Netflix's Worst Nightmare

Netflix came out with earnings yesterday and revealed guidance that many industry analysts were dreading.

It appears that Netflix’s relative subscriber growth rate has reached the high-water mark for now.

Competition is rapidly encroaching Netflix’s moat.

In a letter to shareholders, management opined revealing that they do not “anticipate these new entrants will materially affect our growth.”

I am quite bothered by this statement because one would have to be blind, deaf, and dumb to believe that Disney (DIS) or Apple’s (AAPL) new products will not take away meaningful eyeballs from Netflix.

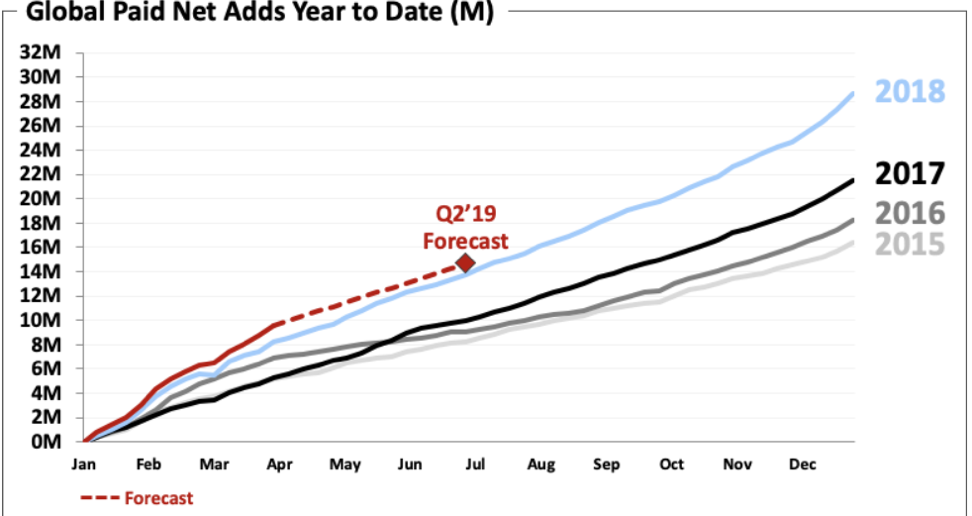

These companies are all competing in the same sphere – digital entertainment.

Papering over the cracks with wishy washy rhetoric was not something I was doing backflips over.

Netflix’s management knew this earnings report had nothing to do with results because everyone wanted to reassess how bad the new entrants would make life for Netflix.

Disney has the content to inflict major damage to Netflix’s business model.

The mere existence of Disney as a rival weakens Netflix’s narrative substantially in two ways.

First, Disney’s entrance into the online streaming game means Netflix will not have a chance to raise subscription prices for the short to medium term.

The last price hike was done in the nick of time and even though management mentioned it followed through “as expected,” losing this financial lever gives Netflix less ammunition going forward and caps EPS growth potential.

Second, another dispiriting factor is the premium for retaining and acquiring original content will skyrocket with more firms jockeying for the same finite amount of actors, producers, directors, and writers.

This particular premium cannot be quantified but firms might try to bid up the cost of certain talent just so the other guy has to foot a bigger bill, this is done in professional sports all the time.

Firms might even take actors off the table with exclusive contracts just to frustrate the supply of content generators.

Uncertainty perpetuates with the future cost of content unable to be baked into the casserole yet, and represents severe downside risk to a stock which trots out an expensive PE ratio of 133.

Growth, growth, and more growth – that is what Netflix has groomed investors to obsess on with the caveat of major strings attached.

This model is highly effective in a vacuum when there are no other players that can erode market share.

Delivering on growth justifies heavy cash burn, and to Netflix’s credit, they have fully delivered in spades.

The strings attached come in the form of steep losses in order to create top of the line content.

Planning to revise down annual cash flow from $3 billion to $3.5 billion in 2019 will serve as a litmus test to whether investors are ready to shoulder the extra losses in the near term.

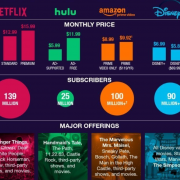

I found it compelling that Disney Plus will debut at $6.99 per month – add that to the price of Netflix’s standard package of $12.99 and you get a shade under $20.

Disney hopes to dictate spending habits by psychologically grouping Disney and Netflix for both at under $20.

The result of breaching the $20 threshold might push customers into ditching Netflix and sticking with the $6.99 Disney subscription.

