It’s time to stockpile food, load up on ammo, and get ready to isolate yourself from the coming Corona Armageddon. If you rely on prescriptions to keep breathing, better lay in a three-month supply. Six months might be better.

At least, that’s what the stock market thinks. That was some week!

Thank goodness it wasn’t as bad as the 1987 crash, when we cratered 20% in a single day, thanks to an obscure risk control strategy called “portfolio insurance” that maximized selling at market bottoms.

In fact, we may have already hit bottom on Friday at Dow 24,681 and S&P 500 (SPX) 2,865.

There are a whole bunch of interesting numbers that converge at the 24,000 Dow Average handle. That is the level where we started the second week of 2019, so we have virtually given up that entire year. If you missed 2019, you get a second chance at the brass ring.

As for the (SPX), as the week’s lows have pulled back exactly to the peaks of twin failed rallies of 2018, right where you would expect major technical support on the long term charts.

And here is something else that is really interesting. If you use the (SPX) price earnings multiple of 16X that prevailed when Trump became president and then add in the 38.62% earnings growth that has occurred since then, you come up with a Dow average of 24,000.

Yes, the market has plunged from a 20X multiple to 16X in a week.

Want more?

If you drop every stock in the market to its 200-day moving average, you get close to a Dow Average of 24,000. I’m talking Apple (AAPL) down to $240, Microsoft (MSFT) cratering to $145. Amazon (AMZN) hit the 200-day on Friday at $1,849.

This means we are well overdue for a countertrend short-covering rally of one-third to two-thirds of the recent loss, or 1,500 to 3,000. That could take the (VIX) back to $20 in a heartbeat. I’ll take any bounce I can get, even the dead cat variety.

What the market has done in a week is backed out the entire multiple expansion that has occurred over the last three years caused by artificially low interest rates and the presidential browbeating of the Federal Reserve.

The fluff is gone.

I have been warning for months that torrid stock market growth against falling corporate earnings growth could only end in tears. And so it did.

Whether the bottom is at 24,000, 23,000, or 22,000, you are now being offered a chance to get off your rear end and pick up at bargain prices the cream of the crop of corporate America, many of which have seen shares drop 20-30% in six trading days.

Stock prices here are discounting a recession that probably won’t happen. That’s what it always does at market bottoms. It’s not a bad time to dollar cost average. Put in a third of your excess cash now, a third in a week, and the last bit in two weeks.

You also want to be selling short the Volatility Index (VIX) big time. With a rare (VIX) level of $50, you can consider this a “free money” trade. Over the last decade, (VIX) has spent only a couple of days close to this level.

Even during the darkest days of the 2008 crash, (VIX) spent only quarter trading between $20 and $50, and one day at $90. That makes one-year short positions incredibly attractive. Get the (VXX) back to last week’s levels and you are looking at 100% to 200% gains on put options very quickly. That’s why I went to a rare double position on Friday.

And then there is the Coronavirus, which I believe is presenting a threat that is wildly exaggerated. If you assume that the Chinese are understating the number of deaths, the true figure is not 3,000 but 30,000. In a population of 1.2 billion that works out to 0.0025%.

Apply that percentage to the US and the potential number of deaths here is a mere 7,500, compared to 50,000 flu deaths a year. And most of those are old and infirm with existing major diseases, like cancer, pneumonia, or extreme obesity.

Thank goodness I’m not old.

Fear, on the other hand, is another issue. Virtually all conferences have been cancelled. A school is closed in Oregon. Most large corporations banned non-essential travel on Friday. Major entertainment areas in San Francisco have become ghost towns. If this continues, we really could scare ourselves into an actual recession, which is what the stock market seemed to be screaming at us last week.

You can forget about the vaccine. It would take a year to find one and another year to mass produce it. They may never find a Corona vaccine. They have been looking for an AIDS vaccine for 40 years without success. So, we are left with no choice but to let nature run its course, which should be 2-3 months. The stock market may fully discount this by the end of this week.

What's disgraceful is the failure of the US government to prepare for a pandemic we knew was coming. I just returned from a two-week trip around Asia and Australia and at every stop my temperature was taken, I was asked to fill out an extensive health questionnaire and was screened for quarantine. When I got back to the US there was nothing. I just glided through the eerily empty immigration.

