communication between the staffs of Germany?s Angela Merkel, France?s Jean Francois Hollande, and ECB president Mario Draghi. But is the creation of this immense new wealth, which would alone rank as 10th in terms of GDP after France, justified?

If the intention was to punish hedge funds, the goal was certainly accomplished. The plaintive bleatings in email and text messages I received from hedge fund friends back home has been overwhelming. It was clear from the price action, straight line moves with no pullbacks, that the pain trade was definitely on. Pre-Thursday, the consensus wisdom was that market would crash into the August doldrums in the face of global economic data that was deteriorating by the day. Such is the price of betting against central banks that I highlighted in my recent trope ?Why Ben Bernanke Hates Me? (click here at http://madhedgefundradio.com).

Leading research houses seemed to be in an arms race with government institutions to see who could cut growth forecasts the fastest. They were all egged on by US Q2 corporate earnings reports, that were highly fudged and indifferent at best, with the most honest wisdom provided by the shocker from Apple (AAPL).

However, in the financial markets that are more often driven by emotion than information, politics trump fundamentals every day. With the street heavily positioned on the short side, the conditions for a snap back rally were ripe. This is why I had no positions at all for 10 days, and no equity holdings for over a month. Rather than chase the market on the downside, I waited for it to come to me, which is usually the best thing to do.

I have always believed that Europe has the ability and the resources to solve its problems at any time. To read my advice to the German government in detail, please refer to my report from Frankfurt, which I will write in the next couple of days, when I get some time.

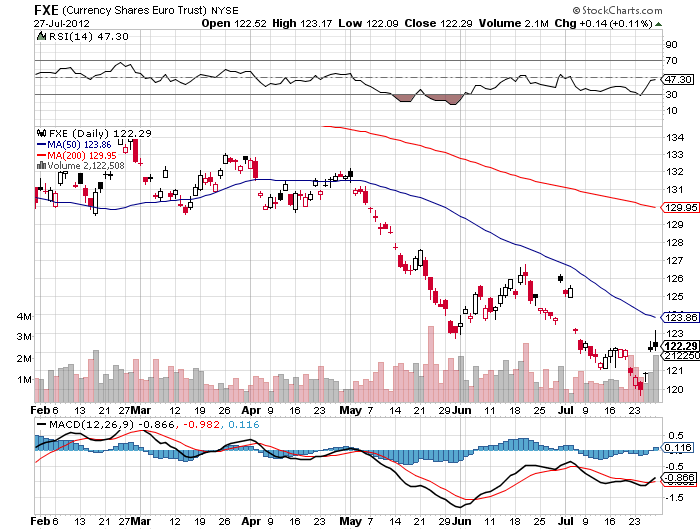

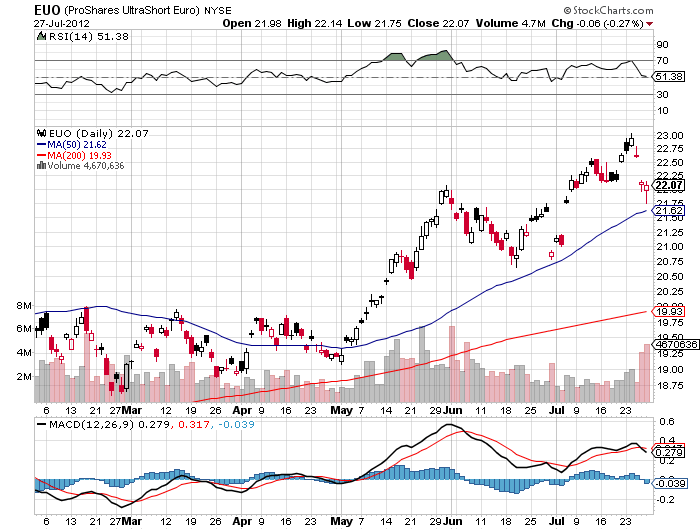

All that is required is for Europe to make some unpleasant admissions of truths, and adopt some policies and institutions that have already been proven to work in the US. These are hard things to do politically, but that can be done. Make the politicians earn their pay for a change, I say. This is what makes the short game in Europe so risky, and why I have recently been so wimpy on my short Euro (FXE), (EUO) recommendations (in the reports, but without trade alerts).

Words are cheap, and their true value will become apparent when it comes time for Mario Draghi to deliver. If he does so quickly, we could see a ?RISK ON?, rally that could last until the end of the year and possibly take the S&P 500 up to 1,500. If he doesn?t, the August crash scenario down to 1,200 is back on the table, but no more. That table loses another leg if Ben Bernanke fails to deliver QE3 on Wednesday.

If all of this leaves you confused and befuddled, then welcome to the club. There are times when markets are just not forecastable, when the number of large variables and unknowns are too great to even make an intelligent guess at outcomes, and this is one of them. That?s why I am still 70% in cash, limiting my ?RISK ON? exposure to small, profitable positions in short Treasury and short yen call spreads. That?s down from 100% I had just last Wednesday.

I think I?ll go climb that Alp over there.

The Pain Trade is on for Hedge Funds