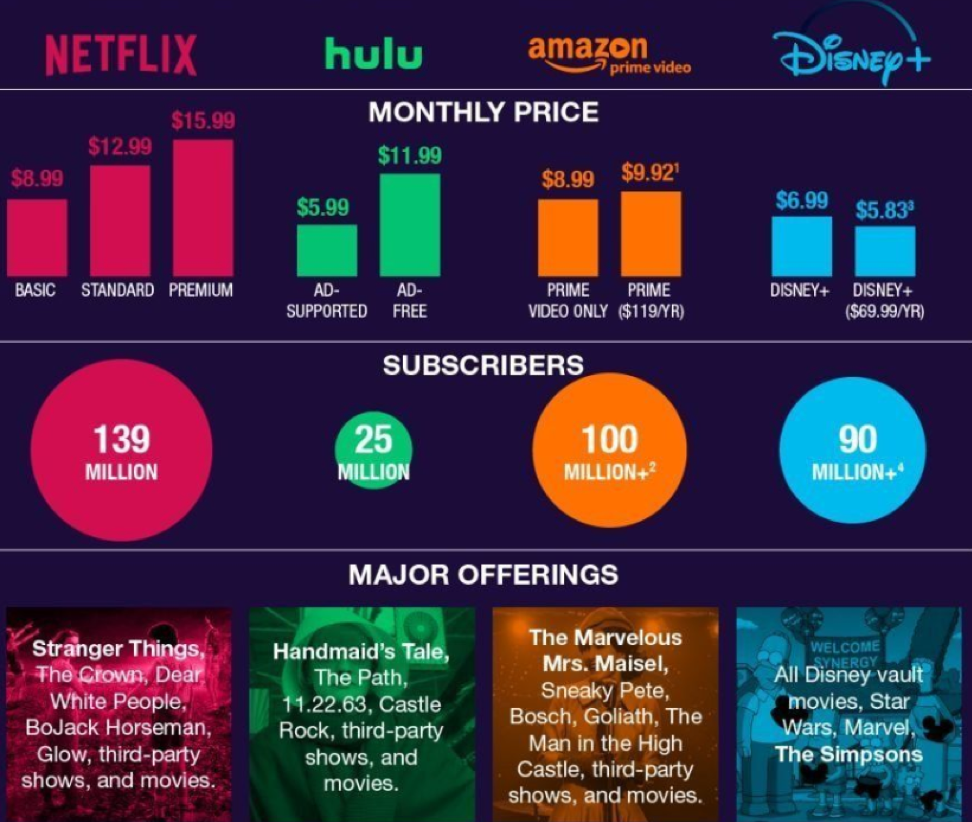

Then there is the thorny issue of Netflix’s growth – the quality and trajectory of it.

The firm issued poor guidance for next quarter projecting total paid net adds of 5.0m, representing -8% YOY with only 300,000 adds in the US and 4.7m for the international segment.

Alarm bells should be sounding in the halls when the most lucrative segment is estimated to decelerate by 8% YOY.

Domestic subscriptions deliver higher margins bumping up the average revenue per user (ARPU).

Contrast this with Netflix’s basic Indian package costing $7.27 or 500 rupees and a mobile package of $3.63 or 250 rupees.

In my opinion, domestically decelerating in the high single digits does not justify the additional annual cash burn of half a billion dollars even if you accumulate millions of more Indian adds at lower price points.

This leads me to surmise that the quality of growth is beginning to slip, and Netflix appears to be running into the same type of quagmire Facebook (FB) is facing.

These models are grappling with stagnating or slowing North American growth and an emerging market solution isn’t the panacea.

The Netflix Indian packages are actually considered expensive by local standards meaning that Netflix’s won’t be able to crowbar in price hikes like they did in America.

On the positive side, Netflix did beat Q1 estimates with paid net adds up 9.6 million with 1.74m in the US and 7.86m internationally, up 16% YOY.

Netflix was able to reach revenue of $4.5B, a company record mostly due to the $2 price hike during the quarter in America.

The letter to shareholders simplifies Netflix’s tactics to investors explaining, “For 20 years, we’ve had the same strategy: when we please our members, they watch more and we grow more.”

What this letter doesn’t tell you is that Disney and the looming battle with Netflix will reshape the online streaming landscape.

In simple economics, an increase of supply caps demand, and don’t get sidetracked by the smoke and mirrors, Disney and Netflix are absolutely fighting for the same eyeballs no matter how much Netflix plays this down.

To highlight an example of how these two are directly competing against each other – let’s take the cast of Monica, Chandler, Rachel, Ross, Joey, and Phoebe – in the hit series Friends.

Netflix acquired the broadcasting rights from Warner Bros, who owns Disney, and it was the most popular show on Netflix.

Warner Bros, knowing that Disney were on the verge of rolling out an online streaming product, renewed Netflix for 2019 at $80 million.

Not only were they hand feeding the enemy in broad daylight, but they handicapped their new products as it is about to debut.

Whoever made that decision must go into the hall of shame of boneheaded online content decisions.

Once 2020 rolls around, Disney will finally be able to slap Friends on Disney Plus where it belongs, and the streaming wars will heat up to a fever pitch.

Ultimately, when Netflix brushes off reality proclaiming that if they please viewers with the same strategy, then everything will be hunky-dory, then I would say they are being disingenuous.

The online streaming industry has started to become more complex by the minute and the “same strategy” that worked wonders in a vacuum before must evolve with the times.

At $360, I would short Netflix in the short to medium term until they prove the headwinds are a blip.

If it goes up to $400, it’s a screaming short because accelerating cash burn, poor guidance, decelerating domestic net adds, and a jolt of new competition aren’t the catalysts that will take shares above the heavenly lands of $400, let alone $450.

Netflix is still a fantastic company though – I’m an avid viewer.