Most American communities have no Corona tests and have to mail samples to the CDC in Atlanta to get a result. We probably already have thousands of cases here already but don’t know it because there has been no testing. When the stock market learns this, expect more down 1,000-point days.

Where is the bottom? That is the question being asked today by individuals, institutions, and hedge funds around the world. That’s because there are hundreds of billions of dollars waiting on the sidelines left behind by the 2019 melt-up in financial assets. It’s been the worst week since 2008. All eyes are on (SPX) 2,850, the October low and the launching pad for the Fed’s QE4, which ignited stocks on their prolific 16% run. Suddenly, we

have gone from a market you can’t get into to a market you can’t get out of.

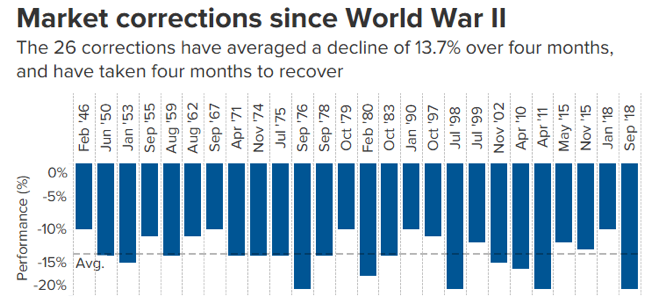

How long is this correction? The post-WWII average is four months, but we have covered so much ground so fast that this one may be quicker. We haven’t seen one since Q4 2018, which was one of the worst.

Corona does have a silver lining. Air pollution in China is the lowest in decades, with coal consumption down 42% from peak levels. It’s already starting to return as Chinese workers go back on the job. Call it the “Looking out the Window” Index.

Consumer Confidence was weak in February, coming in at 130.7, less than expected. Corona is starting to sneak into the numbers. Yes, imminent death never inspired much confidence in me.

International Trade is down 0.4% year on year for the first time since the financial crisis. It’s the bitter fruit of the trade war. The coasts were worst hit where trade happens. Trade is clearly in free fall now, thanks to the virus.

The helicopters are revving their engines, with global central banks launching unprecedented levels of QE to head off a Corona recession. Futures market is now pricing in three more interest rate cuts this year, up from zero two weeks ago. Hong Kong is giving every individual $1,256 to spend to stimulate the local economy. The plunge protection team is here! At the very least, markets are due for a dead cat bounce.

Bob Iger Retired from Walt Disney as CEO and will restrict himself to the fun stuff. The stock is a screaming “BUY” down here, with theme parks closing down from the Corona epidemic. Oops, they’re also in the cruise business!

Will the virus delay the next iPhone, and 5G as well? Like everything else these delays, it depends. Missing market could become the big problem. Missing customers too. I still want to buy (AAPL) down here in the dumps down $90 from its high.

The IEA says the energy outlook is the worst in a decade. Structural oversupply and the largest marginal customers mean that we will be drowning in oil basically forever. Avoid all energy plays like the plague. Don’t get sucked in by high yielding master limited partnerships. Don’t confuse “gone down a lot” with “cheap”.

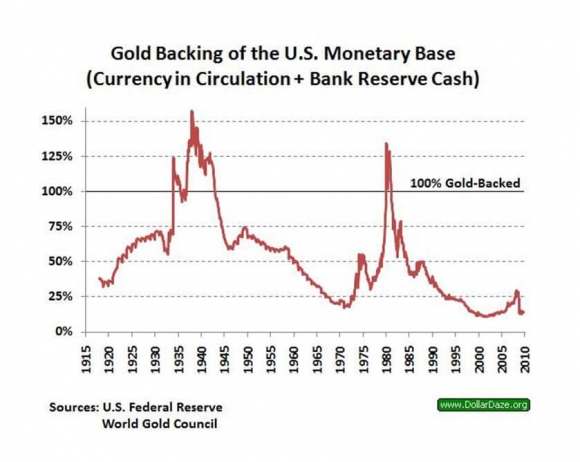

Why is the market is really going down? It’s not the Coronavirus. It’s the Fed ending of its repo program in April, announced in the Fed minutes on February 19. No QE, no bull market. The virus is just the turbocharger. The Fed just dumped the punch bowl and no one noticed. This may all reverse when we get the next update on the Coronavirus.

A surprise Fed rate cut may be imminent, with a 25-basis point easing coming as early as tomorrow. There is no doubt that the virus is demolishing the global economy.

