My Updated Personal Leading Economic Indicator

There is no limit to my desire to get an early and accurate read on the US economy, which at the end of the day is what dictates the future of all of our trades and investments.

I flew over one of my favorite leading economic indicators only last weekend at the controls of a vintage Cessna 172.

Honda (HMC) and Nissan (NSANY) import millions of cars each year through their Benicia, California facilities, where they are loaded onto thousands of rail cars for shipment to points inland as far as Chicago.

In 2009, when the US car market shrank to an annualized 8.5 million units, I flew over the site and it was choked with thousands of cars parked bumper to bumper, rusting in the blazing sun, bereft of buyers.

Then, “cash for clunkers” hit (remember that?).

The lots were emptied in a matter of weeks, with mile-long trains lumbering inland, only stopping to add extra engines to get over the High Sierras at Donner Pass.

The stock market took off like a rocket, with the auto companies leading.

I flew over the site last weekend, and guess what?

The lots are empty.

U.S. new vehicle sales, including retail and non-retail transactions, are estimated to reach 1,354,600 units in August, a 15.4% jump from a year earlier, according to the joint report by J.D. Power and GlobalData. Consumers are estimated to spend $47.8 billion on new vehicles, the highest on record for the month of August, and 10.5% higher than last year, the report said.

Japanese cars are suddenly selling so fast that vehicles are being sold even before they land on the dock.

It is all further evidence that my increasingly optimistic view on the US economy is correct, that multiple crises this year are fully discounted, and that the stock market is poised for new highs.

The conventional auto industry should lead to the upside, as it has already done, led by General Motors (GM) and Ford (F). But the move may not happen until the second half of 2024 when the market’s love affair with big tech stocks reaches the point of temporary exhaustion.

As for Tesla (TSLA), better to buy the car than the stock at these depressed prices. Once the EV price wars end, the stock should double again to new all-time highs.

This is a big deal because the auto industry directly and indirectly accounts for about 10% of the total US economy.

It is also the largest manufacturing employer, with the legacy Big Three accounting for 6 million jobs, 4.87% of the 124 million US total.

Not only do you have to include the big four automakers, but you also must include the vast number of parts suppliers, advertisers, and the national dealer networks.

Since so many car purchases are financed with loans, it turns out that the industry is a great play on falling interest rates.

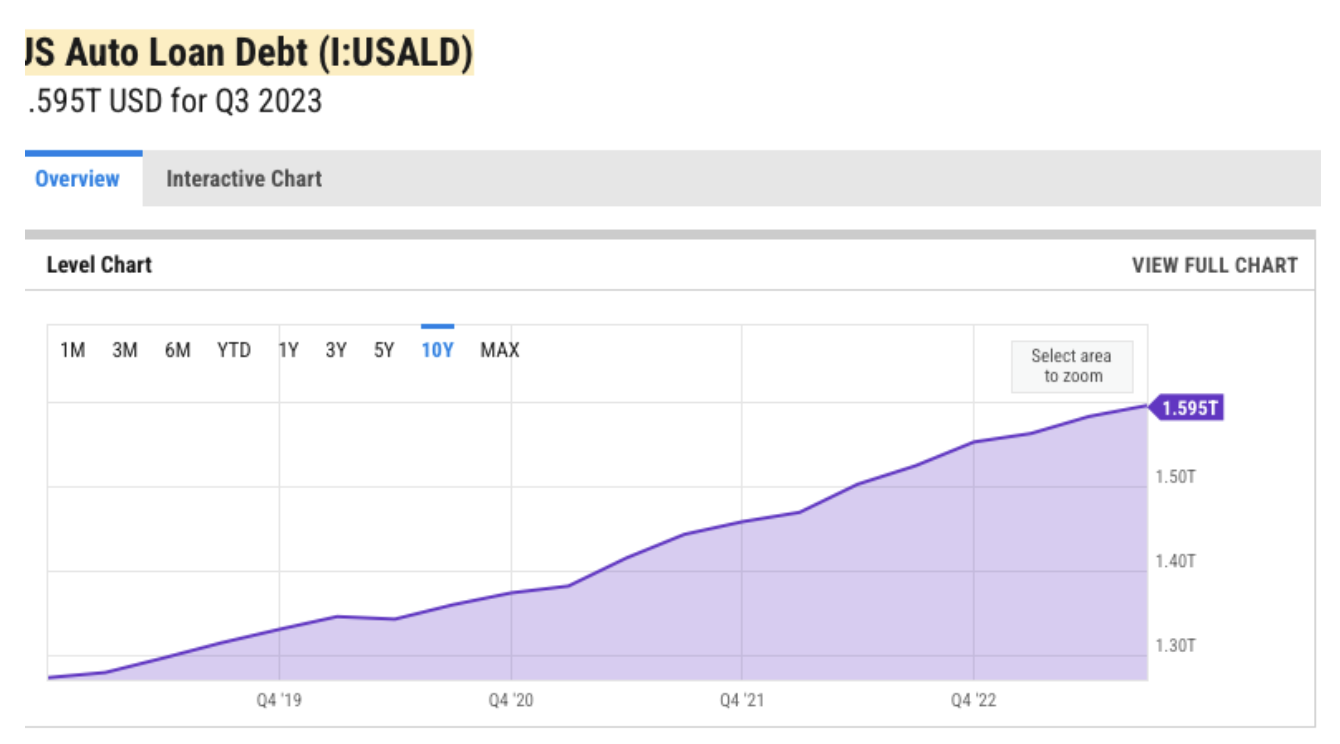

There are $1.6 trillion in subprime auto loans on lenders’ books now.

If you don’t believe me, check out the resale market price of your wheels at Kelly Blue Book (click here for the site)

You will see they have recently risen steadily in value.

It is all further evidence of the hard data/soft data conundrum, which I have written about extensively in the past.

Look no further than Consumer Sentiment, which has held up remarkably well for the past three consecutive months.

Sorry the photo below is a little crooked, but it's tough holding a camera in one hand and a plane's stick with the other, while flying through the never-ending turbulence of the San Francisco Bay’s Carquinez Straight.

Air traffic control at nearby Travis Air Force Base usually has a heart attack when I conduct my research in this way, with a few joyriding C-130s having more than one near miss in recent years.