Investment Spending is Falling off a Cliff, with the Q4 GDP Report showing a 2.3% decline. Consumer spending, the main driver for the US economy, is also weakening as if economic data made any difference right now.

I could see the meltdown coming the previous weekend and was poised to hit the market with short sales and hedges. But when the index opened down 1,000, it was pointless. The best thing I could do was to liquidate my portfolio for modest losses. Two days later, that was looking a stroke of genius. This was the first 1,000 dip in my lifetime that I didn’t buy.

I then piled on what will almost certainly be my most aggressive position of 2020, a double weighting in selling short the Volatility Index at $50. Within 30 minutes of adding my second leg, the (VIX) had plunged to $40, earning back nearly half my losses from the week.

The British SAS motto comes to mind: “Who Dares Wins”.

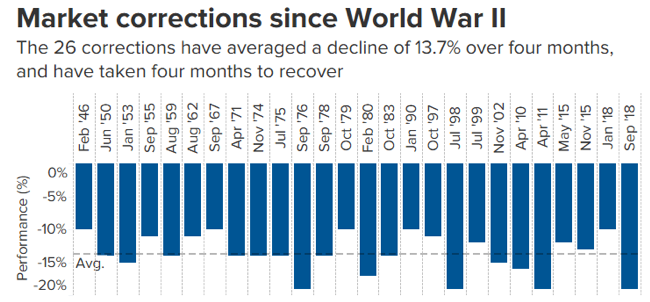

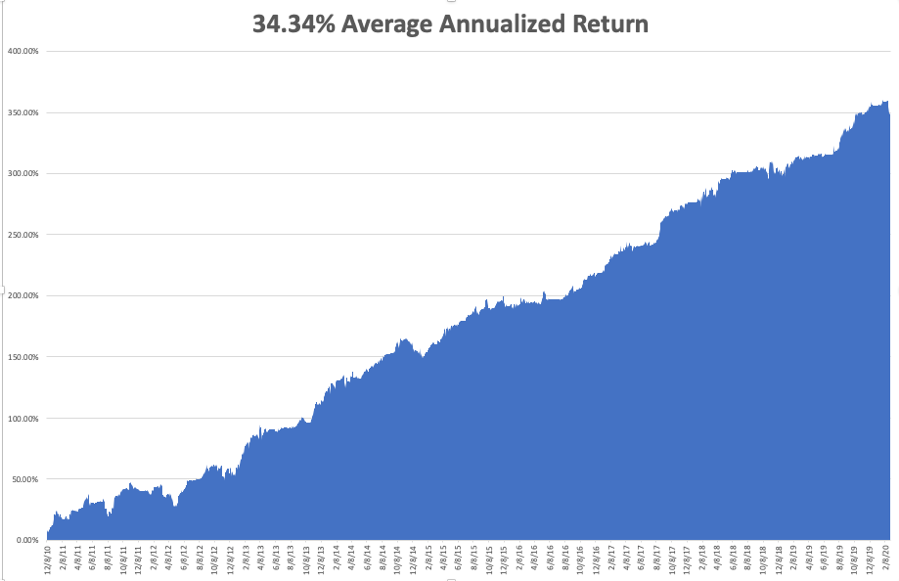

My Global Trading Dispatch performance pulled back by -6.19% in February, taking my 2020 YTD return down to -3.11%. My trailing one-year return is stable at 40.95%. My ten-year average annualized profit ground back up to +34.34%.

With many traders going broke last week or running huge double-digit losses, I’ll take that all day long in the wake of a horrific 4,500 point crash in the Dow Average.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Monday, March 2 at 10:00 AM, the US Manufacturing PMI for February is out.

On Tuesday, March 3 at 4:00 PM, US Auto Sales for February are released.

On Wednesday, March 4, at 8:15 PM, the ADP Report for private sector employment is announced.

On Thursday, March 5 at 8:30 AM, Weekly Jobless Claims are published.

On Friday, March 6 at 8:30 AM, the February Nonfarm Payroll Report is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, we have just suffered the driest February on record here in California, so I’ll be reorganizing my spring travel plans. Out goes the skiing, in come the beach trips.

Such is life in a warming world.

That’s it after I stop at Costco and load the car with canned food.

John Thomas

CEO & Publisher